What is ITIN Number: Meaning, Uses, Renewal, and Benefits Explained

Confused about the purpose of ITIN? Learn today how this tax ID helps residents and non-residents file taxes and potentially claim benefits in the US.

Don’t have an ITIN number? Apply for ITIN and get your Individual Taxpayer Identification Number quickly and effortlessly with our expert guidance. Our user-friendly process makes the ITIN application easy.

Excellent 4.3 out of 5 Trustpilot

Don’t wait—apply for ITIN today. Hundreds of entrepreneurs have already obtained their ITIN and are growing their businesses!

$400 $299

$299 $199

With an ITIN, you can fulfill your tax obligations, ensuring adherence to US tax laws.

Many financial institutions in the US require an ITIN to open bank accounts.

<span data-metadata=""><span data-buffer="">Eligible individuals can claim various tax credits and deductions, potentially reducing their tax liability.

You must have a tax identification number (ITIN) to get a bank loan or credit card.

<span data-metadata=""><span data-buffer="">Non-US residents using PayPal for online transactions or e-commerce need an ITIN.

ITIN is required for non-US residents to verify their identification.

Apply To Get an ITIN as a non-resident, you must form a company in the US and have an EIN number. If you need assistance with these crucial steps, trust Business Globalizer to guide you through the process.

Apply for ITIN as a non-resident dependent—it can often be challenging and complex. Various diplomatic considerations and confusing procedures can lead to unwanted issues and complications for the dependent involved.

Dependents are non-citizens who receive financial support from US taxpayers. They can be spouses, children, or other family members who qualify for US tax-dependent status. ITIN is a crucial thing for them.

Business Globalizer has extensive experience helping non-resident dependents get an ITIN. We handle all the complexities and diplomatic issues efficiently, ensuring a smooth process for our clients. Trust us to simplify the ITIN application procedure for you.

Dependents can get an ITIN easily with our simple process. We only need a few essential documents and information to get started.

We understand that getting an ITIN can be a difficult task, especially if you are not familiar with the procedure. We offer a complete ITIN application service to help you get your ITIN quickly and easily.

Our experienced professional team ensures a smooth and efficient process to get your ITIN.

We streamline the complex ITIN application procedure, making it hassle-free and easy to follow.

Our dedicated support team is available to assist you at every stage, providing guidance and clarifying any doubts.

With our efficient approach, we try to get your ITIN as soon as possible and in a reliable way.

With a wealth of knowledge in ITIN matters, we handle a wide range of cases with competence and proficiency.

We serve clients worldwide with ITIN services, making them accessible and convenient.

Founder & CEO

Founder & CEO

Co-Founder & CTO

Founder

Founder & CEO

Business Excellence awards achieved

Businesses guided over 9+ years

Business advices given over 9 years

An ITIN (Individual Taxpayer Identification Number) is a tax processing number issued by the IRS to individuals who are required to have a U.S. taxpayer identification number but do not qualify for a Social Security Number (SSN).

Individuals who are non-resident aliens, foreign nationals, or dependents/spouses of U.S. citizens are ineligible for a Social Security Number (SSN). They need an ITIN for tax-reporting purposes.

An ITIN is meant for tax reporting only and is not intended to replace an SSN for other purposes, such as employment eligibility.

You can apply for an ITIN by submitting Form W-7 along with the required documents to the IRS. An IRS-Certified Acceptance Agent like Business Globalizer can help you to apply for your ITIN. We are a listed CAA of the IRS. Our user-friendly process makes your ITIN application easy.

The processing time can vary, but it usually takes around 16 to 18 weeks to receive your ITIN after submitting your application.

No, an ITIN is a tax processing number, while an SSN is used for a variety of government and financial purposes.

Some banks accept an ITIN to open an account, but requirements can vary. Check with your chosen bank for their policies.

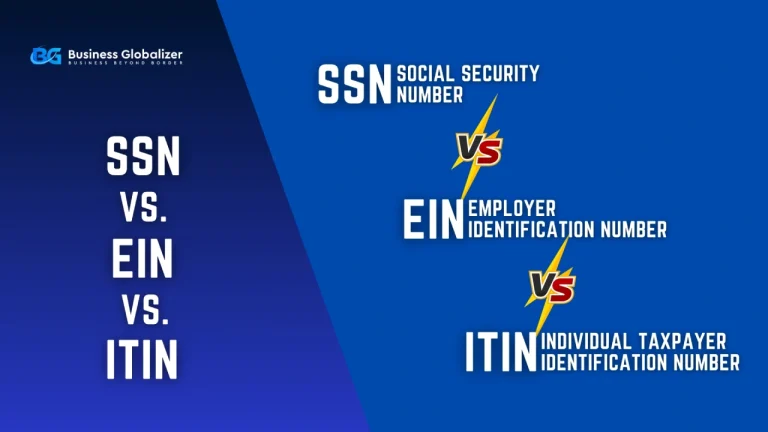

SSN is only available to U.S. citizens and permanent residents, while ITIN is available to non-resident and resident aliens who must comply with U.S. taxation compliances.SSN enables govt and private services, while ITIN is specifically for tax-related obligations.To know more, visit our blog page.

You should apply for an ITIN when you need a tax identification number for complying with US taxation compliances and a payment gateway account like PayPal.

To get an ITIN, you must complete IRS Form W-7 and other details, which is a complex and time-consuming process. Besides, You need to verify yourself via a CAA. That’s why getting an ITIN is so expensive.

No, an ITIN doesn’t permit one to work in the US.

Yes. You can renew an expired ITIN by submitting the appropriate W-7 form with the necessary supporting documents. Business Globalizer is here to help you.

If you have a US business, you must pay taxes. And if you don’t have an ITIN, you can pay taxes with an EIN. But it’s better to get an ITIN.

Confused about the purpose of ITIN? Learn today how this tax ID helps residents and non-residents file taxes and potentially claim benefits in the US.

SSN, EIN, or ITIN: What, why, and when? With this guide, learn the comprehensive differences between these three U.S. identification numbers.

Explore the detailed concept of ITIN Vs. SSN, including their purposes, eligibility, and uses in the US, in this concise comparison guide.

2554 Bedford Avenue , Brooklyn, NY, United States.