Form 1040 vs 1040-NR: Which Should Nonresidents File?

Learn the key differences between Form 1040 and 1040-NR, who should file each form, and how to stay IRS-compliant without penalties.

Learn the key differences between Form 1040 and 1040-NR, who should file each form, and how to stay IRS-compliant without penalties.

A clear guide to IRS Form 1040-NR for nonresidents; When to file, what to report, ITIN notes, and how to file correctly.

Understand the real difference between zero tax return and no income tax filing, when filing is required, and how IRS rules treat each case.

Explore Zero Income Tax return in the US; when filing is required or optional, how to file, and the common mistakes to avoid if you earned no income.

Your complete 2025 guide to the ITIN Mortgage Program; how it works, requirements, lenders, and tips for non-SSN borrowers buying homes in the U.S.

Wondering how much an ITIN costs in 2025? Discover real ITIN application fees, renewal costs, and safe ways to apply without overpaying.

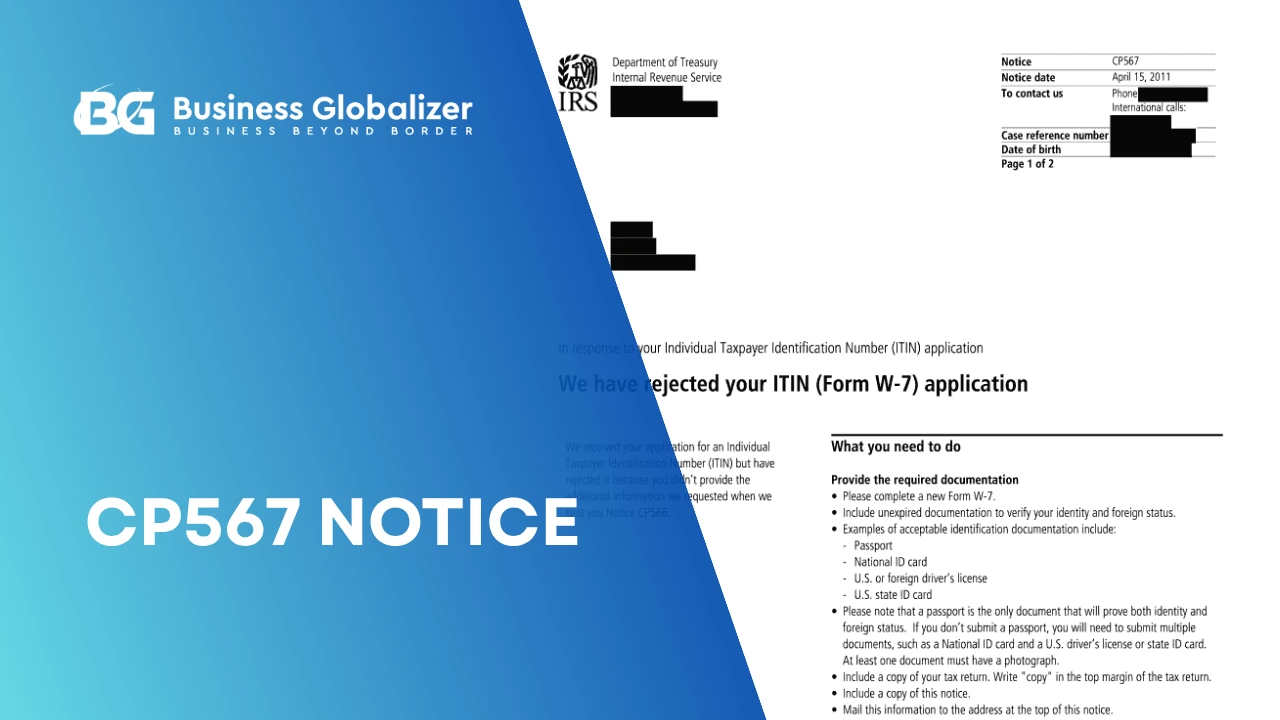

Got a CP567 Notice? Learn why your ITIN application was rejected, what it means, and how to fix it quickly with expert help from IRS-verified CAA.

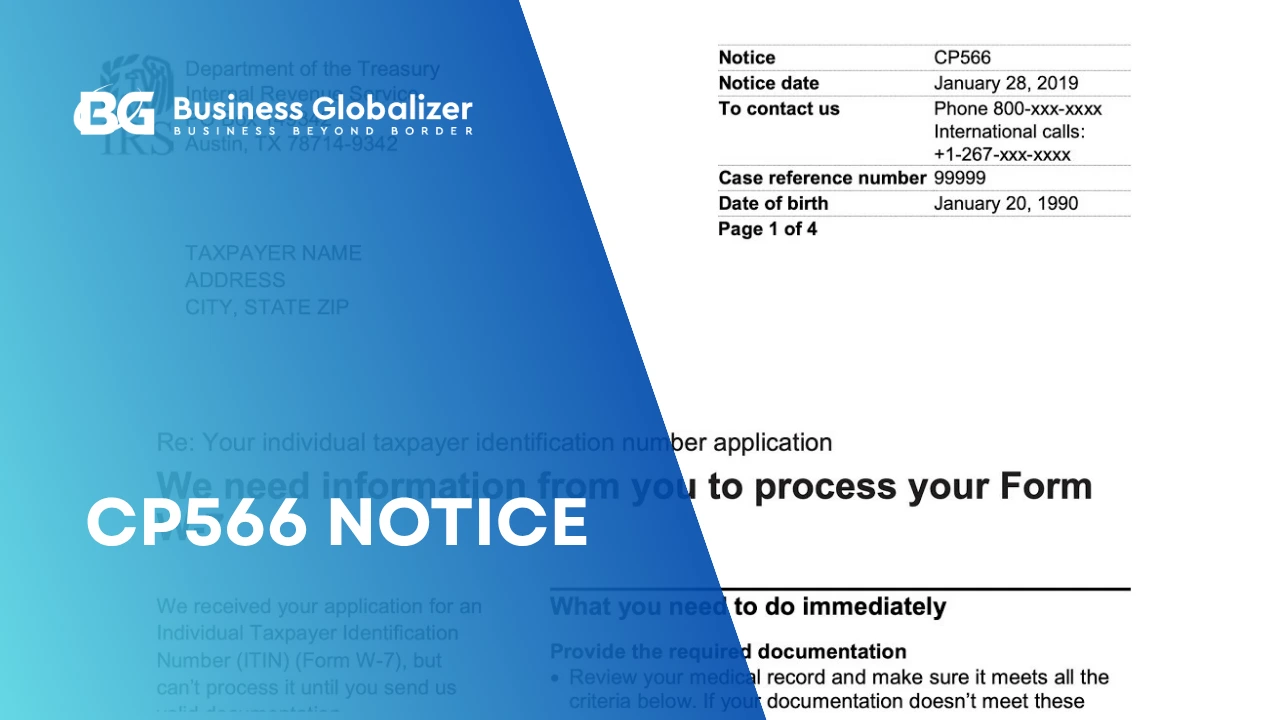

Got a CP566 Notice from the IRS? Learn what it means, which ITIN documents you missed, and how to fix it fast without reapplying.

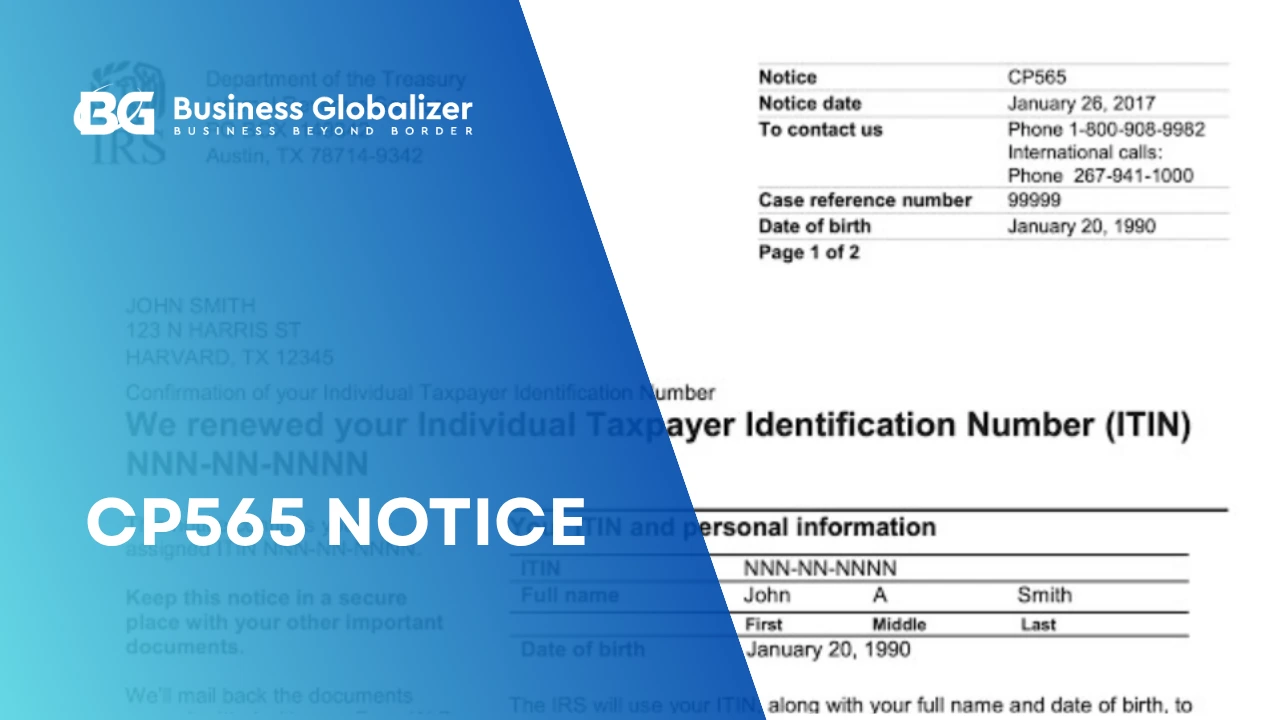

Understand your CP565 Notice from the IRS; what it means, why it’s issued, and how to replace a lost or missing ITIN confirmation letter