To access platforms like Amazon, Stripe, and PayPal, a properly formed U.S. company is essential. Business Globalizer offers a done-for-you U.S. company formation service from Bangladesh, handling LLC or Inc. registration, compliance support, and complete payment-receiving setup—so you can expand globally with confidence.

Happy Clients

Years of Industry Experience

Country On-boarded

Business Awards

Without a properly formed U.S. company, Bangladeshi businesses face payment restrictions, platform limitations, and ongoing compliance risks.

Major payment gateways like Stripe, PayPal, and Wise are unavailable in Bangladesh without a U.S. company structure.

Platforms like Amazon, Walmart, and Shopify prioritize verified U.S. companies for seller access and payments.

U.S. companies require proper filings and compliance, even with zero revenue—missteps can lead to penalties.

Using workarounds, VPNs, or inaccurate information often results in account suspension or permanent bans.

Without a U.S. entity, international clients and partners often hesitate to work or make payments.

Local banking systems lack integration with global eCommerce and international payment networks.

Freelancers and businesses face delays and limitations withdrawing earnings or accepting off-platform payments.

Many global clients prefer paying U.S.-registered companies due to compliance and trust concerns.

To help you make informed decisions, we’ve prepared a concise PDF resource covering the key considerations

Bangladeshi entrepreneurs should understand before forming a U.S. company.

Small business or startups

+State Fee

Large business or startups

+State Fee

Large business or startups

+State Fee

One setup that gets you PayPal, Stripe, Amazon, and worldwide clients from Bangladesh.

Largest consumer market.

Tax treaty, incentives, pass-through benefits for non-residents

Sell legally on Amazon, Walmart, Shopify, Etsy, and more.

Access PayPal & Stripe without fear of country restrictions.

Build credibility with global buyers, banks, and marketplaces.

Run your eCommerce or freelancing business as a trusted U.S. brand.

Receive payments directly from the U.S. and worldwide.

Qualify for a High-Risk Merchant Account with our verified signers.

Forming a U.S. company goes beyond registration. Our 4C framework explains the long-term advantages

you gain when your company is set up correctly.

Compliance

Receive complete U.S. compliance support from Bangladesh, including EIN, ITIN, registered agent services, and annual filings.

Credibility

A properly registered U.S. company strengthens your credibility with global clients, platforms, banks, and payment providers.

Capabilities

Access PayPal, Stripe, Amazon, and global clients directly with a verified U.S. business structure.

Convenience

Manage everything remotely with expert support from Bangladesh — from company formation to banking and tax compliance.

From formation to banking to gateways, we cover every step so Bangladeshi founders don't get stuck halfway.

Employment Identification Number (EIN)

EIN is issued quickly through the IRS for your company.

Individual Taxpayer Identification Number (ITIN)

Processed fast through Bangladesh's first IRS- Certified Acceptance Agent.

Business Bank Account

Remote U.S. account opening arranged, no travel required.

Business PayPal

Fully verified account set up for international transactions.

Business Stripe

Stripe application guided and approved on the first try.

1:1 Tax & Accounting Advice

Personalized guidance ensures compliance and peace of mind.

Debit Cards for You & Employees

Company debit cards ready for spending and global withdrawals.

Mail Forwarding Address

U.S. mail received and forwarded without hassle.

Business Address

A verified U.S. address provided to meet banking and marketplace standards.

we know the dream that need solid foundation at affordable price.

Features/Service |  |  | |

|---|---|---|---|

Company Formation Fee | $199 + State Fee | $297 + State Fee | $399 + State Fee |

Registered Agent (1 Year) | Included | Included | Included |

EIN (Tax ID) | Included | Included | Included |

Annual Filing & Compliance Support | Included (Attorney-led) | Included | Included |

Business Address (1 Year) | Included | Included | Not Included |

Mail Forwarding (1 Year) | Included | Included | Not Included |

Payment Gateway Support | Included (Expert Guidance) | Not Included | Not Included |

Banking Support | Included | Not Included | Included |

Tax Consultation & Optimization | Included (Non-resident Focused) | Not Included | Add-on for $199/hour |

Dynamic Client Dashboard | Included (Real-Time Updates) | Basic (Limited Updates) | Basic (Limited Updates) |

State Coverage | All States | All States | Only 2 States |

Operating Agreement | Included | Included | Included |

Note: Additional documents may be required later by banks or payment processors, such as proof of address, invoices, or website details.

We manage every stage of the U.S. company formation process for you, from initial setup to banking and ongoing compliance,

ensuring a smooth and legally compliant experience from Bangladesh.

Pick Your Package & Pay Securely

Choose the package that fits your goals and pay via supported gateways.

Share Your Details

Fill a short onboarding form. We'll handle everything after this.

Company Registration & EIN

We form your U.S. company with proper requirements and get your IRS tax ID.

Bank & Payment Setup

Open your U.S. bank account and activate the required payment gateway.

You're Live & Supported

Start selling and getting paid, while we stay with you for compliance and ongoing support.

We keep your U.S. company active, penalty-free, and trusted.

Annual Report

Filed every year to keep your company in good standing

Tax Filing

Even if you earned $0, you still have to file.

BOI Report

A federal rule that all U.S. companies should follow

Bangladeshi founders face blocked gateways, frozen payouts, and failed hacks. A verified U.S. company is the only way to unlock real growth.

The Shortcuts Bangladeshis Try | What You Get With a U.S. Company |

|---|---|

VPN PayPal → works for a few weeks, then banned, money stuck | Verified U.S. PayPal → approved with EIN, ITIN and U.S. address |

Fiverr/Upwork withdrawal limits → money blocked | U.S. Bank Account → global withdrawals, no limits |

Fake Stripe → instant rejection | U.S. Stripe Account → approved once the company is verified |

Registering in wrong states → high tax, hidden fees | Expert state selection guidance → choose the right state, save money |

Ignoring compliance → IRS penalties, notices, company shut down | Ongoing compliance handled → annual report, BOI, tax filing |

We've created a clear, simple PDF guide that shows you exactly what to expect. You'll get:

Expert Consultation (Free & Premium)

Get tailored advice on structure and taxes, starting from a free session, with premium options when you need deeper guidance.

Proven Expertise

10+ years helping founders form and manage U.S. companies with full compliance.

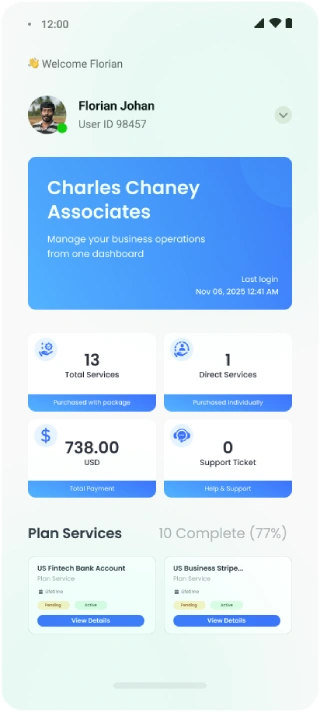

Dynamic Dashboard

Track your services, documents, payments, queries, and support, all in one place: your own dashboard.

Strong Compliance Support

Attorney-backed filings so you never miss reports, taxes, or any other compliance deadlines.

Banking & Gateway Access

Get PayPal, Stripe, and U.S. bank accounts set up smoothly, crucial for Bangladeshi entrepreneurs.

24/7 Support in Bangla & English

Dedicated customer support in Bangla plus global languages, anytime you need us.

First IRS-Certified CAA in Bangladesh

We issue ITINs for every case: dependents, spouse, or payment gateway verification. Always 100% compliant.

Process Made Simple

We break down every step so you don't feel lost, perfect for busy BD founders who just want results.

During our 10+ year journey in this industry, our decision-making and strategic planning expertise greatly expanded our 3,000+ customers' yearly profit! Our whole team works hard to help you succeed and achieve new milestones.

and Get Real-Time Updates on Every Step

Stay in the loop with real-time notifications on both your dashboard and email.

Know exactly where your application stands at any given moment.

Experience the advantage of 8+ years of expertise in U.S. business setup.

Our extensive experience with 3000+ Clients give you the confidence that you're in good hands.

"No income = no tax filing."

Big mistake. Even with $0 income, U.S. companies must file annual reports and taxes.

"VPN PayPal works fine."

Wrong. Accounts opened with fake addresses or VPNs always get banned, and you lose your money.

"Stripe doesn't support Bangladesh."

Half true. Stripe won't support you directly in Bangladesh, but with a U.S. company, Stripe verifies and approves you.

"I can skip compliance in the first year."

Many Bangladeshis assume the first year is "free." It's not. Compliance starts the moment your company is formed.

"I'm a nonresident, the IRS can't touch me."

Wrong. The IRS doesn't care where you live. Ignoring filings can bring heavy fines, interest, freeze your company's assets, and even shut the company down.

Choosing the Wrong State

Forming in New York or California just because the names sound big often leads to higher taxes and costs. Picking the right state matters.

Mixing Personal & Business Accounts

Using personal bank accounts or transferring PayPal money through friends is a fast way to lose credibility and get flagged.

Delaying Payment Gateway Setup

Waiting months after forming your company often leads to expired documents, missed deadlines, and rejected accounts.

Forming a U.S. company or handling taxes from Bangladesh? Get clear answers on setup, banking, gateways, and compliance, made simple for Bangladeshi founders.

Development, Bizcope LLC

CEO, Alcoba LLC

Founder, FlowBites

CEO, Sharp Query LLC

Founder, Al Amin Mun LTD

Developer

Founder & CEO

Founder & CEO

Co-Founder & CTO

Founder

Founder & CEO

Founder

Founder

Executive Director

No. Bangladeshi non-residents can fully own LLCs and C-Corps without a U.S. partner.

Both work, but U.S. LLCs are simpler for PayPal/Stripe, while U.K. Ltds may fit EU trade. Most BD founders start with U.S. LLC.

Directly, no. With a U.S. company, EIN, ITIN, and U.S. bank, PayPal can be legally verified.

No. Gateways block Bangladeshi addresses. A real U.S. company is mandatory for approvals.

The state will dissolve it, but IRS penalties may continue. Bank accounts and gateways also get shut down.

Yes. U.S. company bank accounts issue debit cards usable worldwide, including in Bangladesh.

You can dissolve it through the state. Costs vary ($50–300). Taxes and compliance must be cleared first.

You can dissolve it through the state. Costs vary ($50–300). Taxes and compliance must be cleared first.