Skip the confusion and messy paperwork; get a proper U.S. setup with EIN, Amazon-ready documents, tax filing support, and banking/payment guidance. All-in-one U.S. setup solution for Indian founders.

Our Strategic Partners

Happy Clients

Years of Industry Experience

Country On-boarded

Business Awards

Most Indian founders don’t get stuck on formation; they get stuck on approvals.

Funds get stuck on Payoneer or marketplace payouts when the setup looks incomplete. Then come reviews, reserves, and delays.

Formation is easy. Banking isn’t. Indian founders often face extra checks, long waits, or straight rejections.

One small mismatch, such as name format, address style, or role/title, can trigger repeated verification requests.

Stripe, PayPal, Wise, and Payoneer may not fully work in India. Access often depends on your U.S. entity and documents.

Amazon, Walmart, and Shopify often ask for U.S. business proof: documents, address, and tax details. Missing one piece, approvals halt.

Forget one deadline, and you risk penalties, status issues, or account problems later.

Founders get stuck between U.S. requirements and India-side reporting. What to file? What to claim? What counts as taxable?

An India-only setup can make overseas buyers pause, especially on bigger invoices, subscriptions, or long-term deals.

Check out our free PDF guide on what Indian founders should consider before starting a U.S. LLC or Inc.

Small business or startups

+State Fee

Large business or startups

+State Fee

Large business or startups

+State Fee

A U.S. setup provides global credibility, gateways, and marketplace access, managed from India.

Wider access to Stripe, PayPal, Wise, and merchant processors

More global SaaS tools work without restrictions

Easier verification for Amazon, Walmart, and Shopify

Tax treaty, incentives, and pass-through perks

Higher trust with U.S.-style invoices and contracts

Easier to scale, add partners, and raise later

Personal risk stays separate from business activity

High-risk merchant account eligibility with verified signers

Don't form a U.S. company just to get registered. Build it to unlock advantages that last.

Our 4C formula shows what you really get.

Compliance

Stay compliant and covered in the U.S. with EIN/ITIN support, registered agent, and annual filings.

Credibility

A U.S.-registered business makes you look more legit to clients, vendors, banks, and gateways.

Capabilities

Get access to tools and platforms that prefer U.S. entities, like Stripe, PayPal, Amazon, and more.

Convenience

Handle everything remotely from India, with guided support from formation to banking and tax filing.

Everything from formation to banking to payment tools, handled carefully so Indian founders don’t lose momentum.

Employment Identification Number (EIN)

EIN is issued quickly through the IRS for your company.

Individual Taxpayer Identification Number (ITIN)

Processed fast through India's first IRS- Certified Acceptance Agent.

Business Bank Account

Remote U.S. account opening arranged, no travel required.

Business PayPal

Fully verified account set up for international transactions.

Business Stripe

Stripe application guided and approved on the first try.

1:1 Tax & Accounting Advice

Personalized guidance ensures compliance and peace of mind.

Debit Cards for You & Employees

Company debit cards ready for spending and global withdrawals.

Mail Forwarding Address

U.S. mail received and forwarded without hassle.

Business Address

A verified U.S. address provided to meet banking and marketplace standards.

We know the dream and offer a solid foundation at an affordable price.

Features/Service |  |  | |

|---|---|---|---|

Company Formation Fee | $199 + State Fee | $297 + State Fee | $399 + State Fee |

Registered Agent (1 Year) | Included | Included | Included |

EIN (Tax ID) | Included | Included | Included |

Annual Filing & Compliance Support | Included (Attorney-led) | Included | Included |

Business Address (1 Year) | Included | Included | Not Included |

Mail Forwarding (1 Year) | Included | Included | Not Included |

Payment Gateway Support | Included (Expert Guidance) | Not Included | Not Included |

Banking Support | Included | Not Included | Included |

Tax Consultation & Optimization | Included (Non-resident Focused) | Not Included | Add-on for $199/hour |

Dynamic Client Dashboard | Included (Real-Time Updates) | Basic (Limited Updates) | Basic (Limited Updates) |

State Coverage | All States | All States | Only 2 States |

Operating Agreement | Included | Included | Included |

Note: Extra docs may be needed later for bank or payment processors (proof of address, invoices, website).

From Bangladesh to Your U.S. Company in 5 Easy Steps

Pick Your Package & Pay Securely

Choose the package that fits your goals and pay via supported gateways.

Share Your Details

Fill a short onboarding form. We'll handle everything after this.

Company Registration & EIN

We form your U.S. company with proper requirements and get your IRS tax ID.

Bank & Payment Setup

Open your U.S. bank account and activate the required payment gateway.

You're Live & Supported

Start selling and getting paid, while we stay with you for compliance and ongoing support.

We keep your U.S. company active, penalty-free, and trusted.

Annual Report

Keep your company in good standing with annual U.S. filings

Tax Filing

Even with $0 revenue, required filings may still apply.

BOI Report

A federal rule most U.S. companies follow

Indian founders hit payout holds, random rejections, and repeat verification. A properly built U.S. company is what platforms approve and pay.

The Shortcuts Indians Try | What You Get With a U.S. Company |

|---|---|

VPN logins → accounts flagged, payouts frozen | Verified U.S. accounts → stable access, clean payouts |

Personal PayPal → limiting, sudden reviews | Business PayPal (U.S.) → higher limits, smoother withdrawals |

Fake Stripe → instant shutdowns | U.S. Stripe account → approval with proper documents |

Wrong state filing → higher yearly costs | Right state selection → lower fees, cleaner structure |

Skipping filings → penalties, account risk | Ongoing compliance → company stays active |

Local bank routing → failed transfers | U.S. bank account → global payments, faster settlements |

Each U.S. structure works differently. Pick the one that fits your goal, payouts, and compliance.

Sole Proprietorship

Not a separate legal entity. Not preferred for cross-border growth—limited protection and harder to scale cleanly.

Partnership

Possible for U.S. non-residents, but risky in the sense that partners are personally liable for debts. Rarely used by Indian founders for U.S. expansion.

Corporation (C-Corp)

Available for Indian non-U.S. residents. Ideal for startups looking to raise funding or sign up investors. Comes with stricter compliance and potential double taxation.

Limited Liability Company (LLC)

Most popular entity type among Indian entrepreneurs. Works for both single-member and multi-member setups. Offers liability protection, flexible ownership, and simpler ongoing maintenance.

S-Corporation (S-Corp)

Not available for non-U.S. residents from India. The U.S. law restricts S-Corp ownership to U.S. citizens and residents.

Non-Profit Corporation

Can be formed by non-residents, but it’s only for charitable or community purposes and requires strict compliance. Not meant for commercial business.

Whether you’re a solo founder in India or building with partners, a U.S. LLC gives you a flexible structure with clear ownership and liability protection.

LLC is easier to manage. A C-corp is better if you want investment.

Feature | U.S. LLC | U.S. Corporation |

|---|---|---|

Tax treatment | Pass-through by default; can choose corporate tax. | Corporate tax + possible dividend tax; no S-Corp for nonresidents. |

Admin load | Fewer formalities; operating agreement matters most. | More formalities: bylaws, directors, and records required. |

Ownership | Flexible ownership. Members can be from any country. | Foreign ownership allowed; fixed share structure. |

Cost & Speed | Lower fees, faster setup | Higher cost, longer process |

Best for | Solo founders, service businesses, e-commerce brands, and lean teams. | Funded startups, shares, and investors. |

This clear and simple PDF guide will show you exactly what to expect.

Expert Consultation (Free & Premium)

Start with a free call for the basics. Upgrade only if you need deeper structuring or tax support.

Proven Expertise

10+ years helping founders form and manage U.S. companies with full compliance.

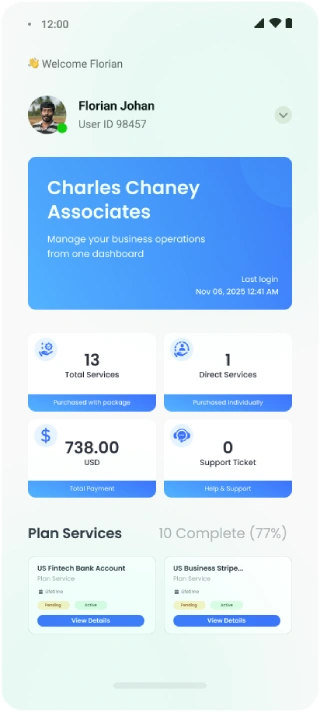

Dynamic Dashboard

Track your services, documents, payments, queries, and support, all in one place: your own dashboard.

Strong Compliance Support

Attorney-backed filings so you never miss reports, taxes, or any other compliance deadlines.

Banking & Gateway Access

Get PayPal, Stripe, and U.S. bank accounts set up smoothly, crucial for Bangladeshi entrepreneurs.

24/7 Support Built for Indian Founders

Quick responses, clear updates, and no confusing back-and-forth.

IRS-Authorized CAA Support

If needed, we handle your ITIN process end-to-end, including spouse and dependent cases.

Straightforward Setup

Clear 5-step process from signup to launch, with checklists and updates at each stage.

3,000+ founders chose us because “registered” isn’t enough. We set it up to pass checks, get payouts, and stay compliant.

and Get Real-Time Updates on Every Step

Stay in the loop with real-time notifications on both your dashboard and email.

Know exactly where your application stands at any given moment.

Experience the advantage of 8+ years of expertise in U.S. business setup.

Our extensive experience with 3000+ Clients give you the confidence that you're in good hands.

No income means no U.S. filing.

Not true. Even with $0 revenue, you may still have yearly filings and tax reporting to keep the company in good standing.

A VPN setup is fine for PayPal or Stripe.

It might work briefly, then reviews start. Accounts get limited, and payouts can get stuck.

Stripe isn’t possible from India.

You can’t access everything directly as an India-based entity, but a properly set up U.S. company can make approvals realistic.

I’ll handle compliance later.

That’s how penalties start. Compliance begins right after formation, not next year.

I live in India, so U.S. rules don’t matter.

Wrong. U.S. filings are tied to the company, not your location. Ignoring them can lead to fines and status problems.

Picking the Wrong State

Choosing a state just because it sounds popular can mean higher yearly fees and extra rules.

Mixing Personal and Business Accounts

Using personal PayPal/bank accounts for business receipts triggers limits and looks risky to platforms.

Delaying Banking and Gateway Setup

Waiting too long can cause verification issues later, especially when documents and details don’t match across profiles.

Are you forming a U.S. company and need help handling taxes from India? Get easy setup, banking, and compliance made simple for Indian founders.

Development, Bizcope LLC

CEO, Alcoba LLC

Founder, FlowBites

CEO, Sharp Query LLC

Founder, Al Amin Mun LTD

Developer

Founder & CEO

Founder & CEO

Co-Founder & CTO

Founder

Founder & CEO

Yes. From India, you can complete formation, EIN, and document setup fully remotely.

No. You can form and fully own a U.S. LLC or C-Corp from India without a U.S. partner.

Most Indian founders pick LLC for simplicity. C-Corp fits startups from India planning funding and share-based ownership.

Usually, your passport/ID, Indian address proof, and a working email and phone number. For banking or gateways later, you may need a website, business description, or invoices/contracts.

We standardize your name format, address style, and business activity wording across formation, EIN, and platform profiles. That way, your Indian documents don’t trigger repeat verification.

Yes, when your setup is verification-ready. Most holds happen when platforms can’t match entity details, address, or business category to your documents.

Yes, but banks review your business model, documents, and U.S. address. We guide what to prepare so you don’t get stuck in “more info needed” loops.

A U.S. company helps, but Stripe still checks your business type, website, products/services, and matching documents before approval.

Yes. A U.S. entity usually helps with seller verification, tax interviews, and document checks, especially when your details match across accounts.

EIN is your company’s tax ID. You’ll need it for banking, platforms, and U.S. filings.

Not always. You may need an ITIN if your case requires individual tax filing or certain platform/banking verification steps.

Often yes. You may still have annual filings and tax reporting, depending on your structure, even with zero income.

Annual reports, renewals, BOI filing (if required), and tax filing based on your U.S. setup.

You risk penalties, loss of good standing, and future banking or gateway issues.

It depends on your goal. Many Indian founders pick Wyoming for low upkeep, Delaware for investors, and New Mexico for a simpler setup.

Yes. From India, you can add partners as LLC members or C-Corp shareholders with proper roles, access controls, and clear documentation.

From India, you can track documents, service status, support tickets, and updates in real time on desktop and mobile through our dashboard.

Yes. When your U.S. company, bank account, and platform details are set up correctly, USD payouts move without repeated holds or reviews.

You get your formation certificate, registered agent details, operating agreement, and EIN confirmation, plus a clear checklist for banking, gateways, and compliance.

Yes. We stay involved for compliance, filings, and guidance so Indian founders don’t get stuck after registration.