Applying for an Individual Taxpayer Identification Number (ITIN) can be essential for non-U.S. residents for various reasons, such as owning a U.S. company, filing taxes, or property-related matters.

At Business Globalizer, we streamline the ITIN application process to ensure a smooth experience. In this blog, a detailed process sequence and turnaround time (TAT) for obtaining an ITIN are given for you.

Step-by-Step Guide to Obtaining an ITIN

Getting an ITIN might seem tricky at first, especially if you’re outside the U.S., but don’t worry. With the right steps and proper guidance, the process is simpler than you’d think. Here’s a step-by-step breakdown to help you through it.

Step 1: Determining the Reason for Applying

Before applying, make sure you’re clear on why you need an ITIN. Whether it’s for filing taxes, claiming a refund, or meeting other U.S. requirements, your reason will guide what documents you need. Here are the seven most common scenarios:

7 Common ITIN Application Scenarios of ITIN Requirement

There are several situations where applying for an ITIN becomes essential. Now, here are 7 of the most common ones you might face.

- Scenario 1: Owning a U.S. Company as a Non-U.S. Resident (Most Common Case)

- Scenario 2: Spouse of a U.S. Citizen or Resident Alien

- Scenario 3: Dependent of a U.S. Citizen or Resident Alien

- Scenario 4: Selling a Property in the U.S.

- Scenario 5: Owning Property in the U.S.

- Scenario 6: Non-U.S. Resident Student, Professor, or Researcher Filing a U.S. Tax Return

- Scenario 7: Non-U.S. Resident Filing a Federal Income Tax Return

Required Documents to Obtain an ITIN

To apply for an ITIN, you’ll need to prepare a few essential documents based on your specific situation. Below, we’ve listed the general requirements; these may vary depending on your specific ITIN scenario.

- Article of Organization.

- Home Country Address (Bank Statement).

- EIN Document CP575 (Official) & 147C (Official).

- Company Ownership Document.

- Scan Copy of Passport.

Note: If you don’t know how to provide a scanned copy of your passport, then check our blog, “How to Properly Scan & Submit Your Passport for Global Business Incorporation?”

Step 2: Document Verification

The Business Globalizer team carefully checks every document you’ve submitted. If anything’s missing or doesn’t meet the requirements, we’ll promptly reach out with clear instructions, so you can quickly fix it and keep things moving without stress.

Step 3: ITIN Application Form Preparation

Once we’ve carefully verified all your documents, we’ll move on to preparing your ITIN application. This includes accurately filling out Form W-7 with the details you’ve provided, making sure everything is in perfect order before moving further in the process.

Step 4: Sending the Form for the Client’s Physical Signature

Once we’ve carefully prepared your ITIN application form, we’ll send it over to you for a physical signature. This step is important, as your hand-signed copy is required before we can proceed.

Step 5: Client Signs & Returns the Form

Once the form is received, the client carefully reviews, signs it, and sends it back to Business Globalizer for the next step.

Step 6: CAA Signature & IRS Submission

Once everything’s double-checked, our Certified Acceptance Agent (CAA) signs your form and securely ships it to the IRS through a trusted shipping partner for official processing.

Step 7: IRS Processes the Application

Once the IRS receives your complete ITIN application, they begin reviewing and processing it. This step usually takes a few weeks, depending on their current workload.

Step 8: ITIN Issuance (If Everything Goes Smoothly)

Once the IRS processes your application without any issues, they’ll go ahead and issue your ITIN and send it your way.

ITIN Processing Time: Standard & Exceptional Cases

Standard Processing Time

7 weeks from the date the IRS receives the form.

Exceptional Cases Where Processing Can Take Longer (9-12+ Weeks)

Processing time may be extended due to:

- U.S. Holidays (November-December).

- IRS Rush Seasons (e.g. Tax season) (January-April).

- High Application Volume.

- Errors in Required Information or Documents.

- Misplaced Documents (by IRS).

- Delays in Shipment & Shipping Methods.

- IRS Internal Processing Issues.

Sometimes, the IRS simply delays processing with no explanation, no reason provided, no official response. In many cases, delays occur due to high workload during tax season, missing or incorrect documents, slow shipment handling, or internal IRS processing inefficiencies.

But sometimes, despite everything being in order, they just delay without any justification. As a third-party service provider, we actually don’t have any say or control over this.

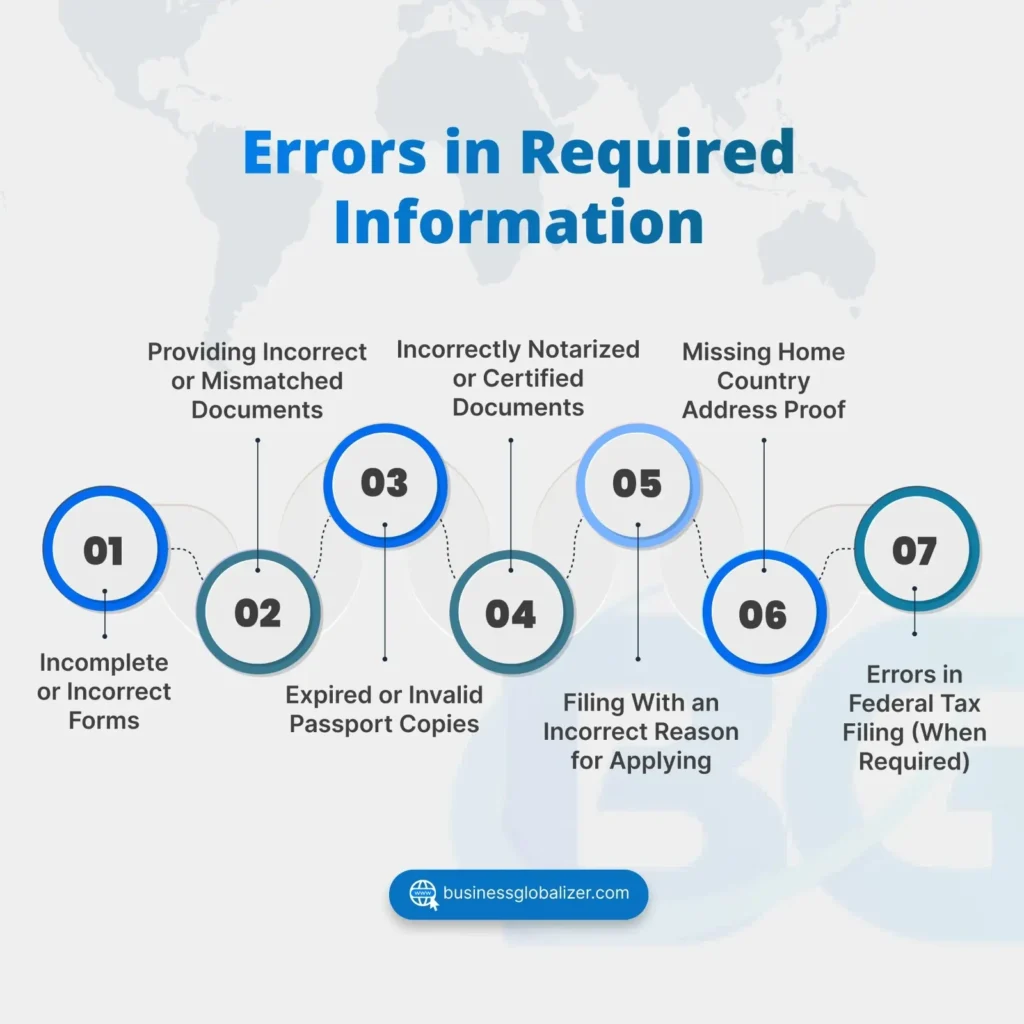

Errors in Required Information or Documents That Can Delay ITIN Processing

Mistakes in an ITIN application can cause significant delays. Here are some common errors and how to avoid them:

- Incomplete or Incorrect Forms

Mistake: Missing signatures, incorrect names, or incomplete Form W-7 (due to client errors).

Solution: Double-check all information before sending us. Ensure your names match passport records.

- Providing Incorrect or Mismatched Documents

Mistake: Submitting a home country document that doesn’t match IRS requirements.

Solution: Follow the exact document list per your scenario. Ensure documents are translated into English if required.

- Expired or Invalid Passport Copies

Mistake: Sending an expired passport copy.

Solution: Provide a valid and clear scanned copy of your passport.

- Incorrectly Notarized or Certified Documents

Mistake: Sending improperly notarized copies of documents.

Solution: Use an IRS-approved Certifying Acceptance Agent (CAA) or get documents certified at a U.S. embassy.

- Filing With an Incorrect Reason for Applying

Mistake: Selecting an incorrect reason on Form W-7.

Solution: Ensure you choose the correct scenario based on your requirements. And inform us accordingly.

- Missing Home Country Address Proof

Mistake: Forgetting to send us a bank statement or utility bill as proof of address.

Solution: Ensure your address proof is recent (within the last 3 months).

- Errors in Federal Tax Filing (When Required)

Mistake: Submitting an incomplete or incorrect federal income tax return.

Solution: Ensure your tax return is correctly signed, filed, and includes a payment receipt. Then, provide it to us properly for processing.

Real-World Exceptions

Fastest Case:

We take pride in having Bangladesh’s first IRS-Certified Acceptance Agent (CAA) on our team! In a standout case, our CAA personally delivered an ITIN application to the IRS in the U.S., expediting the process. As a result, the ITIN was approved in just 4 weeks instead of the standard 6 weeks.

Delayed Case:

A form was shipped to the IRS in May 2024 but the applicant still hasn’t received the document, even though the ITIN has been issued. The IRS, when contacted, sometimes asks for more documents or simply delays sending the final document.

Important Disclaimer: Business Globalizer’s Role in the Process

- Business Globalizer facilitates the ITIN application process by verifying documents, preparing the application, and submitting it to the IRS. However, once the application is shipped to the IRS, we have no control over their processing timeline or final approval.

- Our support team regularly follows up with the IRS for updates on behalf of our clients, ensuring that any additional information or documents requested by the IRS are promptly provided. However, we cannot guarantee an exact processing time or influence the final outcome.

- Business Globalizer holds no responsibility for any delays, misplaced documents, or additional requirements imposed by the IRS. The final decision and timeline remain solely under IRS control.

How to Contact Us?

- Existing Clients: Reach out to us directly through your dashboard for support.

- New Clients: If you’re looking to form a company, or trying to purchase any other services, contact our support team through the official channels or book a consultation for personalized guidance.

Final Thoughts

The ITIN application process requires careful document preparation and submission. While Business Globalizer ensures a smooth and efficient process, external factors like IRS processing delays can sometimes extend the timeline.

Need help applying for an ITIN? Business Globalizer is here to assist you at every step!