So you’ve applied for your ITIN and finally received a letter from the IRS labeled “CP565 Notice.” Most people either panic or ignore it. Both are bad moves. The CP565 Notice isn’t a problem; it’s actually good news. It means your ITIN application was approved and your number is now official in the IRS system.

But here’s the catch: this letter is more important than it looks. It’s not just another letter from the IRS; it’s the document that proves you actually own your ITIN. And let’s be honest: unless you’ve somehow memorized all nine digits, you’ll need that number every single time you file taxes, renew your ITIN, or confirm who you are.

So, here’s the deal: let’s unpack what the CP565 notice actually is, why it matters if you lose it, and how to get a fresh copy without the stress.

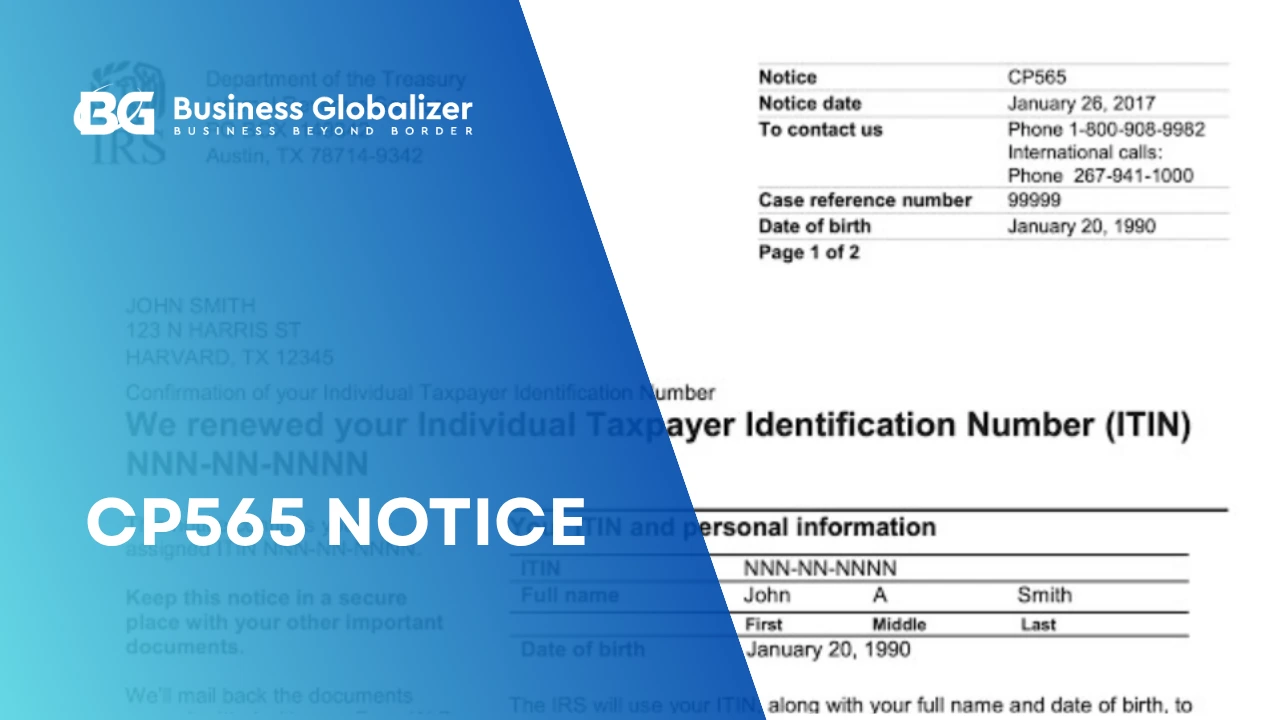

What Is a CP565 Notice?

The CP565 Notice is basically the IRS’s way of saying, “Your ITIN is ready and official.”

It’s the confirmation letter that proves your Individual Taxpayer Identification Number has been approved and issued.

You’ll usually get it in your mailbox a few weeks after your Form W-7 application is successfully processed. Simple, but important to keep safe.

What does it include? Well…

- Your assigned ITIN number.

- The date of issue.

- A brief message from the IRS confirming that your ITIN is active and ready for use.

Keep it safe. The IRS doesn’t send another copy unless you specifically request one.

CP565 Notice Sample

A sample of IRS Notice CP565 pdf attached below:

- The official English version can be viewed here: https://www.irs.gov/pub/notices/cp565_english.pdf

- The official Spanish version can be viewed here: https://www.irs.gov/pub/notices/cp565_spanish.pdf

Why You Receive a CP565 Notice

If you’ve got a CP565 Notice in the mail, take it as good news; it means the IRS has checked your Form W-7, verified your documents, and officially approved your Individual Taxpayer Identification Number (ITIN).

You’ll typically get this notice if:

- You’re a non-U.S. resident getting ready to file your U.S. taxes for the very first time.

- You might’ve applied for an ITIN because your spouse or dependent is tied to a U.S. taxpayer.

- You’ve earned income, invested, or own property in the U.S. and needed a tax ID for reporting or compliance.

In short, the CP565 Notice is your green light from the IRS, proof that your ITIN is active and ready to use. You’ll need it when filing taxes, claiming treaty benefits, or confirming your identity with banks or payment platforms. Think of it as your official IRS “yes” — your application went through successfully.

What to Do When You Receive Your CP565 Notice

When your CP565 Notice lands, give it a quick, careful look. It’s the IRS confirming your ITIN (Individual Taxpayer Identification Number) is active and on record.

Here’s what to do next:

- Verify the details. Make sure your name, ITIN, and mailing address are accurate. If anything’s off, contact the IRS right away.

- Store it safely. Keep the notice with your important tax or legal documents; you’ll need it for renewals, bank verification, or future filings.

- Start using your ITIN. You can now use it for tax filing, claiming treaty benefits, or verifying your taxpayer status with financial platforms like PayPal or banks.

Remember, your ITIN stays valid as long as you use it at least once every three years. If it remains inactive, it expires. But you can easily renew it before your next tax season.

What If You Lost Your CP565 Notice?

Losing your CP565 Notice happens more often than you’d think and thankfully, it’s not the end of the world. The IRS can issue a replacement so you can still prove your ITIN status when needed.

Here’s what to do:

- Call the IRS ITIN Unit at 1-800-829-1040 (inside the U.S.) or 1-267-941-1000 (outside the U.S.).

- Ask for a reissued ITIN confirmation letter. You can request a replacement for your CP565 Notice, and the IRS will send you a new one called CP565A.

- Verify your identity. Be ready to confirm details like your full name, date of birth, and ITIN number (if you still have it recorded somewhere).

Within a few weeks, your new CP565A letter will arrive in the mail. It’s an official duplicate and holds the same legal value as your original CP565 form, keep it safe this time.

CP565 vs. CP565A, What’s the Real Difference?

If you’ve received a CP565A instead of the original CP565 Notice, don’t be concerned. It’s okay. Both serve the very same purpose.

Here’s the simple breakdown:

- CP565 Notice: This is the first letter, or notice, which you get from the IRS confirming your new ITIN approval.

- CP565A Notice: This is a replacement or duplicate version, issued when you’ve lost your original CP565 or requested another copy.

Both are official IRS documents that confirm your ITIN is valid and active. Now, whether you’re filing taxes, renewing your ITIN, or proving your taxpayer identity, either notice works perfectly. So, no need to stress. A CP565A holds the same legal value as your original CP565.

Why You Should Never Ignore Your CP565 Notice

Think of your CP565 Notice as more than just a letter, it’s your IRS-issued proof that your ITIN exists and is valid. Losing or overlooking it can quietly cause trouble down the road.

Here’s why it matters:

- You’ll need it for future tax filings as proof of your assigned ITIN.

- If your ITIN expires, you’ll have to present this notice when renewing.

- Banks, fintech platforms, and PayPal may request it to verify your taxpayer identity.

In short, the CP565 Notice is like your tax ID passport. Small, but powerful. Keep it stored safely in both physical and digital form, because replacing it later takes time and paperwork.

Business Globalizer: IRS-Certified Help for ITIN Applicants

If you haven’t yet received your CP565 Notice or your ITIN application got stuck, that’s where we step in.

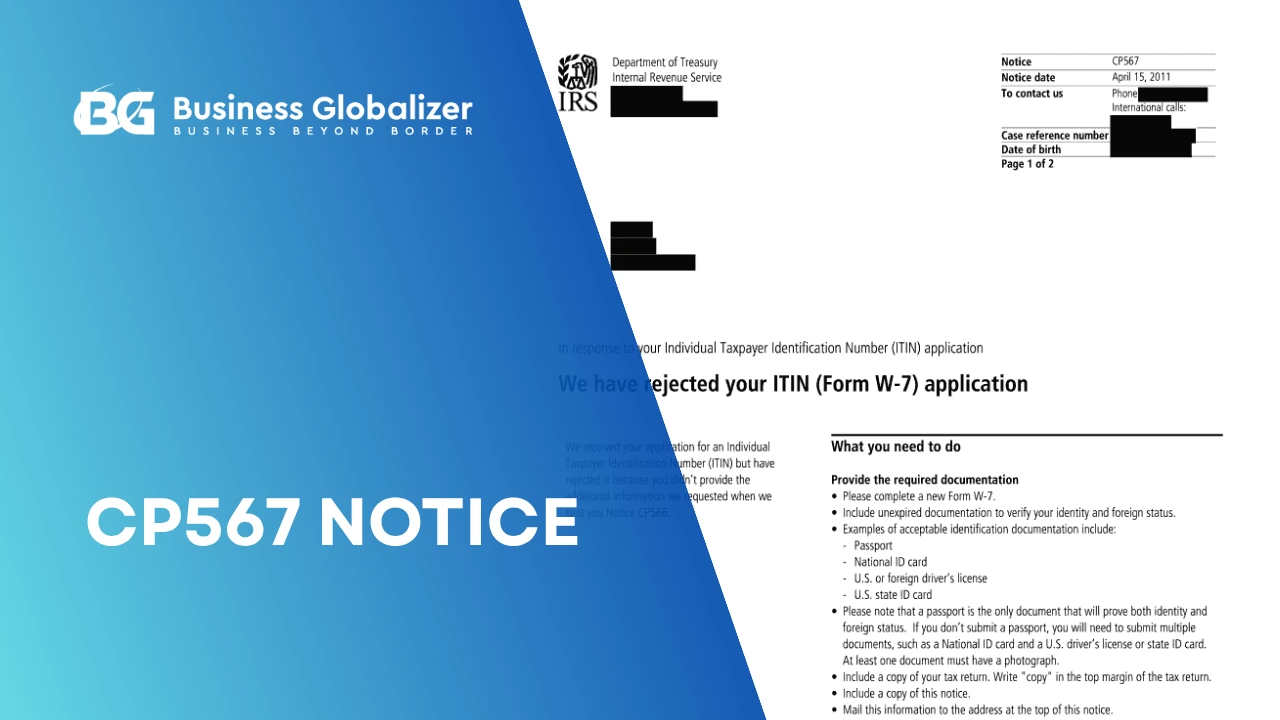

At Business Globalizer, we’re not just another service; we’re Bangladesh’s first IRS-authorized Certified Acceptance Agent (CAA). We help clients worldwide apply for ITINs safely, verify passports locally, and ensure IRS notices like CP565, CP566, and CP567 are handled correctly.

We make sure that your application is filed correctly the first time, whether you are a business owner, a dependent, or an investor. No more forms getting lost or having to deal with the IRS.

Closing Thoughts

The CP565 Notice is more than a formality; it’s your official proof that your ITIN is active and recognized by the IRS. Whether you’re filing taxes, running a U.S. business, or verifying your PayPal account, that single piece of paper makes all the difference.

If you’ve lost it or never received it, act quickly. Call the IRS or reach out to an IRS Certified Acceptance Agent like Business Globalizer to help you retrieve or confirm your ITIN safely.

Because when it comes to taxes, clarity and proof go hand in hand.

Frequently Asked Questions on CP565 Notice

What is a CP565 Notice?

Answer: It’s the official IRS letter confirming that your ITIN application was approved and your number has been issued.

How do I respond to a CP565 Notice?

Answer: You don’t need to respond, it’s a confirmation, not a demand. Just keep it safe for future use.

What are common reasons for CP565 Notices?

Answer: You’ll receive it after a successful ITIN application via Form W-7, usually for tax filing, dependent status, or investment reporting.

I lost my CP565 Notice. What should I do?

Answer: Just call the IRS ITIN Unit and ask for a duplicate. They’ll mail you a replacement confirmation letter, it’s called CP565A, which works exactly the same as your original.

I got CP565A instead of CP565. What’s the difference?

Answer: Well.. there isn’t one; no differences I mean. CP565A is simply the reissued version of your original CP565. It confirms your ITIN in the same way.

Can I get a CP565 notice online?

Answer: Unfortunately, no. The IRS only sends it through physical mail for security reasons. So, you just make sure your mailing address (or your registered agent’s—if you are nonresident) is up to date so it doesn’t get lost in transit.

How long does it take to receive a CP565 Notice?

Answer: To receive a CP565 notice, it normally takes 7 to 11 weeks after your ITIN is approved. But can take a bit longer depending on where you live and the IRS’s workload at that time.