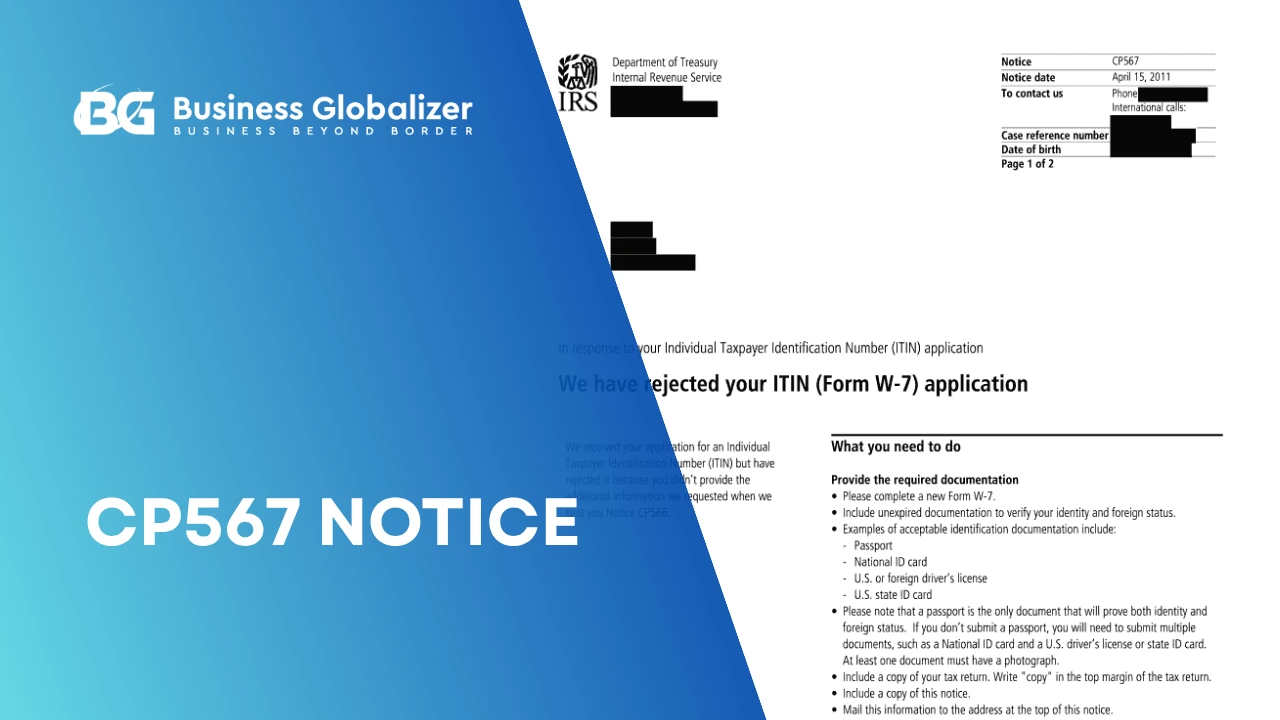

If you’ve applied for an ITIN and instead of an approval letter (CP565 Notice), you find “IRS Notice CP567” in your mailbox, it means your application didn’t go through. But before you panic, take a breath. A CP567 Notice isn’t the end of the road; it’s simply the IRS telling you why your ITIN application was rejected and how to fix it.

Understanding what this letter means and acting on it correctly is the difference between waiting another few weeks and restarting the whole process. Let’s go through it, clearly and properly.

What Is a CP567 Notice?

A CP567 Notice is an official rejection letter from the IRS stating that your ITIN application has been denied. It’s the IRS’s way of saying, “We reviewed your Form W-7, but something didn’t meet the requirements.”

Unlike a CP566 Notice, which means you’re missing documents, a CP567 Notice means your file has been fully reviewed, and the IRS decided not to issue your ITIN.

The Notice CP567 also explains why your ITIN application was rejected. Common reasons include:

- Your documents didn’t prove identity or foreign status.

- You didn’t provide a valid tax filing reason.

- You already have an active ITIN or SSN.

- The information you submitted conflicted with IRS records.

- You failed to respond to a prior CP566 Notice within 45 days.

This letter is your guide to understanding what went wrong. Not a final wall. At least not always.

Why You Received a CP567 Notice

Most ITIN rejections fall into a few predictable categories:

- Invalid or Uncertified Documents

The IRS was unable to verify your identity since your passport or ID wasn’t certified by the issuing authority or a Certified Acceptance Agent (CAA).

- Incorrect or Missing Reason for Applying

You didn’t clearly state why you need an ITIN. The IRS only issues ITINs for valid tax purposes, like filing a federal return, claiming dependents, or reporting U.S. income.

- Duplicate Application

You already have an ITIN or a Social Security Number (SSN). The IRS won’t issue duplicates under any circumstances.

- Expired Documents or Late Response

If you failed to respond to a CP566 Notice (a request for missing paperwork) or sent expired documents, your case automatically moves to rejection.

- Incorrect Filing Setup

Your W-7 might not have been attached to the right tax form, or your filing address or country details didn’t match supporting documents.

What to Do After Receiving a CP567 Notice

Here’s how to get your ITIN application back on track:

- Read the CP567 Notice carefully.

It specifies the exact reason for rejection, don’t skip this step. Each case is different.

- Fix the mentioned issue.

- If the IRS questioned your ID, get a certified passport copy or use a CAA to verify it.

- If your tax return was missing, attach it this time.

- If you had the wrong reason code, update it correctly on Form W-7.

- Prepare a new Form W-7.

The IRS doesn’t reopen old applications, you’ll need to reapply with a fresh form and corrected documents.

- Submit through the right channel.

- By mail: Send your full application package to the IRS address listed in the notice.

- Through a Certified Acceptance Agent: This is the easiest option, especially if you’re abroad. A CAA verifies your documents locally and submits your case directly to the IRS.

Once the IRS receives your corrected file, your new ITIN will usually be approved within 7–11 weeks (longer during tax season).

Common Mistakes That Lead to a CP567 Notice

A CP567 Notice usually happens because of small but critical oversights in your ITIN application, the kind that seem minor until the IRS flags them. Let’s look at the most common ones:

- Sending scanned or photocopied passports instead of certified copies verified by the issuing authority or a Certified Acceptance Agent (CAA).

- Leaving the reason box on Form W-7 blank, or writing something vague, is one of the quickest ways to get rejected. The IRS wants to know exactly why you’re applying: whether it’s to file taxes as a nonresident, claim dependents, report as a spouse, verify student status, or handle income from U.S. investments or property.

- Forgetting to attach your federal tax return when it’s required with your ITIN application.

- Mixing personal and business filings; such as using business tax details for a personal ITIN or vice versa.

- Submitting mismatched information; names, addresses, or birth dates that don’t line up across your forms and IDs.

Each of these can trigger a CP567 ITIN rejected notice. The good news? They’re all fixable. Reviewing your paperwork carefully, or better yet, filing through an IRS-approved Certified Acceptance Agent, keeps you out of this trap the next time.

How to Prevent Future ITIN Rejections

A CP567 Notice is frustrating, but it’s also a chance to get things right the next time. Here’s how to avoid another ITIN application rejected letter:

- Work with an IRS-authorized Certified Acceptance Agent (CAA). A CAA reviews and certifies your documents before submission, minimizing the risk of rejection.

- Download the latest Form W-7 directly from IRS.gov. Outdated versions are one of the most common reasons for IRS ITIN rejection.

- Keep all previous IRS correspondence, including your CP567 Notice and any other relevant notices, as references when reapplying.

- Double-check document validity. Never reuse expired passports, IDs, or forms.

- Be consistent across all forms. Make very sure that your name, date of birth, and address perfectly match on your tax return and supporting documents.

A correctly filled and verified ITIN application rarely faces rejection twice, especially when you’ve learned from the first attempt and corrected every detail the IRS pointed out.

Business Globalizer: Fixing CP567 Notice Cases the Right Way

If your ITIN was rejected, don’t waste another 11 or 12 weeks repeating the same mistake.

At Business Globalizer, we’re the first IRS-authorized Certified Acceptance Agent (CAA) in Bangladesh, helping clients worldwide fixing ITIN application rejection cases, fast and correctly.

We’ll review your rejection letter, pinpoint the cause, verify your documents locally (no need to mail your passport to the U.S.), and refile your ITIN package directly with the IRS.

Whether your case involves personal tax filing, dependent claims, or business compliance, our IRS-vetted process ensures your next application doesn’t bounce back again.

Closing Thoughts

Getting a CP567 Notice can feel like a setback, but it’s not the end of your ITIN process. There’s always an alternative.

Once you understand the reason behind your ITIN rejection and address it properly, approval is completely within reach.

And if you’d rather not go through another round of guesswork, working with an IRS-authorized Certified Acceptance Agent (CAA), like Business Globalizer, makes all the difference. Because when it comes to tax filing with ITIN, every nonresident deserves accuracy, peace of mind, and a clear green light from the IRS.

FAQs on CP567 Notice

Does the IRS notify you of rejection?

Answer: Yes. The IRS sends an official CP567 Notice when your ITIN application is rejected. It explains exactly why: missing documents, expired ID, or incorrect details. Keep this letter safe; it’s your guide for fixing and resubmitting the application.

How long does it take the IRS to accept or reject an ITIN application?

Answer: Usually, it takes about 7–11 weeks for the IRS to review an ITIN application. If something’s missing or unclear, you’ll get a CP566 or CP567 Notice instead of an approval letter. During tax season or if you applied from outside the U.S. expect it to take a little longer.

Can I reapply immediately after receiving a CP567 Notice?

Answer: Yes, you can. Just fix what the notice points out first. Then use a new Form W-7 and make sure all your documents are updated and correct before sending it again.

What’s the difference between a CP565, CP566, and CP567 Notice?

Answer: The differences between these notices are as follows:

- CP565 Notice: Confirms your ITIN has been approved.

- CP566 Notice: Means your application is incomplete or missing documents.

- CP567 Notice: Indicates your ITIN application was rejected and needs correction before resubmission.

Can I still file taxes after receiving a CP567 Notice?

Answer: Not until your ITIN is approved. You’ll need a valid ITIN to file or claim tax benefits. Once you reapply and the IRS approves it, you can submit your tax return normally.

Who can help fix an ITIN rejected by the IRS?

Answer: Well, an IRS-Certified Acceptance Agent (CAA), such as Business Globalizer, can help you by reviewing your CP567 notice, ensuring your documents are in order, and resubmitting your ITIN application correctly to avoid any further rejections.