Imagine this: you’re a non-U.S. resident with income connected to the United States. Maybe you run a small online store registered in Delaware. Maybe you’re renting out a small place in Florida, or your spouse is a U.S. citizen and you’re filing taxes together. You don’t qualify for a Social Security Number, yet the IRS still wants to see your income on record.

That’s when the question hits: Do I actually need to complete my U.S. tax filing with ITIN?

Here’s the plain truth, if you can’t get an SSN but still need to file taxes or claim benefits under a tax treaty, then yes, you do. That nine-digit ITIN is basically your pass to stay compliant and connected with the U.S. tax system.

What Is an ITIN and Why It Exists

The ITIN, which is also called Individual Taxpayer Identification Number, is a unique nine-digit number issued by the IRS for tax purposes. This one-of-a-kind number is designed for people who need to file U.S. taxes but are not quite eligible for a SSN (Social Security Number). Most often those people are non-U.S. residents, foreign spouses, dependents, or investors with U.S.-based income.

Having an ITIN doesn’t give you the right to work or change your immigration status; it’s purely for tax filing with ITIN and record-keeping. But it does allow you to:

- File federal income tax returns correctly.

- Receive any tax refund you’re entitled to.

- Stay compliant with IRS tax reporting rules.

- Claim tax treaty benefits that help reduce withholding rates.

In short, an ITIN for tax filing bridges the gap for anyone earning from U.S. sources who isn’t eligible for an SSN; giving them a legal, trackable way to stay on the IRS’s good side.

When a Non-Resident Needs an ITIN for Tax Filing

Not every foreigner with a U.S. connection needs an ITIN. But if you earn, invest, or file taxes in the U.S., chances are you do.

Here’s when tax filing with an ITIN becomes necessary:

- You earn U.S.-based income.

Maybe you’re earning from a U.S. company: rent, dividends, or a few consulting checks here and there. The IRS still expects you to report that income.

- You must file a federal income tax return.

Even as a non-resident, if you have taxable U.S. income (owning a US company or through other ways), you need an ITIN to submit your return correctly.

- You’re claiming a tax treaty benefit.

To take advantage of reduced tax rates under your country’s treaty with the U.S., you’ll need a valid ITIN.

Stipends, scholarships with taxable portions, or required returns, typically require an ITIN for tax filing if you can’t get an SSN.

- Your spouse is not eligible to have an SSN.

If you’re filing a joint return and your spouse doesn’t have an SSN, they must have an ITIN to be included on your tax filing.

- You’re claimed as a dependent.

Dependents without SSNs also need an ITIN so their parents can claim them for credits or deductions.

- You’re a nonresident investor or property owner.

U.S. brokerage income, FIRPTA-related real estate sales, or rental income generally trigger filing needs; you’ll use an ITIN to report and claim any treaty benefits.

In plain terms, if your money or family ties connect you to the U.S. tax system, tax filing with ITIN isn’t optional; it’s how you stay compliant and protect your refund.

When an EIN Might Be Enough

Here’s where most non-residents get confused: “If my company already has an EIN, do I still need an ITIN for tax filing?”

It really comes down to who’s earning the money, you or your company.

If you’re a foreign individual running a U.S. single-member LLC, you’ll still need an ITIN to file your Form 1040-NR (Nonresident Tax Return). Your EIN only identifies the business, not you personally for tax purposes.

However, if your LLC is owned by another company instead of an individual, the EIN alone usually works, since the income belongs to a corporate entity. Not a person.

So, think of it this way:

- EIN = for your business

- ITIN = for you as the person behind it

For most non-residents filing federal taxes, tax filing with ITIN ensures the IRS links your income, refunds, and compliance to you, not just your business entity.

How to Apply for an ITIN for Tax Filing

Getting your ITIN isn’t complicated, it just needs to be done right. The IRS only issues it through a proper application using Form W-7, which must be submitted with your federal tax return (unless you qualify for an exception).

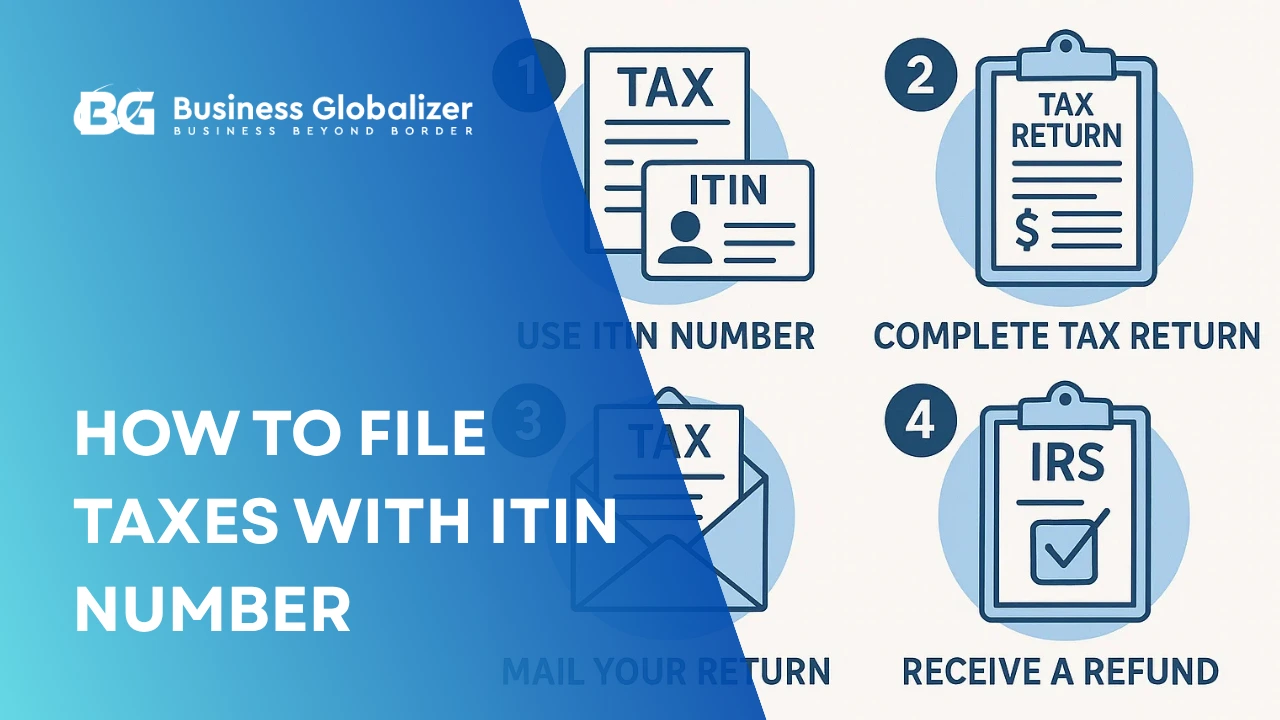

Let’s go through the quick breakdown:

- Fill out Form W-7.

You’ll choose the right reason; for example, “Nonresident alien filing a U.S. tax return.” Just make sure every detail matches your passport exactly, down to the last letter.

- Attach your supporting documents.

A valid passport is enough in most cases. If you don’t have one, you’ll need a combination of ID and proof of foreign status (like a national ID and visa).

- Include your federal tax return.

The IRS uses this to verify your tax purpose for applying.

- Submit through a Certified Acceptance Agent (CAA).

Especially if you’re abroad, using a CAA is the safest route. They verify your identity, check your documents, and send your file directly to the IRS. No need to mail your passport.

That’s it. In about 7–11 weeks, you’ll receive your ITIN confirmation letter. Once issued, you can confidently proceed with tax filing with ITIN, avoiding any hold-ups or compliance issues.

Why Timely ITIN Application Matters

Here’s something many non-residents realize too late: timing matters as much as accuracy when it comes to your ITIN.

Filing your federal return without an ITIN can cause:

- Processing delays. The IRS won’t process your return or issue a refund until your ITIN is approved.

- Missed tax deadlines. If your W-7 and tax return are sent too close to the deadline, the IRS may mark your filing as late, even if you mailed it on time.

- Refund complications. Any refund due stays on hold until your identity is verified.

- Extra paperwork later. If you file without an ITIN, you’ll eventually need to file an amended return once your ITIN arrives.

Applying early, ideally before the tax season rush, ensures your tax filing with ITIN goes smoothly and your return isn’t caught in months of processing limbo.

In short, the sooner you secure your ITIN, the sooner your taxes (and refunds) move forward without a hitch.

Filing Taxes Without an ITIN Can Backfire Fast

Here’s the catch most non-residents (who are required to have an ITIN) don’t see coming: sending your tax return without an ITIN doesn’t skip the line; it puts you at the very back of it.

Here’s what really happens when you try to file without one:

- The IRS won’t process your return. Without a valid ITIN or SSN, your tax filing just sits there; unprocessed until the IRS gets your number.

- Refunds stay locked. Even if you’re due a refund, it won’t be released until your ITIN for tax filing is approved and linked to your record.

- Payment platforms hit a wall. Payment platforms like PayPal ask for a valid tax ID to verify who you are and stay within IRS rules. Without an ITIN, most non-U.S. residents run into roadblocks; limited accounts, held payments, or flat-out verification refusals.

- Banks can block or limit accounts. Some U.S. and international banks (especially when opening remotely or for non-residents) request an ITIN for tax reporting under FATCA and IRS compliance. No number, no account access.

- Late penalties sneak in. If your ITIN delay causes missed tax deadlines, the IRS can tag your return as “late” and add interest.

- Compliance red flags build up. Repeated filings without a valid ITIN can raise questions about your reporting accuracy, not a great look when dealing with U.S. tax authorities.

- You’ll end up refiling later anyway. Once your ITIN arrives, you’ll have to amend your original return; doubling your paperwork and waiting time.

In short, filing without an ITIN isn’t a shortcut, it’s a stall. If you’re required to report U.S. income or run a business that falls under U.S. tax rules, get your ITIN first. It’s the one detail that keeps your compliance clean and your money moving.

Common Mistakes When Filing Taxes with an ITIN

Even simple errors can delay or derail your tax filing with ITIN, and they happen more often than you’d think. Check the following to learn what to avoid:

Wrong reason code on Form W-7.

Selecting the incorrect purpose (like “dependent” instead of “nonresident filer”) is one of the top causes of rejection.

Mismatched personal details.

Make sure your name, date of birth, and country match exactly on your passport, W-7 form, and tax return. Even a single misplaced letter can throw the IRS off and delay everything.

Expired or unclear passport copies.

If your ID isn’t valid or the scan isn’t clear, the IRS won’t process your application. Always use certified or verified copies.

Skipping the tax return attachment.

Unless you qualify for an exemption, you can’t apply for an ITIN without including your tax return.

Mailing documents directly from outside the U.S.

Many nonresidents lose weeks, or even months, waiting for mail verification. Working with a Certified Acceptance Agent (CAA) helps avoid that risk altogether.

Getting ITIN for tax filing right the first time saves you from unnecessary delays, penalties, or rejection letters, and ensures your U.S. tax compliance stays spotless.

Business Globalizer: Your Trusted Partner for ITIN and Tax Compliance

Getting your ITIN right the first time isn’t about filling out a form only; it’s about peace of mind. At Business Globalizer, we’re more than a service provider. We’re Bangladesh’s first IRS Certified Acceptance Agent (CAA), trusted by non-U.S. residents, business owners, freelancers, and even spouses to secure their ITINs legally, quickly, and stress-free.

From ITIN applications and renewals to U.S. company formation, annual filings, and tax reports, our experts make sure every step follows IRS standards, and gets accepted the very first time.

Closing It Out

When it comes to filing taxes with an ITIN, timing and accuracy are not just some details. They’re everything. Whether you run a U.S. LLC, earn income from abroad, or need verification for PayPal or your bank, your ITIN is what connects you to the U.S. tax system. Safely and officially.

So before tax season quietly creeps in, make sure your ITIN is active, valid, and filed right. Because in tax compliance, even the smallest number can make the biggest and real difference.

FAQ on Filing Taxes with an ITIN

Do I need an ITIN to file taxes as a non-resident?

Answer: Yes. If you earn income from the U.S. or need to file a federal tax return but don’t qualify for an SSN, you’ll need an ITIN. It’s the number the IRS uses to identify you for tax purposes.

Can I get a tax refund with an ITIN?

Answer: Absolutely. If you’ve paid more tax than you owe, the IRS will send your refund just like it does for any U.S. taxpayer, as long as you file with a valid ITIN.

Do I need to file taxes if I don’t live in the U.S.?

Answer: If your money comes from the U.S. whether it’s business income, rent, or interest, then yes, you’re still required to file a federal return. Having an ITIN simply keeps your filings legal and stress-free.

How do I know if I need an ITIN or EIN for my business?

Answer: Use an ITIN for individual filings or tax reports as a foreign owner. Use an EIN for company-level filings or payroll. Sometimes, you’ll need both.

I’m a nonresident, Can I file taxes without an ITIN?

Answer: Well, you can submit a return, but the IRS won’t process it until your ITIN is approved. That means no refund, no confirmation, and possible late penalties.

How long does it take to get an ITIN approved?

Answer: Usually, it takes 7–11 weeks. But applying through a Certified Acceptance Agent like Business Globalizer can make the process faster and error-free.

Can I renew an expired ITIN online?

Answer: No. ITIN renewal still requires submitting Form W-7 with valid ID or verification through a Certified Acceptance Agent. And no, you can’t do it online.