You’ve probably filled out your LLC paperwork, received your EIN, and maybe even opened a U.S. bank account, feeling like things are falling into place. But then comes U.S. PayPal. You apply for a business account, upload your documents, and just when you think you’re good to go, it asks for your Social Security Number.

Not ideal when you’re not a U.S. citizen.

This is the part where many non-resident entrepreneurs get stuck.

You might think: “I already gave them the EIN for my business. Shouldn’t that be enough?”

The answer? Not quite. And that’s where the ITIN steps in.

Now, let’s walk through why ITIN actually matters more than EIN when it comes to getting your U.S. PayPal Business account fully verified and working.

Key Insights:

- Many non-residents think an EIN is enough for PayPal, but deeper checks eventually force PayPal to confirm the person behind the business.

- PayPal accepts an EIN for business setup, but it still needs an SSN or ITIN to verify your personal identity when you’re not a U.S. resident.

- An ITIN works as your personal tax ID in the U.S., and PayPal uses it to confirm you’re a real individual who can legally report income if required.

- Accounts opened with only an EIN often run into sudden limitations, freezes, or verification blocks once PayPal asks for personal ID.

- PayPal checks both: the company (EIN) and the owner (ITIN), and without that personal link, your account never reaches full functionality.

- An ITIN becomes essential for non-residents who want unrestricted access to incoming funds without worrying about review-triggered limits.

- Beyond PayPal, you’ll need an ITIN for taxes, property deals, investments, dependents, or any U.S. activity tied to personal identification.

- Stripe, Wise, and other platforms follow similar compliance rules, which is why an ITIN keeps you verified across multiple financial systems.

- The ITIN is the only legal alternative to an SSN for non-residents, and it’s fully accepted by PayPal for personal verification.

- In simple terms: the EIN proves your business exists, but the ITIN proves you exist — and that’s what keeps your PayPal account safe long-term.

What is an ITIN?

An ITIN or Individual Taxpayer Identification Number is a U.S. tax ID. This ID is issued and provided by the IRS for those who are unable to obtain an SSN (Social Security Number). This mainly applies to those who are non-residents, foreign nationals, or anyone lacking U.S. immigration status.

The purpose of an ITIN is simple: to identify you as a person in the U.S. tax system (tax treaty, individual tax return, etc.), especially when platforms like PayPal need to verify the account holder.

What is an EIN?

An EIN or Employer Identification Number is issued to U.S. businesses by the IRS. It functions like a Social Security Number, but for your company only.

It’s used to file business taxes, open a business bank account, and register your LLC or corporation.

However, when it comes to platforms that need to know who’s behind the company, like PayPal, the EIN alone doesn’t go far enough.

Why Do You Need an ITIN instead of an EIN for Opening a U.S. PayPal Business Account?

Let’s make one thing clear right away:

PayPal isn’t just looking at your business; it’s also looking at you.

Even when you’re opening a PayPal Business account, it still needs to confirm the identity of the person behind the business.

Here’s the difference:

- EIN is your company’s tax ID.

- ITIN is your personal tax ID if you’re not eligible for a Social Security Number.

Now, most people stop at the EIN stage, especially after forming an LLC. You can technically open a PayPal Business account with just an EIN. But here’s the catch: without an ITIN, your account might function with limited features, and you could run into verification issues later on.

These issues usually don’t appear at the beginning. You might even get your account up and running without problems. But once PayPal runs deeper checks, or if your account is flagged or temporarily limited, you’ll be asked to verify your personal identity. That’s part of PayPal identity verification, and if you’re not eligible for a Social Security Number (SSN), that’s where the ITIN comes in.

If you’re managing a company from overseas and want unrestricted access to your PayPal funds, and don’t want to worry about sudden limitations or account freezes, then getting an ITIN isn’t just helpful. It’s almost mandatory.

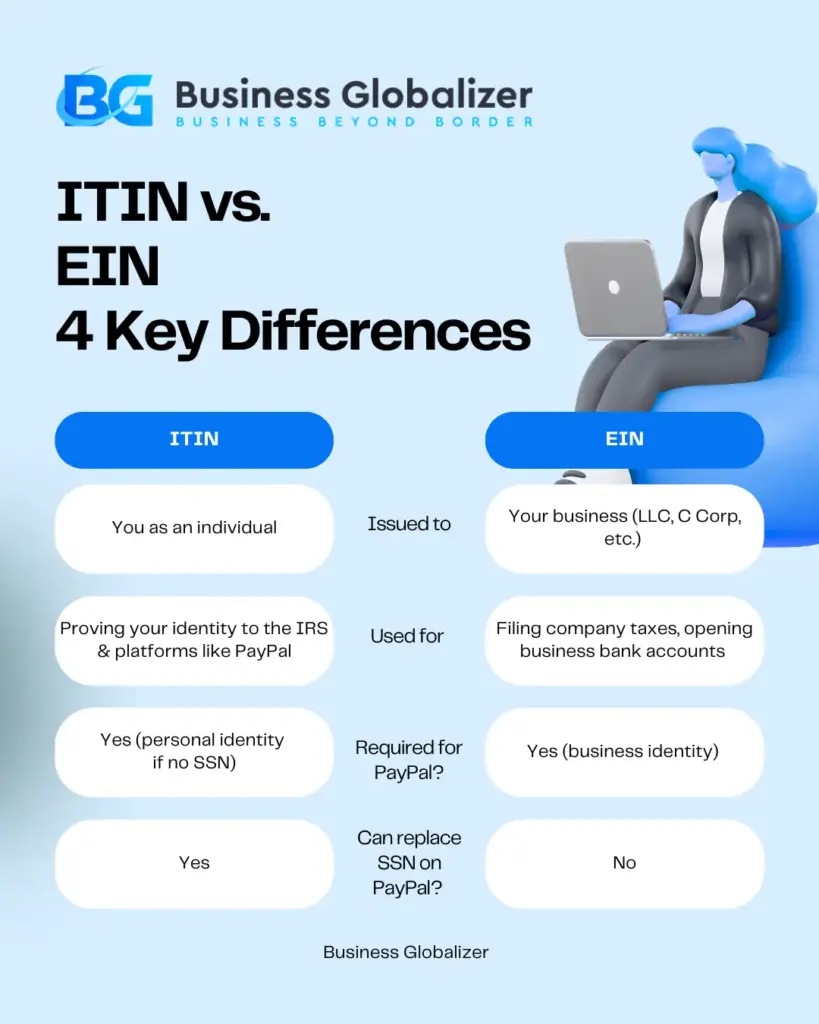

Let’s break it down: EIN vs. ITIN

Hoping you are a bit curious about the differences between an EIN and ITIN, here’s a brief comparison table for you:

| Criteria | EIN (Employer ID Number) | ITIN (Individual Tax ID Number) |

| Issued to | Your business (LLC, C Corp, etc.) | You as an individual |

| Used for | Filing company taxes, opening business bank accounts | Proving your identity to the IRS & platforms like PayPal |

| Required for PayPal? | Yes (business identity) | Yes (personal identity if no SSN) |

| Can replace SSN on PayPal? | No | Yes |

In short, if PayPal asks for a personal tax ID and you provide only an EIN, that won’t work. It’s like submitting your company’s passport instead of your own.

That personal link, which ITIN provides, is what allows your account to remain trusted and fully functional.

What U.S. PayPal Actually Wants

When you go through the U.S. PayPal business account setup, especially as a non-resident, here’s what typically gets requested:

- Company details: Name, address, EIN, formation documents

- Owner information: Full name, date of birth, country, tax ID

- Proof of address and sometimes bank account verification

If you don’t have an SSN, the correct and legal replacement is an ITIN. That’s what PayPal accepts. And yes, it’s officially confirmed by lawyers, tax experts, and even PayPal users on their own community forums.

If you’re outside the U.S. and don’t plan to relocate just to access your business funds, applying for an ITIN may be the only practical way to meet PayPal’s verification requirements.

It’s not that your EIN is useless; it’s just not enough when PayPal decides they need to verify you as a person. This is exactly where people start asking, “is ITIN same as EIN?” — and the answer is no. Your EIN identifies your business, but PayPal needs an ITIN to identify you.

And let’s be honest, they will. That’s why relying solely on an EIN might feel okay at first, but often backfires later.

What if You Only Have an EIN?

It’s not the end of the road, but it is a dead end for verification.

A business EIN is important, no doubt. But it doesn’t identify the actual owner of the company in a way that satisfies PayPal’s internal checks.

From a compliance perspective, PayPal needs to:

- Report income (if applicable) to the IRS

- Link accounts to real people (KYC rules)

- Verify the real person running the company for financial risk protection, and this is where the PayPal EIN limitation shows up. Your EIN tells them there’s a business, but not who’s really in charge.

That’s why the ITIN matters more here. Especially if you’re outside the U.S. and can’t provide a Social Security Number. Because whether you’re forming an LLC or opening payments, PayPal ITIN verification eventually becomes the gatekeeper for full account access.

So yes, the EIN lets you open the account, but it’s the ITIN that lets you actually use it fully, safely, and long-term.

What about the Process and Timeline of Obtaining a PayPal Account?

At Business Globalizer, opening a PayPal US account takes 2–7 business days if your documents are complete, including the ITIN.

But if you’re missing the ITIN, your application may stall during verification, or worse, your account could be limited when you least expect it.

How Do You Get an ITIN?

The quickest, safest, and of course, the best way to get an ITIN for PayPal non-residents is through a Certified Acceptance Agent (CAA). They assist with all the paperwork and filing, especially if you’re located outside the U.S.

To obtain an ITIN, you’ll need:

- A valid reason for applying

- A passport copy

- A completed W-7 form

To learn more, check out our blog on ITIN Turnaround Time. The process can take 8–10 weeks in total.

Besides PayPal, When Else Would You Need an ITIN?

So, as you are reading through this blog, a question can easily come into your mind: “Is ITIN just for PayPal?” Not really.

While PayPal might be the reason you started Googling ITIN, it’s actually useful in several other situations, especially if you’re doing anything U.S.-related.

Here are just a few real-life reasons people get one:

- If you own a U.S. company as a non-resident and need to file taxes or verify identity.

- If you’re married (a spouse) to a U.S. citizen or green card holder and need to be listed on their tax returns.

- If you’re a dependent of someone living in the U.S. and you need to be claimed for tax purposes.

- If you’re a foreign investor earning U.S.-sourced income (real estate, stocks, partnerships) and need a tax ID for reporting.

- If you’re selling property in the U.S. and the IRS needs to track the sale.

- If you own property and have to deal with property tax filings.

- If you’re a student, researcher, or professor in the U.S. on a visa, and have tax obligations.

- If you’re simply filing a U.S. federal income tax return from abroad.

So yes, ITIN isn’t just about PayPal. It’s a personal U.S. tax ID that helps you stay compliant, credible, and connected with systems that don’t know how to process “non-resident” otherwise.

Heads up: Stripe and Wise might also ask for a personal tax ID like your ITIN. So even though we’re focusing on PayPal here, the same rule often applies across platforms that deal with U.S.-based money flow. Better safe than limited.

Business Globalizer: Your Trusted Partner for PayPal ITIN Support

If all of this feels like too many moving parts, EIN here, ITIN there, PayPal asking for things you’ve never heard of, that’s exactly where we come in. As Bangladesh’s first IRS-Authorized CAA, Business Globalizer helps you secure your PayPal ITIN, form your U.S. company, get your EIN, and handle every document PayPal might ask for.

No guessing, no rejected forms, no risk of account limits due to incorrect information. You just focus on your business; we handle the tax IDs that keep PayPal happy.

Final Thoughts

This isn’t about paperwork for the sake of it. It’s about trust, both with the IRS and with PayPal. And if you’re outside the U.S., it all comes down to having the right paperwork in place. At the end of the day, getting a PayPal ITIN is what keeps your account running without fear of sudden freezes or limitations.

The EIN tells PayPal your business exists.

But the ITIN tells them you exist.

That you’re the one responsible. The one behind the business. The one they can report to, if needed.

Even if you’ve set up an LLC with ITIN for PayPal purposes, that ITIN is still the backbone; the part that confirms you’re more than just a filing.

If you’re serious about running your business through PayPal and keeping your account safe from surprise limitations, get your ITIN. It’s one of those things that quietly does all the heavy lifting behind the scenes.

FAQs on EIN or ITIN which is Matter for PayPal

Is ITIN same as EIN when applying for PayPal?

Answer: Not at all. An EIN tells PayPal who owns the business. An ITIN tells PayPal who the actual human behind the account is.

So when PayPal asks for the SSN field and you don’t have one, they expect an ITIN, not an EIN. Two different IDs, two different purposes.

Can I open a PayPal account with EIN?

Answer: Yes, you can open the account itself with an EIN.

But here’s the catch: PayPal won’t fully verify the account until you provide a personal tax ID (SSN or ITIN). So the EIN gets you through the business setup step, but the ITIN completes the identity check.

Can I use an EIN instead of an ITIN for PayPal verification?

Answer: No, PayPal requires your ITIN (or SSN) to verify your identity. The EIN only represents your business, not you as the individual behind it. Think of it as the business’s ID card, but for PayPal, they need to know who you are.

I don’t have a tax ID for PayPal, what should I do?

Answer: If you’re not a U.S. resident and you don’t have an SSN, the only legal and IRS-approved option is an ITIN.

That’s the number PayPal uses to confirm that you’re a real person who can legally report income if needed. So your next step is simple: apply for an ITIN, then update your PayPal account with it.

What happens if I don’t provide an ITIN to PayPal?

Answer: Eventually, PayPal will limit withdrawals, freeze certain features, or just lock the account until you submit the correct ID.

They don’t do it to annoy you — it’s part of U.S. financial compliance.

If you skip the ITIN step, your account stays half-verified, and PayPal will treat it as a risk.

Can non-U.S. residents apply for an ITIN just for PayPal?

Answer: Yes, and it’s completely valid.

Many people get an ITIN solely because PayPal, Stripe, or a payment processor needs it. As long as your reason fits one of the IRS-approved categories (and PayPal verification does), it’s allowed.

Is it legal for non-residents to have a PayPal Business account?

Answer: Yes, absolutely.

PayPal doesn’t require you to be a U.S. citizen or even live in the U.S.

They just need:

- A legitimate business (U.S. LLC or foreign business)

- Correct tax IDs (EIN + ITIN)

- Clear identity verification

If those boxes are checked, you’re good.

How do I get an ITIN?

Answer: It’s actually pretty straightforward. We’ve got our own IRS Certified Acceptance Agent (CAA) who can legally sort your ITIN for you; no solo struggles, no confusing forms. We take care of all the required paperwork, and you get the ID you need, plain and simple.

Why do I need an ITIN if I’m not a U.S. citizen?

Answer: Great question. An ITIN is basically your personal tax ID when you can’t get an SSN. It helps the IRS identify you, basically it’s their way of saying, “Yep, we know who this is,” especially if you’re making money or running a business there.

Can I open a PayPal account with an ITIN number?

Answer: Yes, and thousands of non-U.S. founders do exactly that.

PayPal accepts ITIN for personal verification, and EIN for business verification.

Think of it as:

EIN → tells PayPal “this is my company.”

ITIN → tells PayPal “this is me.”

Both together complete the setup.

Is an ITIN only needed for PayPal?

Answer: Not at all! ITIN shows up everywhere: tax filing, buying U.S. property, linking Stripe or Wise, or even if your spouse needs to claim you on their tax return. It’s like your key to the U.S. financial system.

Can I use someone else’s ITIN for my PayPal account?

Answer: Never.

That’s not just a “bad idea” it’s an identity mismatch, and PayPal will permanently ban the account.

Your business must use your EIN, and the personal verification must use your ITIN.

No shared IDs, no shortcuts.

Can Business Globalizer help me set up a U.S. PayPal account even if I’m a non-resident?

Answer: Yes! We specialize in helping non-residents open verified U.S. and UK PayPal accounts. We can help you with anything from receiving your ITIN to opening your company account to filing your taxes and meeting all of your other obligations.

Do I need an ITIN if I just want to start a U.S. company?

Answer: Yes, if you’re looking to start a U.S. business and have it linked to PayPal or other U.S.-based systems. While an ITIN is not solely needed for forming your company, it’s required for tax reporting and verification on platforms like PayPal and others.

What other services does Business Globalizer offer for non-residents?

Answer: Besides ITIN services, we handle U.S. company formation, tax filing, compliance, and even a business address; all the essentials you need to run your business smoothly, legally, and effectively.