Ever had a customer demand their money back, even after you delivered exactly what they ordered? That’s a chargeback—and for high-risk businesses, it’s not just annoying; it’s a recurring storm. Industries like gambling, CBD, or dropshipping are hit hardest, where chargebacks can pile up and put your business under serious pressure.

But what exactly is a chargeback? Why does it happen so often in high-risk businesses? And most importantly, how can you handle it without losing sleep—or your revenue? In this blog, we’ll discuss everything about a payment chargeback in high-risk businesses.

Let’s get going!

Chargeback Meaning

A chargeback is like a refund, but it’s initiated by the customer’s bank instead of the business. It literally means the bank “charges back” the money from the merchant’s account to the customer, often after a dispute.

Chargeback Example

For instance, imagine you run an online store, and a customer buys a gadget from you. Weeks later, they tell their bank they didn’t receive it—even though tracking shows it was delivered. The bank pulls the payment back from your account, refunding the customer without even asking you. That’s a chargeback. Sometimes it’s fair, like in genuine fraud cases, but often it’s a misunderstanding—or worse, a fraudulent claim against your business.

What Is a Chargeback in High-Risk Business?

In high-risk businesses, a chargeback isn’t just a refund—it’s a constant headache. It happens when a customer disputes a transaction, and the bank takes back the money, leaving you in the lurch.

For industries like gambling, SAAS, dropshipping, or online subscriptions, chargebacks are more common because of higher fraud risks, misunderstood charges, or unhappy customers. They not only cut into your profits but also hurt your credibility with payment processors, making it harder to keep your merchant account in good standing.

High-Risk Business

You might be thinking, “What’s a high-risk business again?” It’s a business that payment processors see as more likely to deal with fraud, chargebacks, or disputes. Common signs of a high-risk business include working in industries like gambling, CBD, or online subscriptions, handling large transactions, or selling across borders.

Compared to low-risk businesses, high-risk ones face tougher terms from payment gateways—higher fees, stricter rules, and more hoops to jump through. That’s why many high-risk businesses rely on a special high-risk merchant account to keep payments running smoothly.

What Is the Chargeback Process?

The chargeback process starts when a customer disputes a transaction with their card issuer. The card issuer, card network, and merchant’s acquiring bank review the dispute to determine if the customer deserves a refund. If the dispute is valid, the customer gets their money back, and the merchant faces financial liability unless they provide strong evidence to challenge it.

Chargeback Process Time Frame

The chargeback process can take multiple weeks or even months. Merchants typically have 10–35 days to respond with evidence after being notified by their acquiring bank. Final decisions can depend on the card issuer’s review and may extend into pre-arbitration or arbitration stages, especially for unresolved disputes.

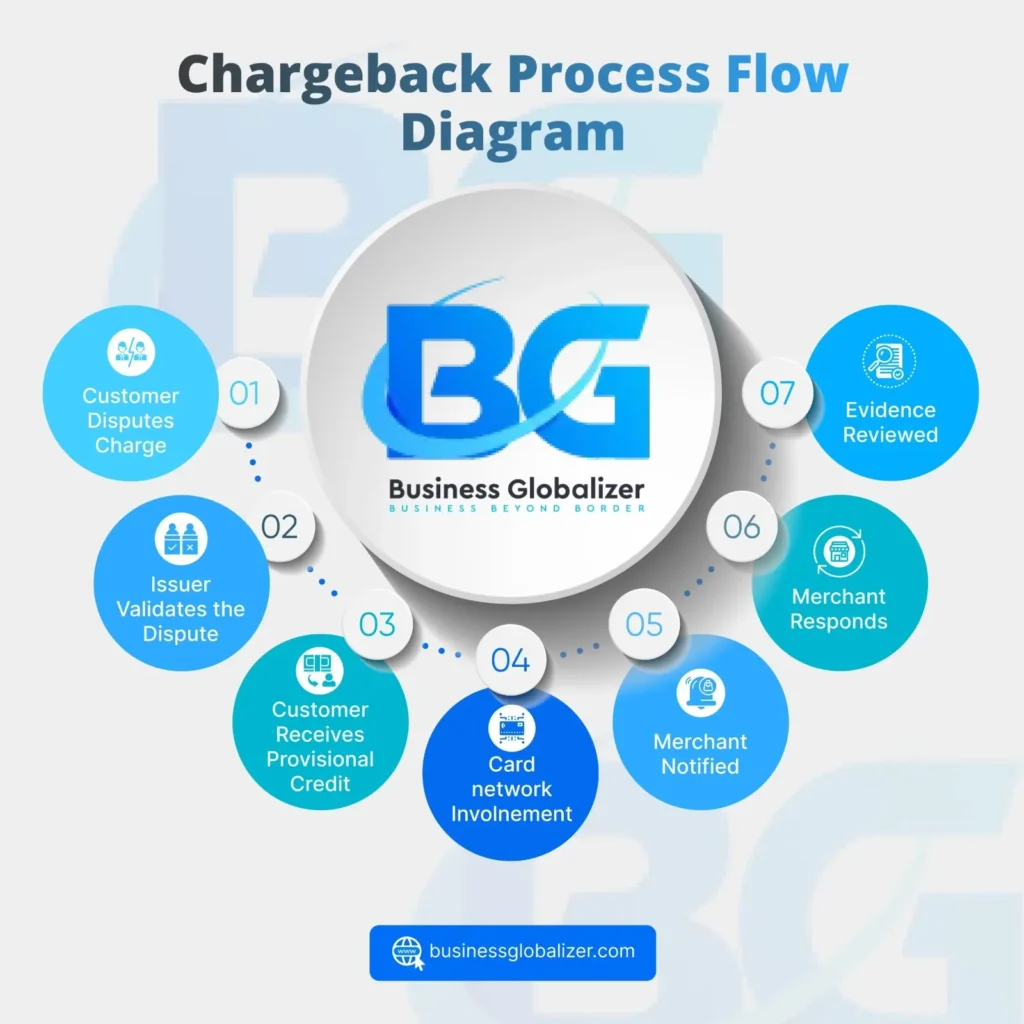

Chargeback Process Steps

For your better understanding, let’s talk about the chargeback process step-by-step here:

Customer Disputes Charge: The process begins when a customer informs their card issuer of a dispute, providing reasons like fraud, dissatisfaction, or unrecognized charges.

Issuer Validates the Dispute: The issuer assigns a reason code and decides if the dispute should move forward.

Customer Receives Provisional Credit: The issuer temporarily refunds the disputed amount to the customer.

Card Network Involvement: The card network collects and shares dispute details with the merchant’s acquiring bank.

Merchant Notified: The acquiring bank informs the merchant and deducts the transaction amount from their account.

Merchant Responds: Merchants can either accept the chargeback or submit evidence to dispute it within 10–35 days.

Evidence Reviewed: The acquiring bank and issuer review the evidence and make the final decision, determining whether the chargeback is upheld or reversed.

Quick Tip

Merchants must act quickly to provide strong evidence to win disputes and minimize financial losses.

MasterCard Chargeback Process

In Mastercard’s chargeback process, disputes are assigned a reason code explaining the issue (e.g., fraud, authorization error). The card network notifies the acquiring bank, which informs the merchant. If the merchant wants to fight the chargeback, they must provide compelling evidence to prove the transaction was legitimate. Mastercard rules guide each step, ensuring fair outcomes for all parties.

Chargeback Process UK

In the UK, the Chargeback scheme allows you to reclaim funds for faulty goods, undelivered items, or unauthorized transactions made with debit, prepaid, or credit cards. To initiate a chargeback, contact your card provider within 120 days of the transaction or when you become aware of an issue. They’ll investigate and, if your claim is valid, reverse the payment, returning your money.

It’s important to note that while Chargeback offers valuable protection, it’s not legally mandated like Section 75 of the Consumer Credit Act, which covers credit card purchases between £100 and £30,000. Therefore, chargeback policies can vary between card providers. Always consult your bank or card issuer for detailed terms and conditions.

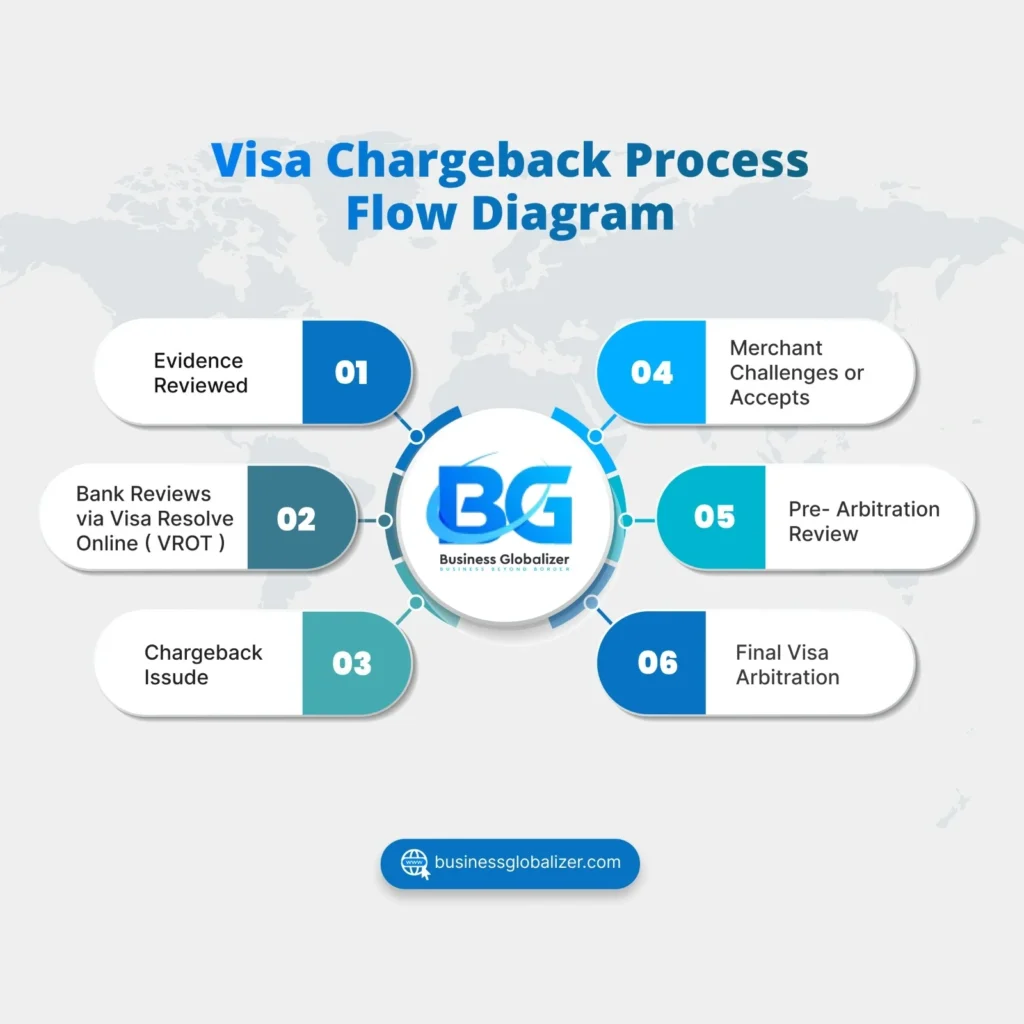

Visa Chargeback Process

The visa chargeback process steps are:

Cardholder Dispute Initiation: The cardholder notices an issue—like an unknown charge or incorrect billing—and contacts their bank to raise a concern.

Bank Reviews via Visa Resolve Online (VROL): The issuing bank checks Visa’s database for transaction details, attempting to resolve the issue before escalating it.

Chargeback Issued: If the claim appears valid, the merchant’s funds are withdrawn, and the cardholder receives a temporary refund. If not, the dispute is dismissed.

Merchant Challenges or Accepts: The merchant can either accept the chargeback or fight it with supporting evidence to prove the transaction was legitimate.

Pre-Arbitration Review: If the merchant submits evidence but the bank still favors the cardholder, additional arguments and documents may be submitted.

Final Visa Arbitration: Visa steps in as the final decision-maker, reviewing all records and issuing a binding resolution on who is responsible for the charge.

Why Are Chargebacks Important for Merchants to Understand?

Chargebacks let customers get their money back when they feel a charge was unfair or didn’t receive what they paid for. For merchants, not understanding chargebacks can mean losing money and damaging their reputation.

Here’s why understanding chargebacks matters:

- Protecting Against Fraud: Disputing unauthorized transactions prevents losses from fraudulent purchases.

- Maintain Customer Trust: Chargebacks offer customers a fair resolution, keeping their loyalty intact.

- Avoid Losses: Understanding chargebacks can help merchants use evidence to fight disputes and save money.

- Stay Compliant: Following chargeback rules set by Visa, Mastercard, and others can help you maintain your payment processing.

- Identifying Problems: Chargebacks can highlight product or service problems that need fixing.

Reasons of Chargebacks

Chargebacks are not all the same. When a customer requests a chargeback, they have to give a reason. And the most common reasons are:

- Billing dispute: Errors like overcharging or duplicate charges often lead to chargebacks if not fixed quickly.

- Broken item: If a customer gets a damaged product, they might request a chargeback.

- Not receiving an item: Customers who don’t receive what they paid for will likely file a chargeback.

- Item not as described: Wrong or misleading products often result in disputes.

- Unrecognized transaction: Charges customers don’t recognize on their statements can lead to chargebacks.

- Fraud, card not present: Stolen card details used online can result in chargebacks.

- Service Issues: Instead of reaching out to the merchant about shipping delays or damaged products, some customers dispute the transaction to get a credit on their statement.

Considering these reasons, chargebacks are categorized into different categories. The categories of chargebacks are given below.

Main Categories of Payment Chargeback

There are two main categories of chargebacks:

- Fraud-related or fraudulent chargebacks and

- Non-fraudulent chargebacks.

The primary difference between these two categories is the reason for the dispute.

1. Fraud-Related or Fraudulent Chargebacks

As the name suggests, these chargebacks happen due to fraudulent activities, such as unauthorized use of a card or stolen card details. The cardholder disputes the charge, claiming they did not authorize or make the purchase, and the transaction is reversed.

Fraudulent fraud can be put into a few various categories. Those are-

- Friendly Fraud

Friendly fraud, also known as chargeback fraud, occurs when a cardholder disputes a legitimate charge they made. It’s a significant issue for businesses, costing billions annually.

What Causes Friendly Fraud?

There are two reasons why friendly fraud happens. They are-

- Transaction confusion: Cardholders forget a purchase and report it as fraud.

- First-party fraud: Someone close to the cardholder uses the card without permission, like a family member paying for a movie.

How Can Merchants Prevent and Fight Friendly Fraud?

Friendly fraud chargebacks can be challenging to stop. Still, merchants can fight back and win by maintaining the following measures:

- Keep Detailed Records: Save order details and provide receipts or proof of delivery to dispute fraudulent claims.

- Block Repeat Offenders: Use a blocklist for customers who frequently file malicious chargebacks.

- Clear Merchant Descriptors: Ensure your business name and contact info match your merchant descriptor to avoid confusion.

- Focus on Customer Satisfaction: Offer great service and a clear refund policy to reduce disputes.

- Don’t Accept Unfair Chargebacks: If the transaction is verified, it’s not your responsibility to accept the chargeback.

- Submit Evidence: Fight back by submitting proof that the transaction was authorized and fulfilled.

- Criminal Fraud, Malicious Fraud, or Credit card Chargeback

This kind of chargeback occurs when someone uses stolen credit card details to make a purchase and disputes it as unauthorized. Businesses lose money on both the product and chargeback fees, making these frauds highly damaging.

For example, if a stolen card is used to buy a TV, the merchant may issue a refund while the fraudster keeps the TV.

What Causes Credit Card Chargeback?

Credit card chargebacks can be caused by the following:

- Unauthorized use of stolen credit card information, often from data breaches.

- Lack of fraud detection systems leaves businesses vulnerable to these scams.

How Can the Credit Card Chargeback Be Prevented?

The most effective method to stop fake transactions that result in chargebacks is to prevent fraud from happening in the first place. You can detect possible fraud by watching out for a few warning signs, such as:

- Watch for buyers from unusual locations or mismatched card regions.

- Monitor small, frequent purchases in a short time.

You can prevent fraudulent transactions by implementing safeguards and using anti-fraud software that recognizes patterns of unusual behavior or purchases during checkout.

- Merchant Error Chargeback

A merchant error chargeback happens due to mistakes made by the merchant, not third parties. Errors like incorrect billing or shipping issues can lead to disputes and are often tricky to spot without reviewing internal processes.

What Causes Merchant Error Chargebacks?

The following factors cause merchant error chargebacks:

- Using unclear or incorrect billing descriptions

- Charging an incorrect amount during the transaction

- Delaying or causing confusion with shipping or tracking

- Delivering the wrong or defective item

- Sharing inaccurate details about the product

How to Prevent Merchant Error Chargeback?

Identify and fix internal system errors and procedural missteps by thoroughly reviewing your operations. Address problem areas to minimize future issues.

- MasterCard Reason Code 4808: Authorization-Related Chargeback

This chargeback occurs when a Mastercard transaction wasn’t properly authorized, or the buyer disputes the charge, claiming they didn’t approve it. Common reasons include fraud, mistakes, or customer regret. Sellers can challenge these chargebacks by proving the purchase was legitimate.

What Causes Code 4808 Authorization-Related Chargeback?

These often happen when a stolen or fake card is used at a store without a chip reader (EMV-enabled). Swiping or manually entering card details is less secure. If merchants bypass proper authorization or force declined transactions, they risk losing disputes and facing chargebacks.

How Can Code 4808 Authorization-Related Chargebacks Be Prevented?

To prevent authorization-related chargebacks, here are some excellent ideas:

- Always get authorization for every sale.

- Use EMV-enabled payment machines.

- Keep software updated and train staff.

- Submit sales on time or hold them until you can.

- Don’t force charges on declined cards.

- Ensure machines request permission for all transactions.

- Reauthorize if tips increase the total beyond the approved amount.

- Train staff to handle sales and authorizations properly.

- Buyer’s Remorse

When a cardholder regrets a purchase, they might file a chargeback instead of following the return policy. This is called friendly fraud—using a chargeback to get a refund without a valid reason, often to avoid a potential return refusal.

- What Causes Buyer’s Remorse?

The customer or the cardholder’s regret about a purchase causes Buyer’s remorse.

- How to Prevent Buyer’s Remorse?

To prevent buyer’s remorse, there’s only one proven way. Start doing your research.

“Consider the purchase,” says Longwood University psychology professor Catherine Franssen. “Make a ‘pros and cons’ list. Talk with others and review your budget.”

Which means research. And only research. Then again, Research.

2. Non-Fraudulent Chargebacks

Non-fraudulent chargebacks happen when a customer disputes a charge without contacting the seller or is unhappy with how the seller handled the situation. Common reasons include:

- Two charges were made for the same thing

- The seller’s policy for refunds is not clear or unfair

- The seller takes too long to give a refund

- The seller’s name on the bill is not what the person expects

- Online orders are delayed or out of stock.

- The customer is unhappy with how the seller treated them.

Under The Fair Credit Billing Act of 1974, buyers can dispute charges directly with their bank instead of contacting the store. This often results in financial losses for sellers. To prevent these disputes, businesses should prioritize clear policies and good customer service.

What Should I Do If I Suspect A Chargeback Fraud?

If you think a customer is making a false claim to get their money back, here’s what you can and should do:

- Review Their Purchase History: First, check if the customer has requested refunds or chargebacks before. A pattern of repeated claims can be a red flag.

- Evaluate the Disputed Item: Next, look at what they’re disputing. If it’s a high-value item, there’s a higher chance of fraudulent intent.

- Communicate Directly: Lastly, reach out to the customer and ask for details about the issue. If their explanation is unclear or inconsistent, it could indicate fraud.

How Do Different Types of Chargebacks Affect Businesses That Sell Things?

A chargeback occurs when a customer challenges a transaction on their credit card. How it affects your business depends on whether it’s malicious fraud or friendly fraud:

- Malicious Fraud: This occurs when someone uses a stolen credit card without the owner’s permission. In such cases, it’s usually best to accept the chargeback since the cardholder isn’t at fault.

- Friendly Fraud: This happens when a customer makes a legitimate purchase but later disputes it, claiming they didn’t authorize it. To prevent this, maintain strong records, implement good security practices, and clearly communicate with customers. If it occurs, chargeback recovery services can help you reclaim your funds.

Too many chargebacks can damage your business reputation and make it harder to accept credit card payments in the future, so addressing them is essential.

Important Tip: Find the Root Cause of Chargebacks

Chargebacks reveal what’s going wrong—poor customer service, weak security, fraud issues, or untrained staff. Identifying the cause helps you fix these problems and improve your business overall.

What Do Chargebacks Really Cost Merchants?

Chargebacks cost merchants more than just the refunded purchase. Here’s how they impact businesses:

- Lost Revenue: Merchants must refund the customer’s purchase when a chargeback is approved.

- Chargeback Fees: Merchants pay a fee to the card processor, even if they dispute and win. These fees can sometimes exceed the transaction value, adding to the loss. Mastercard estimates operational costs of $15–$70 per dispute.

- Unrecoverable Goods or Services: In cases of fraud, digital goods, or non-returned items, merchants often can’t reclaim what was sold.

FAQ

What Is Chargeback Dispute?

Answer: A chargeback dispute happens when a customer challenges a transaction with their bank, claiming fraud, unauthorized use, or issues with the product/service. The bank temporarily reverses the payment, and the seller must provide proof to fight the claim. If not handled properly, chargebacks can lead to lost revenue and account restrictions.

How Does the Chargeback Dispute Process Work?

Answer: A chargeback happens when a customer disputes a transaction with their bank, and the funds are reversed. To fight it, the seller must provide proof of the transaction, delivery, and customer communication. The bank reviews the evidence and decides whether to return the funds to the seller or uphold the chargeback. Strong documentation and quick action improve the chances of winning disputes.

What is Chargeback Representment?

Answer: Chargeback representment is the process where merchants dispute a customer’s chargeback by providing evidence to the bank that the transaction was legitimate. This helps recover funds lost to unwarranted chargebacks.

How Much Is the Chargeback Time Limit?

Answer: Most card networks allow up to 120 days to file a chargeback, but some cases have shorter limits. Visa and Mastercard follow the 120-day rule, though authorization-related chargebacks on Mastercard must be filed within 90 days. Always check with your bank—acting fast improves your chances!

How to Win a Chargeback as a Consumer?

Answer: Disputing a chargeback? Act fast and stay prepared. Contact your bank or card issuer immediately, explain the issue clearly, and provide strong evidence—receipts, emails, or proof of fraud. Be persistent, follow up regularly, and stick to deadlines. A well-documented claim increases your chances of winning the dispute.

Expert Help to Prevent Payment Chargeback

To prevent chargebacks, we recommend you take expert help. Business Globalizer provides customized and tailored solutions to entrepreneurs who struggle with payment chargeback in their high-risk business. We provide merchant accounts specifically tailored for high-risk businesses.

Struggling with your business? let’s have a chat.

Key Insights on Payment Chargeback in High-Risk Business

- Chargebacks happen when a customer disputes a transaction, forcing the bank to reverse the payment.

- High-risk businesses like gambling, dropshipping, and SaaS face frequent chargebacks due to fraud, disputes, or unclear policies.

- Chargebacks damage business credibility, increase processing fees, and can lead to merchant account termination.

- The chargeback process involves banks, card networks, and merchants, with strict deadlines for disputes.

- Businesses must submit strong evidence (receipts, shipping details, customer communication) to fight chargebacks.

- Common causes include fraud, billing disputes, unrecognized transactions, and delivery issues.

- Chargebacks are categorized into fraud-related and non-fraudulent disputes, each requiring different prevention strategies.

- Visa, Mastercard, and UK chargeback rules have specific timelines and resolution processes.

- Too many chargebacks can lead to financial loss, penalties, and restrictions from payment providers.

- Preventive measures like fraud detection tools, clear refund policies, and proactive customer service help minimize chargebacks.