I still remember the email that hit my inbox at 2:04 a.m.

Subject: “Your LLC has been dissolved.”

It wasn’t a scam. It was my first hard lesson in annual compliance for LLC companies in the USA.

It was my first hard lesson in annual compliance. One that cost me a Stripe account, $8,700 in sales, and a ton of sleep. If you’re running a U.S. company, especially from abroad, you don’t get to skip this part.

Let’s make sure you know exactly what needs to be done, when, and why it matters more than you think.

Meaning of U.S. Annual Compliance

Annual compliance meaning refers to the yearly responsibilities your U.S. business — especially annual compliance for LLC entities — must handle to stay legally active and in good standing. These compliance tasks help keep your company transparent and aligned with both federal and state rules.

For U.S.-registered companies, the annual compliance typically includes:

- Federal filings: Things like tax returns and info reports you’re expected to submit.

- State requirements: filing annual reports, franchise tax filings, and keeping your licenses up to date.

- Record-keeping: Staying on top of your books with clean and accurate records.

Neglecting these can very much lead to penalties, loss of liability protection, or even dissolution.

Two Types of Annual Compliance

There are two types of annual compliance in the US. They are:

- Federal Annual Compliance

At the federal level, businesses must:

- File tax returns: Depending on your entity type (LLC or C Corp).

- Submit information reports: Such as Form 5472 for foreign-owned entities.

- Maintain an EIN: Ensure your EIN is active and associated with your filings.

- State Annual Compliance

State requirements vary but commonly include:

- Annual reports: Updating company information with the state.

- Franchise taxes: It’s the fee that keeps your business officially alive and recognized in your state.

- Business licenses: Most of the time, you’ll need to renew the required licenses every year or so to keep things running smoothly.

The truth is, every state does things a bit differently, as their rules and regulations vary. So it’s always smart to check with your Secretary of State for the exact steps, fees, and timing.

What Is Annual Tax Filing in the USA?

Filing your annual taxes is simply telling the government how much your business made and paying your fair share. Here’s what you should know:

- LLCs: If you’re in a multi-member setup, you’ll usually file Form 1065. For single-member LLCs, income goes on your personal tax return.

- C Corporations: You’ll need to file Form 1120.

- Deadlines: Aim for March 15 if you’re a partnership or S Corp, and April 15 if you’re running a C Corp or sole proprietorship.

Filing on time keeps you stress-free and your business out of trouble.

Key Things to Know About U.S. Annual Tax Filing

- Form 5472: If your U.S. company is foreign-owned and has reportable transactions, this form is a must.

- EIN: Your tax ID doesn’t need renewal each year, but it needs to stay active and be used correctly.

- Record-keeping: Keep clean, detailed financial records. They back up your filings.

- Estimated taxes: Some businesses need to send in taxes every few months.

- Deadlines: Most companies file by April 15th or March 15th, depending on structure.

- Filing Doesn’t Mean Paying: You might not owe taxes, but you still need to file.

- Penalties Are Real: Late or missed filings can cost $25–$500+ per form, per month.

- Federal ≠ State: Filing federally doesn’t mean you’re done. Your state still wants its paperwork.

Filing Requirements for Annual Compliance in the USA

Now, let’s take a look at the key filing requirements or aspects of US companies’ annual compliance:

Federal Tax Filings (IRS)

- LLCs: Depending on structure, file Form 1040 (Schedule C), 1065 (multi-member LLCs), or 1120.

- C Corporations: File Form 1120.

- Form 5472: For 25% or more foreign-owned entities with reportable transactions.

State-Level Annual Reports & Franchise Tax

- Annual reports + filing fee: Update company information; deadlines and other requirements vary by state.

- Franchise tax: A fee for operating in the state; amounts and deadlines vary. Flat franchise tax in Delaware, minimum tax in California.

Employer Identification Number (EIN)

- Needed for tax filings, opening bank accounts, and bringing people on board.

- Make sure it’s active and reflects your latest business details.

Form 5472: Essential for Foreign-Owned LLCs

- Who must file: Foreign-owned U.S. entities with reportable transactions. Required even with $0 income.

- Deadline: Same as the tax return due date.

- Penalties: $25,000 for failure to file or incomplete filings.

State Sales Tax Nexus and Registration

- Nexus: When your business activities link you to a state, you may need to collect sales tax.

- Registration: Required once you have Nexus; rules differ from state to state.

- Resale certificate: Allows tax-free purchases for resale; the certificate must be renewed periodically.

Bookkeeping and Record Retention

- Why it matters: Keeping things tidy helps you breeze through tax season and stay safe if the IRS ever asks questions.

- How long to keep: Hold onto them for 3–7 years, just in case the IRS comes knocking.

- Best practices: Use easy-to-manage accounting tools and stay in touch with a trusted CPA.

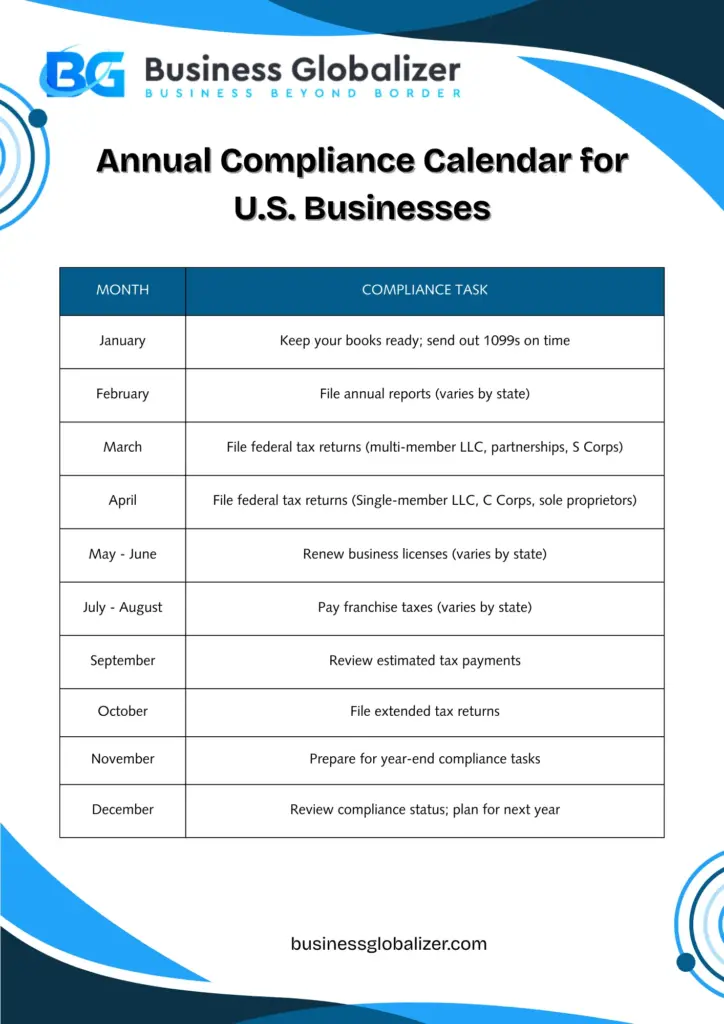

Annual Compliance Calendar for U.S. Businesses

For your convenience, here’s a timeline that highlights annual compliance for LLC and C Corporations in the U.S.:

| Month | Compliance Task |

| January | Keep your books ready; send out 1099s on time |

| February | File annual reports (varies by state) |

| March | File federal tax returns (multi-member LLC, partnerships, S Corps) |

| April | File federal tax returns (Single-member LLC, C Corps, sole proprietors) |

| May – June | Renew business licenses (varies by state) |

| July – August | Pay franchise taxes (varies by state) |

| September | Review estimated tax payments |

| October | File extended tax returns |

| November | Prepare for year-end compliance tasks |

| December | Review compliance status; plan for next year |

Common Mistakes Foreign Companies Should Avoid

Let’s be honest, most non-resident founders don’t intend to skip annual compliance for LLC requirements.

They just… don’t know they’re supposed to do it.

Here are the most common mistakes we see, and trust me, they’re more expensive than you think:

- Ignoring state requirements

Each U.S. state has its own compliance calendar. One size doesn’t fit all.

- Late filings

Missing a deadline can trigger penalties, suspension, or worse: state dissolution.

- Incomplete records

Poor bookkeeping = a nightmare during tax season (and an audit magnet).

- Assuming no activity = no filing

Even if your company had zero revenue, some filings are still mandatory.

- Believing the “no income = no taxes” myth

The IRS doesn’t care if you didn’t earn a dollar; you still need to file. You must.

- Forgetting Form 5472

This one’s critical for foreign-owned LLCs. Skipping it could cost $25,000+.

- Letting your Registered Agent lapse

If your RA expires or changes without notice, you’ll lose your good standing silently.

- Ignoring BOI reporting

Many new founders still don’t know about this FinCEN requirement (BOI Reporting). Missing it is a federal violation.

- Using personal bank accounts

Mixing personal and business funds can void your liability protection. Keep things separate.

- Relying only on Google for compliance

DIY is tempting, but U.S. compliance isn’t always intuitive; get real guidance.

US Company Obligations (LLCs vs. C Corporations)

Let’s be honest, running a company in the U.S. is exciting, but the backend stuff? That’s where it gets serious. Whether you’re the proud owner of a Limited Liability Company (LLC) or a C Corporation, annual compliance isn’t something you can afford to treat as optional. It’s mandatory. And if you’re not watching closely, things can go sideways real quick.

Let’s explore thoroughly what each structure needs to stay compliant. Because truthfully, neither the IRS nor your formation (where your company is formed) state cares if you’re in New York, Nigeria, or Dhaka.

Annual Compliance for LLC: Key Obligations

If you’re running an LLC, especially as a non-resident, understanding annual compliance for LLC is critical because your obligations are slightly different of a U.S. citizen. Here’s what you typically need to handle:

- Federal Tax Filing

- Even if you made zero income, you must file.

- If you’re foreign-owned (single-member), Form 5472 + pro forma 1120 is non-negotiable.

- State Annual Reports & Franchise Tax

- Most states want a yearly report + a small fee.

- Some (like Delaware or California) impose flat-rate franchise taxes, even if you’re not operating inside the state.

- BOI Report (Beneficial Ownership Info)

- As of 2024, this is a major one. You must file it within 30 days of formation (or 90 if formed before 2024), and update it if ownership changes.

- Registered Agent Renewal

- Your RA must be active and reachable year-round. Miss it, and you risk losing your good standing.

- Bookkeeping & Financials

- Even if you’re not filing full financials, good books are your backup plan during audits, Stripe reviews, or business funding.

Annual Compliance for C Corporation: Key Obligations

C Corps come with more layers. There’s more paperwork, but also more options when it comes to raising capital and scaling. Here’s what you’re expected to do:

- Federal Tax Return (Form 1120)

- This is your company’s annual report card to the IRS.

- C Corps pay tax on income before distributing profits to shareholders.

- State Franchise Taxes & Annual Reports

- Most states require both. Delaware, for example, has a complex franchise tax structure based on shares or assets.

- Dividend Reporting (if applicable)

- Any dividends paid to shareholders must be reported and are taxed again at the shareholder level. Yes, that’s the double-taxation pain point.

- Corporate Recordkeeping

- You must maintain meeting minutes, shareholder records, and stock ledgers.

- Unlike LLCs, C Corps are legally obligated to uphold these formalities.

- BOI Filing & EIN Maintenance

- Like LLCs, C Corps must file BOI reports and maintain active EIN registration.

Shared Responsibilities (LLCs & C Corps Alike)

No matter your entity type, some tasks are non-negotiable for every U.S. company:

- Prepare Financial Statements: even if you’re not required to submit them, these include:

- Profit & Loss Statement

- Balance Sheet

- Cash Flow Statement

- Pay and File for State-Specific Obligations: like sales tax, if you’ve established nexus in any U.S. state.

- Keep Your Registered Agent Current: This person or service receives legal mail. If they go MIA, you’re legally exposed.

- Renew Business Licenses: Many cities or counties ask you to update certain permits every year, especially if they’re industry-specific.

What About Other Company Structures?

Good question. We mainly focused on LLCs and C Corporations here because that’s what most non-residents choose. But just so you know, here are other structures that exist in the U.S.:

- S Corporations: Only available to U.S. citizens or residents. Not an option for foreign owners.

- Partnerships (General or Limited): Require multi-member filings, often file Form 1065.

- Sole Proprietorships: Typically used by freelancers within the U.S., not suitable for foreign founders.

- Nonprofits (501(c)(3)): Very specific purposes and heavily regulated.

Even if you’re running one of these, your compliance path will look a bit different, though basics like tax filing, BOI reports, and clean bookkeeping still matter just as much.

What Happens If You Don’t Maintain U.S. Company Compliance?

Missing a filing might not seem like a big deal until your bank account gets frozen or your payment gateway account says goodbye.

Here’s what can happen:

- Hefty fines: Late filings, especially Form 5472, can cost you $25,000+ in penalties.

- “Not in Good Standing” status: Which sounds innocent, but can block you from raising funds, getting loans, or doing business with legit partners.

- Forced dissolution: If you miss filings for too long, some states may close your company, sometimes without even telling you.

- Payment processor issues: PayPal, Stripe, and banks do check your compliance. If you’re not in good standing, they might flag or limit your account. Non-compliance = red flag.

- Loss of liability protection: If your LLC is dissolved, you could lose your liability shield, meaning your personal assets might be at risk.

- Harder reactivation: Bringing your company back to life takes more time, effort, and money than simply keeping it compliant in the first place.

Benefits of Staying Compliant with Your U.S. Company

So, what are the benefits? What will you get by staying compliant with the IRS and your state? Well, the answer lies here:

- Keeps your liability shield intact

Your LLC or Corporation protects you only if it stays compliant. Skip filings, and that shield can vanish when you need it most.

- Builds real business trust

From banks to platforms like Stripe and PayPal, staying up-to-date shows you’re legit and ready to do business.

- Prevents costly disruptions

Missed reports can lead to suspended accounts, frozen bank funds, or even state dissolution. Compliance keeps things running smoothly.

- Keeps your tax records clean

On-time filings and tidy books mean no audit scares, no last-minute chaos; just peace of mind.

- Supports long-term growth

A compliant business is more attractive to investors, lenders, and buyers today and down the line.

- Eases access to U.S. systems

Want that PayPal, Stripe, or U.S. bank account? Clean compliance is often a hidden requirement.

Conclusion

That 2:04 a.m. email?

It taught me that a business can collapse quietly, not because it’s unprofitable, but because it’s non-compliant.

But the fact that you’re here means you actually care.

Now, you’ve got a clear view of annual compliance for LLC in the USA — what needs to be filed, tracked, and when.

And if the paperwork ever starts to feel like a maze, just know, you’re never in it alone.

We built our Compliance Package at Business Globalizer to keep your company alive, aligned, and thriving all year round.

Your peace of mind is worth filing on time.

Business Globalizer’s Compliance Package

Managing U.S. compliance requirements can be complex, especially for non-resident business owners. Business Globalizer offers a comprehensive Compliance Package that includes:

- Federal and state tax filings

- Annual report submissions

- Franchise tax payments

- Registered agent services

- Bookkeeping support

- Form 5472 preparation and filing

Let us handle the hard part (all the required compliance), so you can focus on growing your business.

FAQ

What are the basic US company compliance requirements?

Whether you’ve got an LLC or a C Corp, staying on the right side of U.S. rules means checking off a few yearly tasks: filing federal taxes, submitting state reports, paying your franchise tax, keeping your EIN alive, and making sure your records aren’t a mess. You’ll also need to have a registered agent in place and keep your company details fresh, especially for BOI if you’re just getting started or have foreign ownership.

What are the LLC annual compliance requirements?

Running an LLC in the U.S.? Then you’ll need to:

- File your federal tax return (or 5472 if foreign-owned)

- Submit your state’s annual report (if required)

- Pay any franchise tax your state charges

- Keep your registered agent active

- Maintain clean books: Profit & Loss, Balance Sheet, receipts, all of it

Even if you’re not making money yet, compliance still applies.

Is there a C Corporation compliance checklist I can follow?

Yes! Here’s a simplified C Corp checklist:

- Form 1120 federal tax return every year

- State annual report & franchise tax

- Record minutes of shareholder meetings

- Maintain stock ledgers and corporate books

- Renew the registered agent

- File BOI report (if newly formed)

- Stay on top of payroll taxes and dividend reporting

C Corporations have more formalities, but also more room for raising capital, so it balances out.

What is a state annual report filing, and do all states require it?

Most U.S. states require companies to file a state annual report, a basic document confirming your company’s address, management, and contact info. Some states call it a “statement of information.” Fees and due dates vary. Delaware? Flat fee. Florida? Specific dates. Missing it can lead to late fees or your business being marked inactive. Always mark your calendar for this one.

What is registered agent renewal, and why does it matter?

Your registered agent is your company’s official point of contact for legal notices. If your agent resigns, stops responding, or isn’t renewed properly, your state can mark your business as non-compliant. In some cases, they’ll even revoke your company’s good standing.

So yes, renewal matters. Think of it as your company’s legal safety net.