‘Payment Gateway’ and ‘Payment Processor’ are two common phrases that you might have found if you’ve been living around the eCommerce neighborhood. Since digital marketing is climbing to its peak, it’s better to understand how things take place behind the curtain of payment.

These two are generally the components of credit card processing. Payment Gateway is a tool that facilitates online credit card payments by transferring the data between the parties. On the other hand, the Payment Processor functions as the executive who ignites the fund transfer command.

However, if you are here for a better understanding of how these things work, then be assured that you won’t be leaving empty-handed. Because this article covers the whole nine yards about how a payment gateway and processor work.

At the end of this article, you’ll be able to know the definitions of these two mandatory gears of accepting payments. On top of that, if you are on the verge of setting up a new business, this reading will definitely guide you to decide the best of them since you’ll be needing both.

Hence, let’s find out what these two major elements are and how they work.

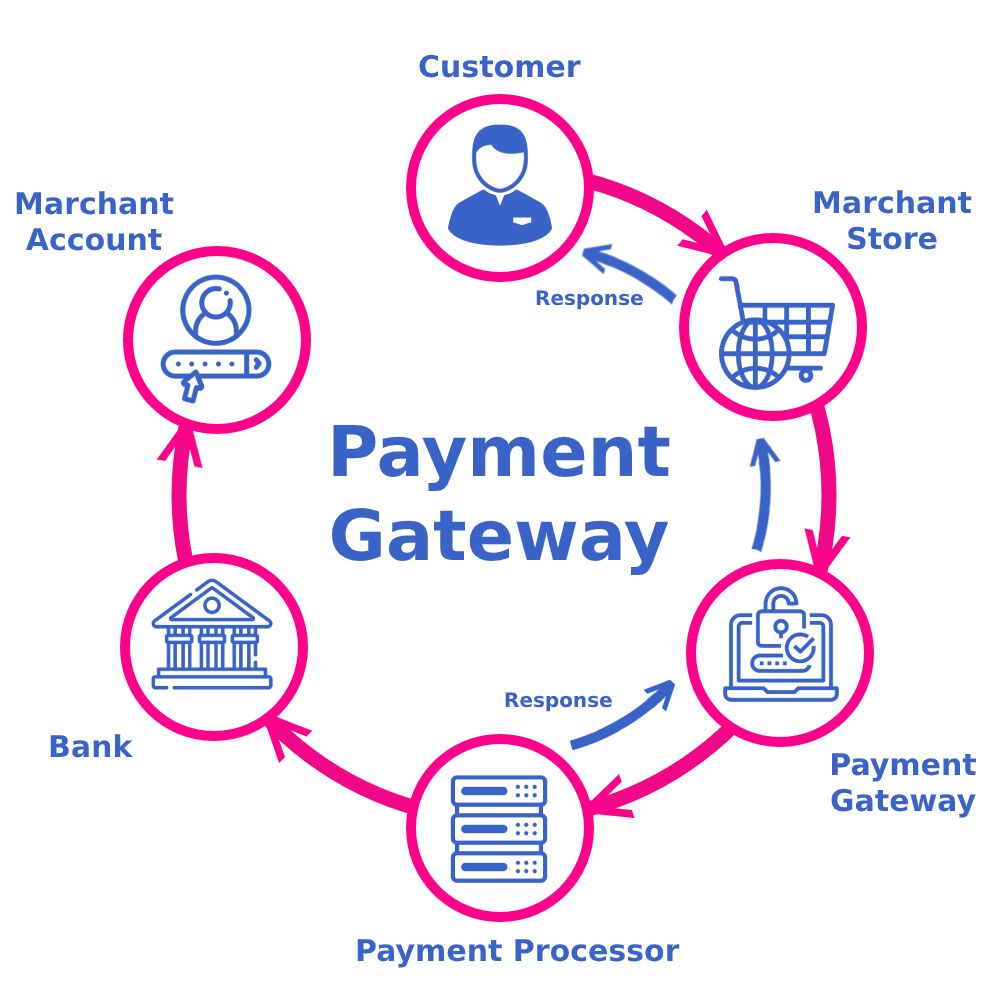

The Parties Involved in the Operation

Though we will try to distinguish between a payment gateway and a payment processor… yet we should crack the key factors that involve a business transaction.

Well, let’s get to the basics of a business in the first place. It’s you, as a merchant, who provides service or goods to the customer, and in response, the customer pays you back.

The customer and merchant that we just talked about are the main two players in a transaction procedure. They can also be called the two operators that steer the wheel. However, they don’t physically come to the field to get the services. Instead, they send representatives.

The representatives are their corresponding bank accounts. Now, we have two other parties that bear the same importance during a transaction. Let’s move on using the same setup. In the process, the fund moves from your customer’s bank account to your merchant bank account.

Here, the customer’s bank account is hosted by the issuing bank and labeled as the same. On the other hand, we call the merchant’s bank account a merchant account. The merchant account is hosted by the acquiring bank – the bank you’ll withdraw the money from as a business owner.

To sum it up, the four parties involved in a fund transfer are the customer, the issuing bank, the merchant, and the acquiring bank.

Well, you may ask why you should know everything that’d take place behind the door.

Honesty, you can skip it totally and take it for granted. But as a business proprietor, it’s smart to know all the ends of a transaction. It’ll certainly give you confidence, and in case something gets stuck while receiving your payment, you’ll know where to put the grease.

What is a Payment Gateway?

A payment gateway is a tool that authorizes the data of the customers. As you know, when an online transaction takes place, the card and the customer remain physically absent. Since the card is not present in the action, someone should come up and advocate on behalf of the cardholder.

This is where the payment gateway performs. It keeps track of all the digital credentials of a customer. Providing customer information within a fraction of a second without exposing anything personal happens to be the first job of a payment gateway.

The traveling data is extremely encrypted because there is a high possibility of fraudulence activity as the whole process takes place rapidly. Luckily, all the popular gateways follow standard encryption. Web developers call it Secure Socket Layer (SSL). It ensures the customers’ data are forwarded safely and sound.

However, a payment gateway makes the transaction process easier for the customers. Without the presence of a payment gateway, it would be impossible for the buyers to get approved instantly and thus could lead to snaily trading.

How Does Payment Gateway Work?

A payment gateway works as a bridge between the card-issuing bank, the credit card network, and the payment processor. As we enter the payment details, it’s sent to the seller’s bank account. If the bank account responds positively to the payment processor, the system will deposit the amount to the seller’s account. However, the processor takes the service charge from the merchant as per the agreement.

Let us elucidate it with an example. You must have noticed the card reader on the cash desk people scan their cards to get the payment done. That’s the payment gateway that we are talking about. As soon as you put your card there, it quickly collects the data and transmits it to the processor.

The difference between these two is one has a physical presence while the other works virtually. This payment gateway is equivalent to a point-of-sale AKA POS terminal. If the online payment gateway didn’t exist, you wouldn’t be able to make any card-not-present (CNP) transactions.

What is a Payment Processor?

As you can understand from the intro both the payment gateway and processor have a reciprocal relationship. The job of a payment gateway is to collect and transfer data between the issuing and the acquiring bank. The function of the payment processor is to transfer funds.

The payment processor provides a connection between you and the customer’s account. Hence, they can perform a successful transaction. Here, the payment gateway also comes into play. A payment gateway connects your credit card or debit card to the payment processor providing the data.

After that, the processor communicates with both your bank and the customer’s bank account. Almost immediately the processor transmits a signal to decline or accept the transaction provided the sufficiency of the customer’s bank account.

A payment processor must calculate the purchase cost and adjust it with associate service charges. The payment gateway doesn’t interfere with the merchant or customer account. Whereas the processor possesses more authority to enter into the details of the accounts to add or move funds.

Since there ARE risks involved in fund transfer, the payment processor also takes responsibility to stop fraudulent activities. It checks the security measures to ensures the customer’s data is correct.

The choice of a payment processor solely depends on the merchant. As a business owner, you should know the basics of the payment processor because you have to make the right decision at the end of the day.

How Does the Payment Processor Work?

Some people tend to mix up the role of a payment processor with the payment gateway. Put simply, the payment processor works with the information provided by the payment gateway. Here is a step-by-step depiction of a payment processor function.

After the initial step triggered by the payment gateway, the payment processor transfers the information to the card network. It could be a Visa or MasterCard or anything else preferred by the merchant. The card network checks for the available balance of the cardholder’s bank account.

If there is enough balance to make the purchase. The card network returns with the acceptance note to the payment processor. Then it comes back to the payment gateway from where the initial request was sent from.

In the end, the payment processor deposits the fund from the customer’s bank account to the merchant bank account, which’s also termed as the acquiring bank account. However, as a merchant, you should know that the funds received by your merchant account need some time to be ready for withdrawal.

Is It Necessary to Put an emphasis on Payment Processors?

You know, whenever you’re using a third-party kit that has access to your financial information, it’s always better to be selective. You wouldn’t want to install an unknown payment processor that’s incapable of providing safety. So, there are a few things that an ideal payment processor should possess.

The first thing that you should look for is the compatibility of your processor. While trading online, you’ll come across several software and tools. It’s important to make sure that the processor is compatible with other e-commerce software.

The safety of your payment processor should be another major concern. Standard payment processors companies like PayPal, Stripe, or Square come up with the PCI or the Payment Card Industry Data Security Standard for keeping the valuable data of the customers safe and secure.

The Difference Between a Payment Gateway and a Payment Processor in Short

According to their roles in the payment transaction, the payment gateway and processor can be divided into two primary phases. The payment gateway works in the first phase where it captures and sends the credit card data to the second phase, namely the payment processor.

It can be said that the customers only see the functions of the payment gateways as it works in the display. However, from there on, it hands over the operation to the payment processor which does its job behind the scene. Eventually, it routes the data between parties and completes the settlement.

Key Consideration Before Choosing the Services

A handy payment gateway, as well as a payment processor… can set the tone for your business. At first, it may seem kinda complicated to select the right payment solution. But since there are so many options available out there, it opens the door to matching the ideal platform that you want.

As an entrepreneur, you should know that then none of these services comes for free. They have their pricing policy. Both of them offer services that charge either monthly basis or through the pay-as-you-go scheme.

The study says it’s better to go for the all-in-one solution provided as far as convenience and charges are concerned. Even if you are operating your business online, it’ll be wise to look for payment facilities that operate both online and in-store so that you don’t need to reshuffle things later.

Payment Processor vs. Payment Gateway: Which Do You Need More?

Well, this happens to be one of the common questions asked by a beginner who wants to set up a payment option for his website or store. Actually, you can’t just think of one of them discretely from the other. Both of them work together to make a successful payment.

Yes, some operators provide both services together so that you don’t need to look after them individually. Yet, some choose different providers. There is a virtual point of sale available to process the transaction as long as you have a data connection.

But it’d be wise to prefer an operator like PayPal or Stripe that provides both payment getaway and processor along the way. That’ll give you an upper hand. Since the merchants frequently face turbulence in the payment system, all you’d need is to call in one place to get things fixed. There are other benefits of choosing an all-in-one-place solution. While accepting payments, merchants might need to take notes of all incoming sales and make reports manually out of them. But you can skip this manual function by setting up a package service that offers additional bookkeeping.

A lot of Customer Relationship Management and Enterprise Resource Planning are involved with most of the all-in-one solution providers. This will let you save time and labor by generating automatic reports at the end of each month.

The Bottom Line

Knowing the difference between a payment gateway and a payment processor is the first move to set up the services for your business. It’ll certainly make things less complicated when you need to make the final decision.

A perfect combination of these two components of payment transactions can boost your business profit by decreasing cart abandonments. On the other hand, a bumpy payment procedure can lead to catastrophe. So, set up the best payment method to make customers happy for recurring purchases.