Are you a non-resident of the UK but have an income source there? Or are you considering establishing an income-generating venture to expand your entrepreneurial journey?

Whatever your situation is from the abovementioned ones, you should be aware of the UK tax return and all its related obligations.

Navigating tax requirements can be challenging, especially if you are a non-resident of the United Kingdom. Don’t worry; we’re here to help!

This UK tax return guidelines will review the rules for non-residents filing their UK tax returns. It is essential to know the basics, even if you have a temporary income in the UK. Let’s clear up the confusion and get you on the right track to meeting your tax obligations efficiently.

What Is UK Tax Filing for Non-Residents?

UK tax filing for non-residents means declaring and paying UK tax on income and gains sourced in the UK. Non-residents are only liable to pay UK tax on their UK-sourced income and gains, including employment income from a UK employer, rental income from UK property, and capital gains on the disposal of UK assets.

If you are a non-resident and have UK-sourced income, you must register with HMRC and file a tax return.

When Is a Non-Resident Eligible to Pay Taxes?

If you are a non-resident, you may need to file a UK tax return if you have any of the following:

- UK income includes employment, business, rental, or investment income.

- UK assets, such as property or shares.

- A UK bank account.

Deadline or Due Date of UK Tax Filing for Non-Resident Entrepreneurs

Corporation tax must be paid 9 months and 1 day after the end of your accounting period (through the CT600 Form). Your accounting period is usually your financial year.

Method of Payment

The method of corporation tax may vary depending on the time or day of the payment as follows:

The Same Day or the Next Day Payment

- Approve a payment through your online bank account.

- Online or telephone banking by Faster Payments or CHAPS.

- Online by debit or corporate credit card.

3 Working Days Payment

- Direct Debit (if you’ve set up one for HMRC before).

- Online or telephone banking by Bacs.

- At your bank or building society.

5 Working Days Payment

- Direct Debit (if you have not set up one for HMRC before).

The most convenient way to pay corporation tax is through online banking or a debit/credit card.

If you are unsure when your tax return is due, contact HMRC. You can contact HMRC by phone, email, or post.

What Are the Accounting Periods for Corporation Tax?

Your ‘accounting period’ for Corporation Tax is the time your Company Tax Return covers.

It cannot be longer than 12 months and is typically the same as the financial year covered by your company’s or association’s annual accounts. It could be different in the year you start your business.

Your accounting period determines the deadlines for paying Corporation Tax and submitting (‘filing’) a Company Tax Return.

Note: If you own a limited company, you may be able to file your accounts with Companies House at the same time as your tax return.

Who are UK Non-Residents?

Now, about the question mentioned above: Who are UK non-residents?

A UK non-resident is someone who does not live in the UK. They could be living in another country, traveling, or working in another country. Or they could be from another country but have an income from the UK.

UK Tax Residency

Different rules apply when determining whether someone is a UK resident for tax purposes. The main rule is that you are a UK resident if you live in the UK as your sole or primary residence. However, other factors can influence your residency status, such as how long you have lived in the UK and how many days you spend in the UK each year.

If you are a non-resident of the United Kingdom, you may still be required to pay UK tax on your UK income. This includes income from employment, self-employment, property, and investments. The amount of income you need to earn before you are required to pay UK tax depends on your residency status and the type of income you earn.

How to Work out Your Tax Residency Status in the United Kingdom

Several factors determine your tax residency status in the UK, including:

- Your Physical Presence in the UK: The number of days you spend in the UK each year is one of the most essential factors in determining your tax residency status. If you spend 183 or more days in the UK in a tax year, you are generally considered a UK resident for tax purposes.

- Your Ties to the UK: Other factors that may be considered in determining your tax residency status include your family ties, employment, property ownership, and financial interests in the UK.

- Automatic Test: You may be resident under the automatic UK tests if:

- Your sole residence was in the United Kingdom for 91 days or more in a row, and you visited or stayed there for at least 30 days during the tax year.

- You worked full-time in the UK for 365 days, with at least one day in the tax year under consideration.

- Your sole residence was in the United Kingdom for 91 days or more in a row, and you visited or stayed there for at least 30 days during the tax year.

You’re usually a non-resident if either:

- You spent less than 16 days in the UK (or 46 days if you were not a UK resident in the previous three tax years).

- You worked full-time abroad (an average of 35 hours a week) and spent less than 91 days in the UK, with no more than 30 working days.

British Tax Compliance Standards

Tax compliance refers to taxpayers’ ability and willingness to follow tax laws, report their income accurately, and pay the appropriate taxes on time. Businesses/traders are usually entangled with Value-Added Tax (VAT) among the various UK direct and indirect taxes.

The rules and regulations that taxpayers must follow to comply with UK tax laws are known as British tax compliance standards. HM Revenue & Customs (HMRC), the UK tax authority, sets these standards.

The key British tax compliance standards include:

- Filing Accurate Tax Returns: Taxpayers must file accurate tax returns with HMRC by the deadline. This includes providing information about their income, expenses, and any tax breaks or allowances they are claiming. Otherwise, HMRC will charge penalties.

- Paying Your Taxes on Time: Taxpayers must pay their taxes on time, even if the amount owed is disputed. Taxpayers who fail to pay their taxes on time may face interest and penalties.

- Maintaining Accurate Records: Taxpayers must keep accurate records of their income and expenses for at least six years. This is done so that HMRC can review their tax returns if necessary.

- Notify HMRC of any Changes: Taxpayers must notify HMRC of any changes in their circumstances that may affect their tax liability, such as a change in address or income.

- Knowing the Law: Taxpayers must understand the tax laws that apply to them. This includes the types of taxes they may be required to pay and the procedures for claiming tax breaks and allowances.

Noncompliance with these standards may result in penalties or even prosecution.

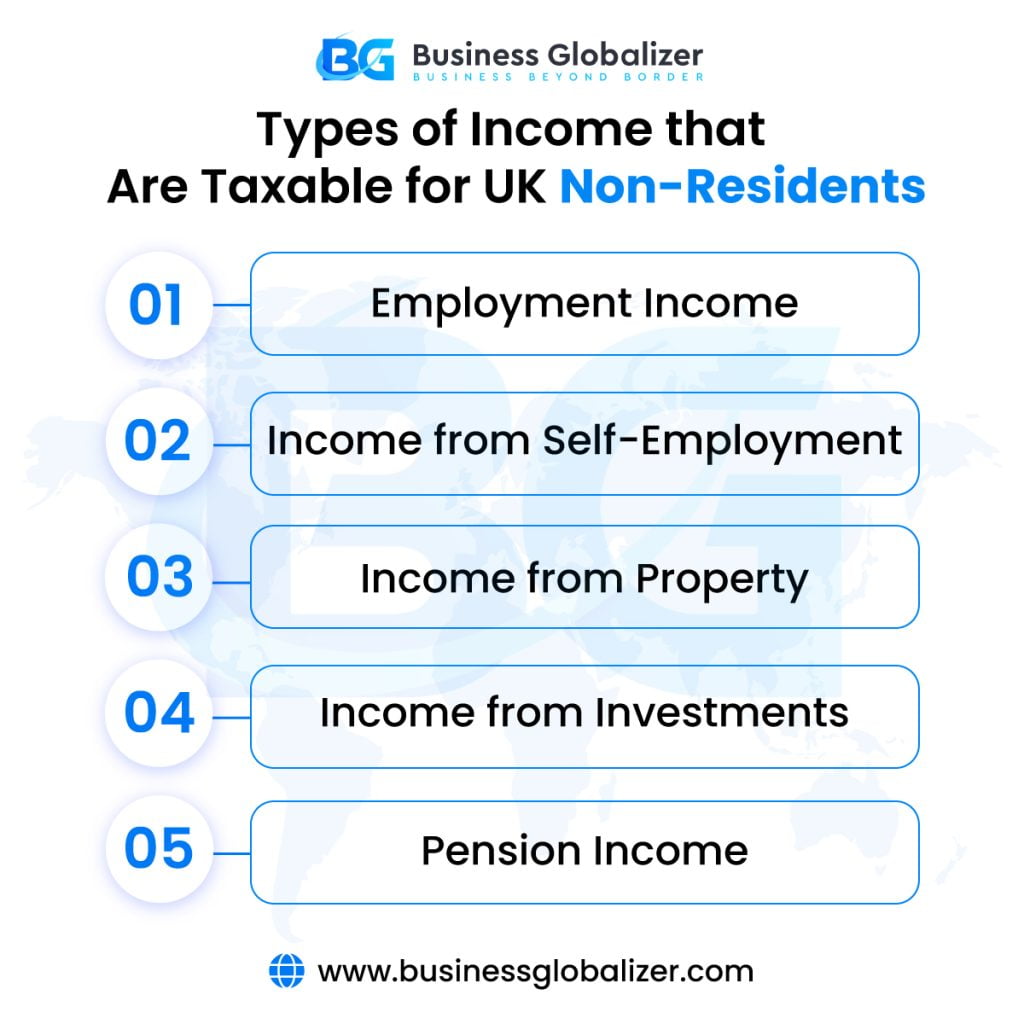

Types of Income that Are Taxable for UK Non-Residents

Non-residents in the United Kingdom have different types of taxable income depending on their residency status and income type.

The following are the main types of income that UK non-residents must pay tax on:

- Employment Income: This type of income includes earnings from working in the UK, even for a short time.

- Income from Self-Employment: Income from self-employment means earning from running a business in the UK, even if you are not a resident there. It’s specifically for UK non-resident business owners.

- Income from Property: This includes income generated from renting out property in the UK, even if you do not live there.

- Income from Investments: This includes income from dividends, interest, and capital gains from investments in the UK.

- Pension Income: This type of income includes earning from UK pensions, even if you are not a resident of the UK. Pension income may come from occupational pensions, private pensions, personal pension plans, or retirement annuity policies (though a portion may be paid as a tax-free lump sum, usually up to 25% of the policy’s value).

Some other types of income may be taxable for UK non-residents, such as income from trusts and estates. Take a look below to learn those:

- Income from a Trust or Settlement: This includes income from UK-based trusts and estates, even if the trust’s or estate’s beneficiary does not live in the UK.

- Income Paid to the Estate of a Deceased Person: This includes income from the estate of a deceased person resident in the UK, even if the estate beneficiary is not resident in the UK.

- Jurors’ Financial Loss Allowance: This is a payment made to reimburse them for the loss of earnings they suffer when they are called up for jury service. If the juror works for himself or herself, this payment might be taxed.

- Payments to Volunteers: If you are a volunteer and receive more than a reimbursement for out-of-pocket costs, these payments may be taxable.

- Assets You Already Owned: You may have to pay this tax on something you gave away but still have some interest in or use for. For example, if you give away a painting but keep the right to live in the house where the painting hangs, you may have to pay tax on the value of the painting.

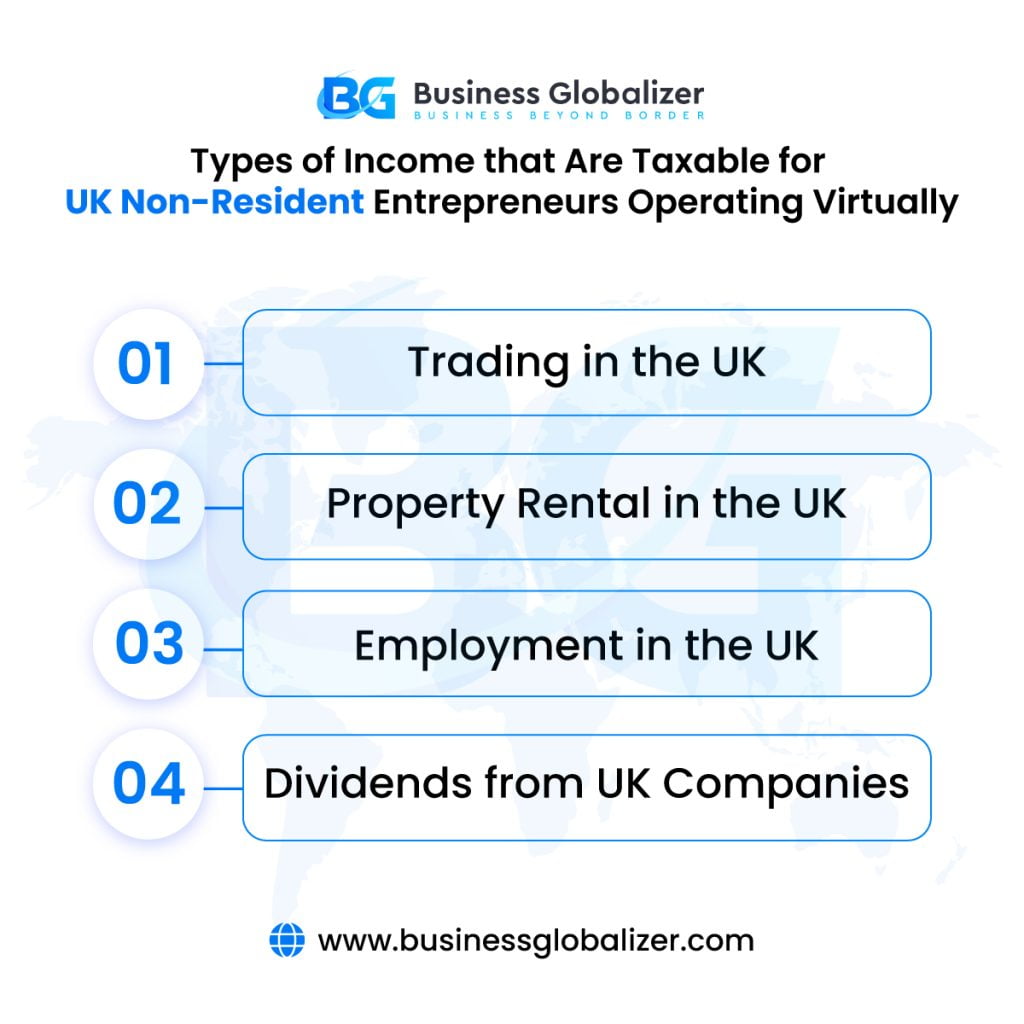

Types of Income that Are Taxable for UK Non-Resident Entrepreneurs Operating Virtually

The types of taxable income for UK non-resident entrepreneurs who operate virtually depend on several factors, including the entrepreneur’s residency status, the source of the income, and the type of business activity.

In general, non-resident entrepreneurs are taxed on their UK-sourced income, which includes income from:

- Trading in the UK: This includes income from selling goods or services in the UK, whether through a physical shop or online.

- Property Rental in the UK: This includes income from renting out property in the UK, whether to individuals or businesses.

- Employment in the UK: Employment in the UK includes income from working for a UK company or organization online.

- Dividends from UK Companies: This includes income from dividends paid by UK companies to their shareholders, regardless of where they reside.

Non-resident entrepreneurs may also be taxed on their foreign-sourced income if they have a UK permanent establishment (PE). A PE is a fixed place of business through which the entrepreneur carries on a business in the UK.

The types of income that are taxable for non-resident entrepreneurs with a PE in the UK include:

- Income from the PE: This includes income from the sale of goods or services through the PE and from the rental of property that the PE owns.

- Dividends from UK Companies: This includes income from dividends paid by UK companies to their shareholders if the PE has a controlling interest in the company.

- Interest from UK Sources: This includes income from interest paid on UK bank accounts, bonds, and other investments if the interest is attributable to the PE.

What Is the Tax Rate of a UK Limited Company?

Limited companies are taxed on their profits at the corporation tax rate. The current corporation tax rates are:

- 19% for profits under £50,000.

- 25% for profits over £250,000.

Tax Declaration Procedures in the UK for Non-Residents

Generally, you must file a Self-Assessment tax return if you are a non-resident taxpayer (sole trader or self-employment income). Remember: You should seek professional advice to determine whether you must register for Self-Assessment and file a Self-Assessment tax return.

The following are the steps involved in the tax declaration procedures for non-resident entrepreneurs in the United Kingdom:

- Sign up for Self-Assessment: You can do this online at the HMRC website.

- Gather Your Tax Information: Gathering your tax information means determining your income, expenses, and any tax reliefs or allowances you claim.

- File Your Self-Assessment Tax Return: You can file your self-assessment tax return online or by mail.

- Pay Any Taxes You Owe: You can pay your owed taxes by direct debit, bank transfer, or cheque.

What Is the Self-Assessment Tax Return?

The Self-Assessment Tax Return is a form you must fill out if you are self-employed or have other income that is not taxed automatically, such as rental or investment income. The return is used to calculate how much tax you owe and to pay that tax. For non-residents, the form is called a Non-Resident Self Assessment (NRSA) return.

The Self-Assessment tax return is due on January 31, following the end of the tax year. However, if you are a paper filer, the deadline is October 31.

Tax Declaration Procedures in the UK for Non-Resident Company Owners

The entire tax declaration procedure could be complex and confusing for a non-resident Company owner. You must gather different information, documents, and other required compliances to file the tax return in the UK.

Non-resident company owners in the UK must declare their UK-sourced income and profits to HMRC. The specific tax declaration procedures will vary depending on the type of income and profits, which involve filling out required forms and documents.

Here are the general tax declaration procedures for non-resident company owners in the UK:

- Identify Your UK-Sourced Income and Profits: Identifying your UK-Sourced income and profit includes income from any business activities in the UK and any income from UK properties.

- File Annual Accounts: You may need to file annual accounts with Companies House. This annual account includes accounting documents, auditor’s report, director’s annual report, etc. Your total assets should match your liabilities because the company’s annual accounts must be “balanced.”

- Calculate Your UK Tax Liability: This will depend on the amount of your UK-sourced income and profits and your residency status.

- Gather the Required Documents: Gather all the required documents.

- File a CT600 Form: This can be done online or by mail.

- Pay Your UK Tax Liability: Then pay your tax liability by any suitable or acceptable means.

Note: Corporation Tax customers must file their Company Tax Returns online, using iXBRL (Inline Extensible Business Reporting Language) accounts and computations.

UK Non-Resident Tax Rules

You are a non-resident for UK tax purposes if you do not have a permanent home in the UK and do not spend 183 days or more in the country in a tax year.

Now, about the tax rules for non-residents:

- Non-residents are generally only taxed on income earned in the United Kingdom.

- The incomes that are taxed come from:

- Property in the UK.

- Employment in the UK.

- Business/venture in the UK.

- UK pensions.

- UK dividends.

- UK savings and investments.

- Non-residents are also taxed on UK-sourced gains from the disposal of assets, such as shares or property.

- Several exemptions and reliefs are available to non-residents, such as the remittance basis.

- Under the remittance basis, you are only taxed on UK-sourced income you bring into the UK.

- This can be a tax-efficient option for non-residents who do not need to bring their UK-sourced income into the UK.

It is important to note that these are only the basic rules. As a non-resident entrepreneur, several complex factors can affect your UK tax liability. You should always seek professional advice to ensure you comply with the law.

Taxation Regulations in the UK for Non-Resident Company Owners

The taxation regulations in the UK for non-resident company owners vary depending on the type of business they operate and their business structure. For example:

Non-Resident Sole Traders

A non-resident sole trader is someone who is not resident in the UK but who carries on a business in the UK. Regardless of where they live, they can pay UK income tax on their business profits. The amount of tax they pay will depend on their income and the tax bands they fall into.

Non-Resident Companies

A non-resident company is a company that is incorporated outside of the UK or is based inside the UK but has a permanent establishment in the UK. A permanent establishment is where the company operates in the UK, such as an office, factory, or mine. Non-resident companies are liable to pay UK corporation tax on their UK-sourced profits.

There are other regulations depending on various factors, such as:

Double Taxation Treaties

The UK has double taxation treaties with many countries. These treaties aim to prevent double taxation by ensuring that a person is only taxed once on the same income in each country. The treaty’s terms will depend on the specific countries involved and the terms and conditions they agreed on.

Capital Gains Tax

If you sell assets (such as property or investments) in the UK, you may be subject to Capital Gains Tax. Non-residents typically pay this tax on assets located in the United Kingdom.

Tax Reliefs and Exemptions

There are several tax reliefs and exemptions available to non-resident entrepreneurs. These may include:

- Entrepreneurs’ Relief: This relief allows non-resident entrepreneurs to pay a reduced capital gains tax rate on selling their business assets. If you are a non-resident entrepreneur with a permanent establishment (PE) in the UK, you may be able to claim Entrepreneurs’ Relief on the capital gains you make on the sale of assets used in the PE. Otherwise not.

- Patent Box: This relief allows non-resident entrepreneurs to pay a reduced corporation tax rate on the profits generated from their patented inventions.

Required Documents or Legal Requirements for UK Tax Filing

Non-residents’ legal requirements for UK tax filing vary depending on their individual circumstances. However, some of the most common documents that may be required include:

- Self-Assessment Tax Return: A self-assessment tax return is a form that non-residents must complete if they have UK-sourced income or gains.

- Proof of Income: Proof of income could include payslips, bank statements, or invoices.

- Proof of Residency: Proof of residency could include a passport, visa, or utility bill.

- Proof of Deductions: Proof of deductions includes receipts for business expenses or charitable donations.

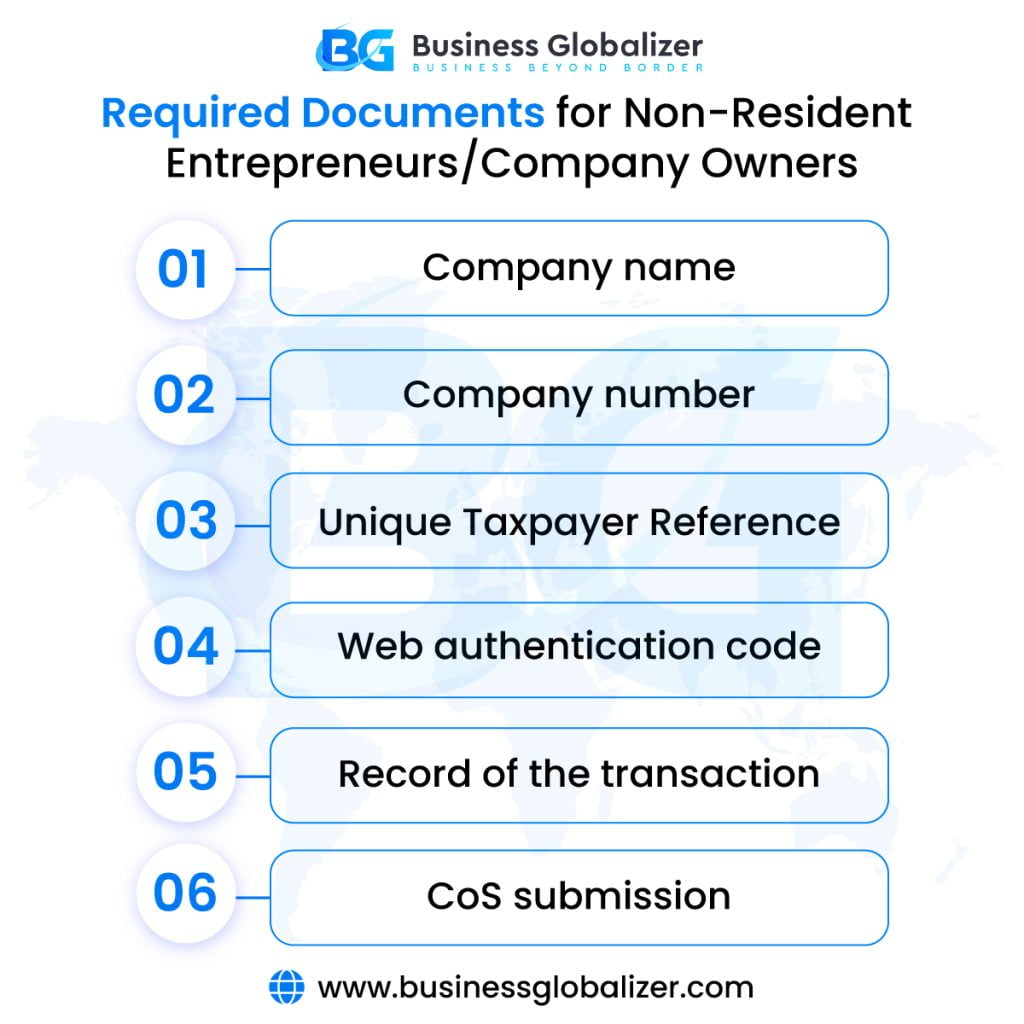

Required Documents for Non-Resident Entrepreneurs/Company Owners

For non-resident entrepreneurs or business owners, this may include, but is not limited to:

- Company name.

- Company number.

- UTR or Unique Taxpayer Reference.

- Web authentication code.

- Annual Accounts.

- CoS submission.

In addition to these documents, non-residents may also be required to provide other information to HMRC, such as their tax residency status, the amount of their UK-sourced income, and the amount of tax they have already paid.

HMRC’s Tax Obligations for Tax Filing

His Majesty’s Revenue and Customs tax obligations for tax filing are given below:

- Income Tax: An income tax is a tax on your earnings, such as those from your job, self-employment, or investments. Your income tax depends on your income level and the tax bands you fall into.

- National Insurance Contributions (NICs): You pay a tax to fund the National Health Service (NHS) and other social security benefits. Both employers and employees pay NICs.

- Value Added Tax (VAT): VAT is a tax on the sale of goods and services. Businesses that sell goods or services worth more than a certain amount must register for VAT and charge VAT to their customers.

- Corporation Tax: A corporation tax is a tax on companies’ profits. Companies must pay corporation tax on their profits within nine months and one day after their financial year ends.

- Capital Gains Tax (CGT): CGT is a tax on the profit from selling assets, such as property or shares. You may need to pay CGT if you sell an asset for more than you paid.

- Inheritance Tax (IHT): Inheritance tax is a tax on the value of assets passed on to someone after someone’s death. If the value of the assets exceeds a certain threshold, IHT must be paid.

- Stamp Duty: Stamp duty is a tax you pay when buying certain property types, such as houses or apartments. The amount of stamp duty you pay depends on the property’s value.

- Employment Taxes: Employers must take some tax from their employees’ wages and report it to HMRC. They must also provide certain documents to employees, such as payslips and P45 forms.

- Customs and Excise Duties: Businesses importing or exporting goods must follow customs and tax rules. These rules vary depending on the type of goods being imported or exported.

- Tax Records: Everyone should keep good records of their financial transactions and store them for a few years. This is important in case HMRC ever audits you.

How to Calculate Your Non-Resident UK Tax Liability

You must take the following factors into account when calculating your non-resident UK tax liability:

- Determine Your Residency Status: The types of income you must pay UK tax depend on whether you are considered a UK resident or a non-resident for tax purposes.

- Identify Your UK-Sourced Income: As a non-resident, you can only pay UK tax on your UK-sourced income. This includes employment income from a UK employer, rental income from UK property, self-employment, various businesses, and capital gains on the disposal of UK assets.

- Calculate Your Taxable Income: Once you have identified your UK-sourced income, calculate your taxable income. This is the amount of income on which you will be liable to pay UK tax.

- Apply the Relevant Tax Rates: The amount of UK tax you owe will depend on your taxable income and the applicable tax rates.

- Claim any Deductions or Reliefs: You may be able to claim certain deductions or reliefs to reduce your taxable income and the amount of UK tax you owe.

Using a tax calculator or seeking professional advice from a tax advisor is the best way to calculate your non-resident UK tax liability.

Tax Reliefs and Allowances Available to Non-Residents

UK Non-residents who have an income from there have some tax relief and allowances available. Take a look below to learn those:

- Personal Allowance: This is a set income you can earn each year without paying income tax. The personal allowance for the 2022/23 tax year is £12,570.

- Pension Contributions: You can deduct your pension contributions from your taxable income. This can reduce the amount of income tax you have to pay.

- Gift Aid: If you donate money to charity through gift aid, the charity can claim an extra 25p for every £1 you donate. This means that your donation is worth 25% more to the charity.

- Medical Expenses: You can claim tax relief on medical expenses, such as glasses, contact lenses, and dental treatment.

- Tax Credits: If you have a low income, you may be eligible for tax credits. Tax credits are a government benefit that can help reduce your tax bill.

British Tax Documentation

British tax documentation refers to the various forms and records that individuals, businesses, and organizations in the United Kingdom must maintain and submit to the tax authorities. These documents are essential for calculating and reporting income, expenses, and taxes owed to Her Majesty’s Revenue and Customs (HMRC), the government department responsible for collecting taxes in the UK.

Common types of British tax documentation include:

- Self-Assessment Tax Return: A Self-Assessment Tax Return is a form that taxpayers who are self-employed or have other income not taxed through PAYE must complete each year.

- PAYE Tax Code: This is a number used to calculate the tax deducted from your monthly wages or salary.

- National Insurance Number: This is a unique number used to identify you for National Insurance purposes.

- P60: This document shows your total earnings and deductions for the previous tax year.

- Tax Credit Award Letter: This letter from HMRC shows the amount of tax credit you are entitled to.

- Inheritance Tax Return: You must complete this form if you inherit more than the inheritance tax threshold.

- Capital Gains Tax Return: This form is required if you sell assets for a profit.

- VAT Registration Certificate: You must apply for a VAT registration certificate—with a unique VAT registration number— if your business sells goods or services subject to VAT.

HMRC Late Payment Penalties

We are at the end of our blog. This blog covered almost everything, including regulations, rules, compliance, procedures, etc.

Let’s talk about the penalties. What if you miss your tax filing deadlines?

Anyone who files after the deadline may be penalized.

HMRC will be lenient with those who have legitimate reasons, as it focuses on those who consistently fail to complete their tax returns and are deliberate tax evaders. Customers who provide HMRC with a reasonable excuse before the deadline are exempt from paying a penalty after the deadline date. The penalties for filing late are as follows:

- If it’s 1 day after the deadline, the penalty will be £100.

- If it’s 3 months late, then another £100 will pile up.

- If it’s 6 months late after the deadline, then HM Revenue and Customs (HMRC) will estimate your Corporation Tax bill and add a penalty of 10% to the unpaid tax.

- And if it’s 12 months after the deadline, another 10% of any unpaid tax will be added to all those piled-up amounts.

If your tax return is late thrice a row, the £100 penalties are increased to £500 each.

If You Are More Than 6 Months Late with Your Tax Return…

If your tax return is six months late, HMRC will write to you and tell you how much Corporation Tax they believe you owe. This is referred to as a “tax determination.” You cannot appeal against it.

You must pay the applicable Corporation Tax and file your tax return. HMRC will recalculate the amount of interest and penalties you must pay.

If you have a valid reason, you can appeal a late filing penalty by writing to your company’s Corporation Tax office.

How Can Business Globalizer Help You?

We know what you are thinking: UK tax return is too much hassle to manage and comply with. With all the legal requirements, form filling can make you exhausted and prone to mistakes—which could result in penalties.

Don’t worry; we are here. To make the whole process easy for you, Business Globalizer has tailored excellent services at affordable prices for you. We are always ready to help you file a UK tax return with all the legal requirements.

FAQ

Q1: What Is the 90-day Tax Rule at HMRC?

Answer: The 90-day tax rule at HMRC is a rule that determines whether a person who has left the UK is still considered to be a UK resident for tax purposes. If you have spent more than 90 days in the UK in either of the two tax years immediately before the year you left, you will usually be considered to have a “90-day tie” to the UK. This means that you will still be considered a UK resident for tax purposes, even if you have left the UK and spent less than 183 days there in the tax year you left.

Q2: What Is the 183-Day Rule in the UK?

Answer: The 183-day tax rule in the UK determines whether a person is a resident of the UK for tax purposes. If you spend 183 or more days in the UK in a tax year, you will usually be considered a resident of the UK for that year.

Q3: What are the three main taxes in the UK?

Answer: The three main Taxes in the UK are:

- Income tax,

- National Insurance contributions (NICs) and

- Value-Added Tax (VAT).

Q4: What are Direct Taxes?

Answer: A direct tax is a tax paid to the government by an individual or a company straight out of their income.

Example:

- Income Tax,

- Corporation Tax or Capital Gains Tax

Q5: What are Indirect Taxes?

Answer: An indirect tax applies to a good or service at the point of sale.

Example:

- VAT,

- Customs duty or Excise duty.

Q6: Why Do I Need to Complete the CT600 Form?

Answer: Corporation tax is paid by some organizations, such as limited liability companies, on their trading and investment profits. This also applies to corporations, clubs, and charitable organizations. Submit a CT600 and any supporting documents to let HMRC know how much corporation tax is owed.

Q7: Who Is Required to Complete the CT600 Form in the UK?

Answer: Limited companies and other corporate bodies subject to corporation tax in the United Kingdom must complete a CT600 form for corporate tax return purposes. This includes companies registered in the United Kingdom, such as private limited companies, public limited companies, and foreign companies operating in the United Kingdom. Clubs, societies, associations, and other non-profit organizations subject to corporation tax must also file a CT600 form.

If a company or organization is dormant and has no taxable income or gains during the accounting period, they must notify HMRC by submitting a CT600 form.

Q8: What is IXBRL?

Answer: The Inline eXtensible Business Reporting Language, or iXBRL is an open standard allowing a single document to contain human and machine-readable data. Corporation Tax customers must file their Company Tax Returns online, using iXBRL (Inline Extensible Business Reporting Language) accounts and computations.

As part of their Corporation Tax return, businesses must submit their financial statements in iXBRL format to HMRC.

Wrapping Up

So, that’s it. We hope we explored and covered all the questions related to UK taxation requirements with this UK tax return guideline. By reading this, you can be stress-free and know how to navigate through the stormy ocean of UK taxation as a non-resident-earning person.

Mastering UK tax rules, even as a non-resident, is your key to financial harmony. Stay organized, meet deadlines, and don’t hesitate to tap into professional expertise. With the right moves, you’ll breeze through the UK tax maze and keep your finances in tune!