Are you running a company in the UK? Paying your Corporation Tax on time and filing your returns correctly are crucial to avoiding HMRC penalties for corporation tax.

Before diving in, let’s first overview this blog. HMRC has some specific deadlines and requirements regarding corporation tax. You will be penalized if your company or organization is subject to Corporation tax and fails to meet those deadlines and requirements.

If you have made a mistake, done something you shouldn’t, or did not do something you should, you must correct it right away. If you do, you may not be charged a penalty, or the penalty charged may be less.

Now, let’s start and explore all the information on HMRC penalties for Corporation tax to stay compliant.

What Is Corporation Tax Filing in the UK?

First, let’s discuss taxation in the UK, which you can learn more about in our ultimate UK taxation guideline. Tell me one thing: Do you know what Corporation tax filing is?

Corporation tax filing in the UK means declaring an active limited company’s corporation tax liability to His Majesty’s Revenue and Customs (HMRC). Companies are responsible for paying this tax on their profits. It is a direct tax, meaning it is paid directly to the government.

The Corporation Tax filing process typically involves completing a form called the CT600, which is available on the HMRC website.

Remember that before filing your corporation tax form with HMRC, you must submit your company’s annual accounts to the Companies House. Failure to do that will result in extensive penalties.

Who Is Eligible for UK HMRC Corporation Tax?

Regardless of residency, anyone with an income-generating company in the UK is eligible for UK HMRC corporation tax. Even if their revenue is zero, they must file their tax return.

- If your company is based in the UK, it must pay Corporation Tax on all profits earned in the UK and elsewhere.

- If your company is not based in the UK but has a branch or office here, it only pays Corporation Tax on profits made in the UK.

What Is Corporation Tax Form CT600?

A CT600 form is a document companies use to declare their taxable profits and losses for a given accounting period. It is a tax return form that businesses must complete and submit to HMRC within 12 months of the end of the financial year.

Limited Liability Companies use the information on the CT600 form to calculate the corporate tax owed to them. Failure to comply with that will result in HMRC penalties for corporation tax will be implied on you.

What Are the Annual Accounts for the Companies House?

Annual accounts are commonly referred to as “financial accounts,” “company accounts,” or “statutory accounts.”

- All limited companies must send their annual accounts to Companies House. It does not matter if you have been successful, broke even, have not traded, or have been dormant.

Corporation Tax Penalties

Corporation tax penalties are fines imposed on businesses that fail to meet their corporation tax or tax-related obligations in the United Kingdom. These obligations include timely filing their corporation tax return and paying their tax bill.

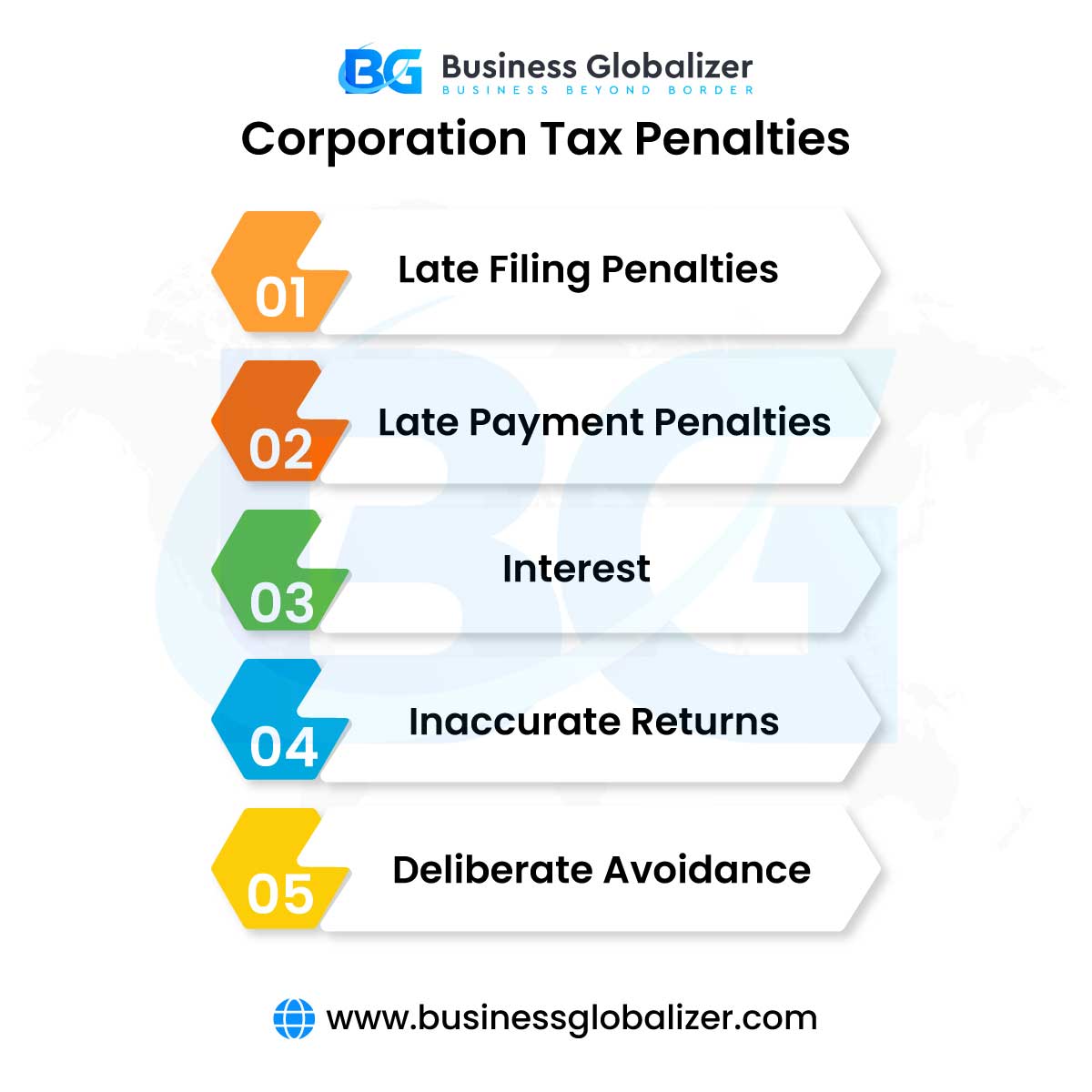

Various Corporation Tax Penalties

Different types of corporation tax penalties can be imposed depending on the offense’s nature. The most common HMRC penalties for corporation tax are:

- Late Filing Penalties: Companies that do not file their corporation tax returns on time are charged late filing penalties. The penalty is calculated according to how many days the return is late.

- Late Payment Penalties: Late payment penalties are assessed to businesses that do not pay their corporation tax bill on time. The penalty is determined by the amount of tax owed and the number of days the payment is late.

- Interest: HMRC can charge interest on any unpaid corporation tax. The interest rate is currently 5% per year.

- Inaccurate Returns: A company could be penalized if it sends an inaccurate corporation tax return. The penalty is based on how much tax was underpaid or overpaid.

- Deliberate Avoidance: If a company intentionally avoids paying corporation tax, it may face a penalty of up to 100% of the avoided tax.

Penalties for Failure to Inform HMRC That Your Company Is Subject to Corporation Tax

If your company or organization owes Corporation Tax but has not received a ‘Notice to Deliver a Company Tax Return’ from HMRC, you should notify them. You must notify them within 12 months of the end of your Corporation Tax accounting period. If you don’t, your company or organization will have to pay a penalty. This is what the HMRC calls a “failure to notify” penalty.

When a Penalty Could Arise

Suppose you don’t tell HMRC—within the required time—that your company or organization is liable for Corporation Tax. In that case, the penalty is based on the amount of unpaid tax your company or organization is liable for. This is known as potential lost revenue (PLR).

However, HMRC will not charge a penalty if you had a reasonable excuse for failing to notify them on time, as long as you did so promptly after the reason for failing to notify them ended.

How Is the Penalty Determined?

The penalty amount is determined by applying a percentage to the tax owed. The percentage applied is determined by whether your error (or failure) was:

- Careless – not taking reasonable precautions.

- Deliberate – for example, sending incorrect information on purpose.

- Deliberate and concealed – such as sending incorrect information on purpose and then taking steps to conceal the error.

While the maximum penalty HMRC can levy on your company or organization is determined by the type of failure, it may be reduced if you:

- Inform HMRC as soon as possible and fully disclose all facts.

- Help HMRC determine what is owed (or not owed) and give them access to the necessary records.

The Maximum Penalty for Each Type of Failure Is the Following:

- Non-Deliberate: Maximum payable penalty is 30% of the potential lost revenue.

- Deliberate But Not Concealed: The maximum payable penalty is 70% of the potential lost revenue.

- Deliberate and Concealed: The maximum payable penalty is 100% of the potential lost revenue.

Remember that if you took reasonable precautions but made a mistake, HMRC will not penalize you.

- The penalty may also be reduced if you do not wait until HMRC takes action before reporting your error. For example, before they write to you or make an assessment.

What Are HMRC’s Late Payment Penalties?

If HMRC has sent you a ‘Notice to Deliver a Company Tax Return’ and you don’t file your return on time, your company or organization will be penalized. HMRC may charge this penalty even if your company or organization doesn’t owe any Corporation Tax.

Let’s talk about the penalties. What if you miss your tax filing deadlines?

Anyone who files after the deadline will be penalized.

HMRC will be lenient with those who have legitimate reasons, as it focuses on those who consistently fail to complete their tax returns and are deliberate tax evaders. Customers who provide HMRC with a reasonable excuse before the deadline are exempt from paying a penalty after the deadline date. The penalties for filing late are as follows:

- If it’s 1 day after the deadline, the penalty will be £100.

- If it’s 3 months late, then another £100 will pile up.

- If it’s 6 months late after the deadline, then HM Revenue and Customs (HMRC) will estimate your Corporation Tax bill and add a penalty of 10% to the unpaid tax.

- And if it’s 12 months after the deadline, another 10% of any unpaid tax will be added to all those piled-up amounts.

If your tax return is late thrice a row, the £100 penalties are increased to £500 each.

If You Are More Than 6 Months Late with Your Tax Return…

If your tax return is six months late, HMRC will write to you and tell you how much Corporation Tax they believe you owe. This is referred to as a “tax determination.” You cannot appeal against it.

You must pay the applicable Corporation Tax and file your tax return. HMRC will recalculate the amount of interest and penalties you must pay.

If you have a valid reason, you can appeal a late filing penalty by writing to your company’s Corporation Tax office.

Penalties on Installment Payments

If your company’s profits for an accounting period exceed £1.5 million annually, you must usually pay Corporation Tax in installments for that specific period.

HMRC may levy a penalty if you intentionally fail to make installments or make insufficient installments.

Any penalty will be assessed only after you have submitted your Company Tax Return (or HMRC has decided) and the normal due date has passed.

How to Avoid Corporation Tax Penalties

HMRC expects you to responsibly manage your company’s or organization’s tax affairs. If you took reasonable precautions but still made a mistake, HMRC may not charge a penalty or reduce the penalty amount. Here are some examples of reasonable care:

- Ensuring the accuracy of your Company Tax Return and its timely submission to HMRC—includes ensuring that all company accounts, computations, claims, and calculations are correct.

- Notifying HMRC promptly (within 12 months of the end of your Corporation Tax accounting period) if your company or organization has profits chargeable to Corporation Tax but HMRC has not sent you a ‘Notice to deliver a Company Tax Return’.

- Maintaining adequate records to support your Company Tax Return, company accounts, and any claims for allowances and reliefs.

- Providing HMRC with all information requested.

- Contacting HMRC if you’re unsure about anything and following the advice they give you.

If you discover that you have made a mistake or have failed to inform HMRC of something that you should have, you must notify them immediately. This may reduce or eliminate the need for you to pay a penalty. What reasonable care entails depends on the circumstances of your company or organization.

If you disagree with a penalty that HMRC has charged your company or organization, you can appeal the decision with proper documentation and compliance.

Corporation Tax Penalty Appeal

Your decision letter will explain how to appeal and when you must do so. Usually, the deadline is 30 days from the date of the letter.

You can either:

- Use the appeal form that was included with your decision letter.

- Write to HMRC at the address on the letter.

You can write to the HMRC office about your return if you do not have a letter.

You must include:

- Your name or your company’s name.

- Your tax reference number (found on the decision letter).

- What you are opposed to and why?

You can also include what you believe the correct figures are and how you calculated them if you wish.

- You should also notify HMRC if you have additional information or believe they have overlooked something.

Reasonable Excuses For Filing Late

Sometimes, things happen. And you can’t file your tax return on time, which results in penalties.

So, what should I do in these situations?

You can appeal! An appeal can be made against penalties if you have a reasonable excuse. For example, for your late return or payment, HMRC will accept particular ‘reasonable excuses’ for being late.

What is a ‘reasonable excuse’?

A reasonable excuse is ‘normally something unexpected or out of your control that stopped you from meeting a tax obligation.’

If HMRC accepts that you had a reasonable excuse, it should waive any late charges.

Examples of reasonable excuses include:

- Someone close to you, like your partner or family member, passed away shortly before the deadline.

- You had to go to the hospital unexpectedly, making it impossible to deal with your taxes.

- You suffered from a severe or life-threatening illness.

- Your computer or software broke down right before or while you did your online tax return.

- There were problems with HM Revenue and Customs (HMRC) online services.

- A fire, flood, or theft happened, and it stopped you from finishing your tax return.

- There were unexpected delays with the postal service.

- Your disability or mental health issues caused delays.

After your reasonable excuse is resolved, you must send your return or payment as soon as possible.

What Will Not Count as Reasonable Excuses for Filing Late

The following will not count as reasonable excuses for late filing:

- Your check bounced, or payment failed because you didn’t have enough money.

- You found it hard to use the HMRC online system.

- You didn’t receive a reminder from HMRC.

- You made a mistake on your tax return.

How to Appeal for a Late Corporation Tax Penalty

To appeal HMRC’s late corporation tax penalty, you must write to HMRC and explain your reasons for being late. If you receive a penalty letter in the mail from HMRC, use the appeal form that comes with it or follow the instructions on the letter.

Include your Unique Tax Reference in your letter and on the first page of any documents you send. You should also provide any evidence that you have to support your claim.

You can appeal a Corporation Tax penalty online through the HMRC website or by sending a letter to their address.

There are additional documents and alternative ways to appeal Corporation Tax.

Corporation Tax Penalty Appeal Address

Initially, you file an appeal with HMRC. Your decision letter will tell you how to make an appeal and when you must appeal. The appeal should normally be filed within 30 days of receiving the penalty notice, but HMRC may consider late appeals.

You can file the appeal online, but if you want to appeal through mail, then the address is:

- Corporation Tax Services.

- HM Revenue and Customs.

- BX9 1AX.

- United Kingdom.

If HMRC rejects your late appeal, you can file an appeal with the Tax Tribunal by completing a form on the Gov. UK website. You should file your tax return before appealing against the late filing penalties.

Corporation Tax Penalty Appeal Deadline

You usually have 30 days from the date your penalty was issued to appeal. If you miss this deadline, you must explain the delay so that HMRC can decide whether they’ll consider your appeal.

Appeals to the First-Tier Tribunal (Tax)

If HMRC rejects your appeal after a review, you can request that the Finance and Tax Tribunals hear it, which is the First-Tier Tribunal (Tax). This can be done verbally or in writing, but the taxpayer always has the right to appear and be heard.

The Gov.UK website has more information about the First Tier Tribunal (Tax) and a form for filing an appeal.

FAQs on HMRC Penalties for Corporation Tax

Q1: Who issues corporate tax penalties for late filing?

Answer: UK corporate tax penalties for late filing are issued by His Majesty’s Revenue and Customs (HMRC), the UK government’s tax authority.

HMRC will automatically penalize a company if it does not file its corporation tax return on time. The penalty will be calculated based on the number of days that the return is late.

Q2: What is the maximum penalty for filing a late tax return in the UK?

Answer: The maximum penalty for filing a late tax return in the United Kingdom can vary depending on how late the return is and whether you owe taxes. The penalties for filing late are as follows:

- If it’s 1 day after the deadline, the penalty will be £100.

- If it’s 3 months late, then another £100 will pile up.

- If it’s 6 months late after the deadline, then HM Revenue and Customs (HMRC) will estimate your Corporation Tax bill and add a penalty of 10% to the unpaid tax.

- And if it’s 12 months after the deadline, another 10% of any unpaid tax will be added to all those piled-up amounts.

If your tax return is late thrice a row, the £100 penalties are increased to £500 each.

Q3: How Does HMRC Set Interest Rates?

Answer: HMRC interest rates are mandated by law and are tied to the Bank of England base rate. There are two rates:

- Late payment interest is calculated at the base rate plus 2.5%.

- Interest on repayment is calculated at the base rate minus 1%, with a lower limit of 0.5% (known as the ‘minimum floor’).

Q4: Corporation Tax Deadline Penalty: How to Avoid It?

Answer: To avoid a Corporation Tax deadline penalty in the UK, you must file your Corporation Tax return and pay any tax owed by the deadline. The Corporation Tax return filing deadline is 9 months after the end of your accounting period.

If you cannot file your Corporation Tax return or pay any outstanding tax by the deadline, you must notify HMRC as soon as possible to explain your situation. HMRC may grant you a deadline extension if you have a valid reason.

Q5: What Is Tax Avoidance in the UK?

Answer: Tax avoidance is bending the tax rules to gain an advantage not intended by Parliament. It often involves fake and made-up transactions that serve little or no purpose other than lowering someone’s tax bill. Tax avoidance deprives public services of much-needed funding.

Q6: What Is a ‘Reasonable Excuse’ for My Late Tax Return?

Answer: You must file your tax return by the deadline. But sometimes unexpected events could happen, and you could miss the deadline. A late tax return will make you the subject of penalties. If an unusual event beyond your control prevents you from filing your tax return, this will be called a ‘reasonable excuse.

Q7: What Are Corporation Tax Late Payment Penalties?

Answer: Late payment penalties for corporation tax in the UK are fines charged to companies that do not pay their tax on time. The penalties are calculated based on the days the tax is late and the amount of tax owed.

Q8: What Are Corporation Tax Helpline Numbers?

Answer: HMRC corporation tax helpline telephone number (for residents or within the UK):

0300 200 3410

For outside of the UK:

+44 151 268 0571

HMRC’s phone line opening hours are:

Monday to Friday: 8 am to 6 pm

Closed weekends and bank holidays.

Q9: What are Direct Taxes?

Answer: A direct tax is a tax paid to the government by an individual or a company straight out of their income.

Example:

- Income Tax,

- Corporation Tax or Capital Gains Tax

Q10: What are Indirect Taxes?

Answer: An indirect tax applies to a good or service at the point of sale.

Example:

- VAT.

- Customs duty or Excise duty.

Q11: Can HMRC’s Late Filing Penalties for Corporation Tax be exempted?

Answer: Yes, HMRC’s late filing penalties for corporation tax can sometimes be exempted.

You may be able to appeal a late filing penalty if you have a reasonable excuse for not filing your return on time.

Wrapping up

In conclusion, staying on top of your Corporation Tax responsibilities is crucial to avoiding penalties. Remember to file your returns on time, and if you ever have questions or concerns, don’t hesitate to reach out to HMRC or a tax advisor for guidance.

By staying compliant, you can keep your business finances in good shape and avoid unnecessary stress. And the most important thing is that you can avoid HMRC penalties for corporation tax.

So, make it a priority to understand and fulfill your tax obligations, ensuring a smoother financial journey for your company.