Are you planning to start your business in the UK? But you do not know which business structure is the best among UK business structures for your startup. It’s okay to be worried; just don’t let it consume you. Let’s discuss what’s worrying you and see if we can find a solution.

In this blog, we will tell you about the importance and types of UK business structures and the insights each structure provides about tax implications. Before the critical discussion, let’s learn about the essential information first.

What Is a Business Structure?

A business structure is how a company is organized and run. It determines how a business is owned, managed, organized, operated, and taxed. A business structure is how your business will be run under the law in jurisdictions where you aim to achieve your entrepreneurial goals.

The different types of business structures available will vary depending on the country or jurisdiction where the business is located. The structure’s choice will determine how you want your company to be represented, how you want it to operate and by how many people, how the taxes will apply once the setup is ready, and how the investments and liabilities will be determined.

In short, a business structure is the type or form of organization that indicates a business’s legal and operational representation. This can be formal, such as a limited company, or informal, such as a sole trader.

What Are Legal Business Structures in the UK?

Now you know the meaning of a business structure, right? But when it comes to legal business structures in the UK, there is a subtle difference between the business structure and the legal business structures in the UK.

When you hear the term “legal structure,” you’re talking about a business structure that follows the rules and laws. It sets out a business’s rights, responsibilities, and obligations. How the government sees a business depends on how it is set up legally. The legal business structure of a company dictates how the government acknowledges it.

As mentioned above, a business structure is how your business is organized and run. However, a legal UK business structure is the legal entity under which a business is organized in the UK. It is created by registering the business with the government.

What are the Different Types of Business Entities in the UK?

Since you now understand the concept of business structures, let’s proceed with our crucial discussion about business structures in the UK. If you want to get the best benefits from doing business, learning about the types of business structures is very important.

Different business structures are based on several things, such as tax implications, the ability to get financing, and the management level. The standard legal business structures in the UK are described below.

Sole Trader

A sole trader is the UK’s most common informal business structure, where only one person owns and manages it. A sole trader is a business structure where the owner is the business, and there is no legal distinction between the two. The sole trader has unlimited liability for the business’s debts and obligations. If the business is sued, the sole trader’s personal assets, such as their home and car, could be at risk.

In general, a sole trader is an individual who runs a business alone and works as a self-employed person. This means that if you work as a self-employed, you must notify HMRC to register through self-assessment. You must pay income tax and national insurance up to a certain level of profits. After paying your taxes and insurance, you can keep all the remaining business profits. However, if your business loses, you will take personal responsibility for it.

Partnership

A partnership is a business structure where two or more people, or partners, own and operate the business together. All the partners share the profits and losses. They are jointly liable for business debt and obligations. In a partnership business, partners don’t have to be real people. This can be any legal entity acting as a person or a partner.

A partnership can be formal or informal. An informal partnership is an agreement between two or more people to start a business together. But when you want a formal partnership, you must prepare a detailed partnership agreement outlining the liabilities and responsibilities, a dividend of ownership, and profits, including how disputes will be resolved and the partnership will be dissolved.

Remember:

- Partnerships are not subject to income tax, but the partners are taxed on their share of the profits. This is called “pass-through taxation.” All partners must be registered as self-employed with HMRC and submit separate tax returns.

- While registering with HMRC, you have to choose a business name. Then, select a nominated partner who will ensure all administrative tasks, including tax returns and keeping business records, are completed promptly.

Limited Liability Partnership (LLP)

When two or more people own and run the business together as members but with limited liability, this is addressed as a limited liability partnership, or LLP. An LLP does not have shareholders or directors. Instead, it has members who are responsible for managing the business. The owners of an LLP are called members.

An LLP is a separate legal entity distinct from its members (partners). This hybrid business structure combines elements of a partnership and a limited company. This provides limited liability to its members (partners) while allowing them to actively participate in business management. If the LLP is sued, the member’s personal assets are not at risk. However, members may still be liable for their own actions or for any personal guarantees they have given.

- In a limited liability partnership, the number of partners isn’t limited. You may have any number, but at least two must be “designated members” at all times. Designated members must register separately as individuals with HMRC and register the partnership for VAT.

- This is similar to a partnership, where the members’ portion of the profit is taxed as income. All general members are required to register as self-employed with HMRC.

- LLPs have to register with Companies House and have a members’ agreement that says how much of the profit each member should get.

- LLPs must also file annual financial and confirmation statements with Companies House. These documents are publicly accessible and provide information about the LLP’s financial status and members.

Note: If designated members don’t follow the law, they risk prosecution. Moreover, the LLP may be removed from the register.

Limited Company

A limited company is one of the most common business structures in the UK. You may have heard of or seen a limited company with “LTD” after the company’s name (if they are trading under their registered name). A limited company is known as “LTD” or Ltd.”

This is a legal and separate business structure from its shareholders, owners, and directors. The owners are called shareholders; those who run it are known as directors.

Most businesses are limited liability companies, meaning guarantees or share ownership limit members’ liability.

The defining feature of a limited company is that its liability is limited to its assets. This implies that the shareholders, owners, and directors are not personally responsible for the company’s debts or liabilities beyond the amount of their investment in the company. Even their assets are not at risk if the company goes bankrupt.

- The limited company must be registered with Companies House—a government agency that keeps records of all limited companies in the UK. Upon registration, the company will be assigned a unique company registration number.

- Directors must also file annual financial and confirmation statements with Companies House.

- Additionally, they must notify Companies House of any changes, such as the addition or removal of directors or a modification to the company’s registered office.

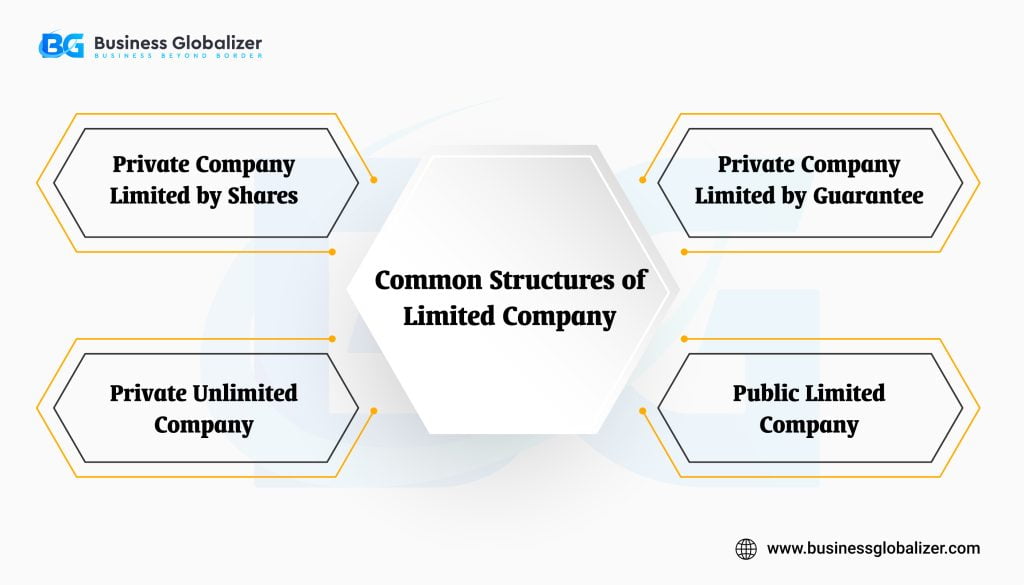

Limited companies in the U.K. come in various sizes and shapes, depending on the types of businesses. The four main types of limited companies in the UK are listed below:

Private Company Limited by Shares

This is the most common type of limited company, known as “Ltd.” The shareholders who own the company are only responsible for its debts up to the amount of their investment. Shareholders own the company through shares, and the company’s capital is divided into these shares. This structure offers limited liability protection and suits various business sizes and types.

Private Company Limited by Guarantee

Typically, a private company limited by guarantee, or CLG, works for sports teams or Charitable organizations. This is a type of company that does not have shareholders. Instead, it has members who agree to contribute a certain amount of money to the company if it goes bankrupt. The profits of a private limited company by guarantee can be distributed to members, but only if the company’s articles of association allow it. The company will not be eligible for charitable status if the profits are distributed.

Private Unlimited Company

Private unlimited companies (PUCs) are rare in the UK because they do not have limited liability for their shareholders. This means that the shareholders are personally liable for the company’s debts. As a result, investors in PUCs need to be able to make informed decisions about whether or not to invest in the company, and therefore, PUCs can share less information about their business than other companies.

Public Limited Company

The public limited company is a separate legal entity from its shareholders, owners, and directors, known as “PLC.” This means the company can own property, enter into contracts, and sue or be sued in its name.

These companies are usually bigger and better-known businesses. They must have at least one person who owns shares, two directors, and a qualified company secretary. It offers its shares to the public. This means that anyone can buy shares in the company, not just a selected group of people.

PLCs are subject to more regulation than other entities. This limited company faces more restrictions than private limited companies. This is because PLCs are regarded as more risky by investors.

What Are the Advantages and Disadvantages of Different Business Structures in the UK?

While doing business in the UK, there are several business structures, as we described above. But each business structure has its own advantages and disadvantages. It is essential to consider the pros and cons of each business structure based on your business goals, liability concerns, and taxation preference before making the big decision on your entrepreneurial journey.

The most common UK business structure’s advantages and disadvantages are listed below:

Business Structures | Advantages | Disadvantages |

Sole Trader |

|

|

Partnership |

|

|

Limited Liability Partnership (LLP) |

|

|

Limited Company |

|

|

Private Limited Company (Ltd) |

|

|

Public Limited Company (PLC) |

|

|

Why Is Business Entity Selection Needed in the UK?

You may wonder why business experts tell you to focus on business entity selection. The different business structures available in the UK have different implications for taxation, liability, and the ability to raise capital.

Here are some reasons business entity selection is needed in the UK:

- Legal Structure: Different business structures have different legal characteristics. The company can operate within the UK government’s established legal framework by choosing the appropriate business entity. This helps protect the business owner’s personal assets and interests and ensures compliance with local regulations.

- Taxation: The different business structures are taxed differently. For example, the profits of a sole proprietorship are taxed as personal income. The profits of a limited company are taxed as corporation tax.

- Compliance Requirements: The different business structures have different compliance requirements. For example, limited companies are required to file annual accounts with Companies House, while it’s not required for sole traders.

- Liability Protection: There are different business structures, each offering various degrees of liability protection. For instance, as a sole trader, the owner is personally responsible for all the debts and obligations of the business. In contrast, in a limited company, the owners are not held personally liable for the debts and obligations of the company.

- Ownership and Governance: The selected business structure defines how ownership is divided among partners or shareholders and how the business is managed. For example, a company limited by shares may have a more complicated way of running things than a sole trader or a partnership.

- Succession Planning: Business entity selection can affect the ease of transferring ownership or passing on the business to heirs or successors. Some structures, like corporations, offer more flexibility in this regard.

Choosing the Right Business Structure in the UK: Which UK Company Structure Is Right for You?

You may be confused about which business structure you should use within several structures.

Choosing the proper business structure depends on your business needs. Private companies limited by shares are a good choice if you want to protect your assets through your business. Opting for a private company limited by guarantee is a superior choice for non-profit organizations. If you intend to raise funds by selling shares to the public, a public limited company is a proper structure. An unlimited company is the only option if you want a business structure without limited liability. Finally, if you are looking for a simple and cost-effective way to start a business, you can choose to be a sole trader.

So, when choosing a business structure, you must consider the following factors:

- The Ideal Legal Benefits and Liability Protection Ratio: How much liability and benefits are the owners willing to take on?

- Advantages and Disadvantages: How much paperwork and administration are involved with each structure, including control ability and responsibility?

- Taxation: What are the tax implications for each structure?

- Business Growth: How easy is growing and expanding your business under each structure?

- Ownership: Who will own the business? Will there be one owner or multiple owners?

Once you have considered these factors, you can choose the best corporate structure for your business.

What Are the Tax Implications for UK Corporate Structures?

As we mentioned above, you should consider taxation. A question may arise about whether UK corporate structures affect taxation.

The answer is yes; your business structure determines what type of taxes you must pay. While you want to rule over UK corporate business structures, you must concentrate on taxation. It may not be the most exciting topic to discuss, but your choice of business structure can affect the earnings you pocket at the end of the tax year. Understanding each structure’s tax advantages and disadvantages can help optimize your business’s tax efficiency to the next level.

Each structure is subject to different tax rules and rates. Here is a brief overview of the tax implications for the four main types of Corporate Governance in the UK:

- Sole Trader: Sole traders are taxed on their individual income tax returns. This is also known as a self-assessment tax return. The profits of the sole trader’s business are added to the sole trader’s other income and taxed at their marginal income tax rate.

- Partnership: Partnerships are taxed similarly to sole traders. Each member of a partnership is considered self-employed and must file an individual tax return. You will be responsible for any tax and National Insurance contributions required on your business share. You must also file a partnership tax return. You will be fined if you do not. You will have additional tax liabilities if you employ staff or exceed the VAT threshold, just as you would if you were a sole trader.

- Limited Liability Partnership (LLP): LLPs combine elements of both partnerships and limited companies. They are taxed like partnerships, with the members paying income tax and national insurance on their share of profits. However, LLPs are subject to a different set of rules for reporting and taxation.

- Limited Company: Limited companies can be more ‘tax efficient’ than other types of businesses. These are separate legal entities from their owners. Limited companies are taxed on their profits at the corporation tax rate. The current corporation tax rates are

- 19% for profits under £50,000

- 25% for profits over £250,00

To calculate the corporation tax payable, you need to file CT600. Completing and submitting this form are essential components of corporate tax compliance in the UK.

Lastly, while doing business in the UK, you should seek professional advice to comply with all relevant tax laws.

Start Your UK Business Incorporation with Business Globbalizer

Business Globalizer is a reward organization for business formation in the US, UK, or other countries. Our legal experts can advise you on choosing a suitable business structure according to your business potential and desired jurisdictions in the UK. We offer upfront and fair pricing for company registration, including completing and submitting annual accounts for Companies House and CT600 with HMRC, without any hidden fees. You can count on our transparency and honesty.

FAQ on UK Business Structures

Q1: Is there any difference between a sole trader and a self-employed person?

Answer: There are subtle differences between “sole trader” and “self-employed.” The name of a type of business is “sole trader.” You are self-employed if you have signed up as a Sole Trader.

Q2: What are some examples of sole traders?

Answer: Freelancers, copywriters, and photographers are examples of sole traders. Like independent tutors, people who work in the “gig economy” are also “sole traders.”

Q3: What is the most popular business structure in the UK?

Answer: The limited company is the most popular business structure in the UK. According to the UK government, there are over 4.8 million limited companies in the UK, making up around 99% of all businesses.

Q4: Is there any difference between a limited company and a partnership?

Answer: In limited companies, the shareholders own the company, but the directors run it. In a partnership, however, each partner owns and runs their share of the business.

Bottom Line

In conclusion, understanding UK business structures is necessary to make informed decisions aligned with your entrepreneurial goals. Each structure offers unique advantages and challenges, so carefully assessing your needs, objectives, and risk tolerance is essential. Whether you opt for the simplicity of a sole proprietorship, the shared responsibilities of a partnership, or the limited liability protection of a company, your choice can significantly impact your business’s trajectory.

We suggest you seek professional advice and adapt your structure as your business evolves. Please contact us for any information or suggestions regarding conducting business in the UK.