Are you a business owner who thrives in local business and wants to expand globally? Are you ready to take your business to a global level but have a few questions about which answers you are looking for? Then you’re in the right place; we have all the answers for you!

Starting a foreign company can be a huge step in your life. It’s a thrilling adventure that can lead to amazing rewards but also has a lot of challenges of its own. Timing is one of the most important things to consider before starting a business.

So, when is the best time to start a business or get it registered? Well, there’s no one-size-fits-all answer because the answer depends on many things, like the kind of business you want to start, your finances, your situation, and the state of the market at the time.

Today, we’ll talk about some of the most important things that can affect your company when it starts up. We’ll also give you ideas and suggestions to help you figure out when to form a company. This blog post is for anyone who wants to start a business or who already has one and wants to grow it globally.

What Is a Company?

A group of people who work together to sell or make something is called a company. Companies can be big or small, and they can make food, cars, clothes, and many other things. Most of the time, people or groups that invest money in a business to help it grow own it. The company makes money when it sells its products or services. This money can be used to pay employees, put back into the business, or give dividends to shareholders.

Key Considerations for Forming a Foreign Company

There are a few things to consider before forming a global company. Take a look at the considerations listed below:

Considerating Foreign Governments: When considering international business opportunities, it is important to prioritize the stability and authority of the local government. Important factors to consider include:

- Currency exchange rates,

- Access to necessary resources,

- Communication and transportation options,

- Government support for businesses,

- Affordable capital availability,

- Protection policies, and

- Immigration and employment laws.

Government stability ensures contract integrity, employee security and rights, and the safeguarding of trademarks and intellectual property. Before expanding overseas, seek advice from local experts who understand the political and business landscape to make informed decisions.

Local Markets and Cultural Norms: Understanding your target market’s unique culture and business practices is important. For example, negotiating and meeting face-to-face in Colombia is important for successful deals. When hiring people, it’s important to research the local job market because there are differences in employment laws, benefits, and skill sets. You can learn a lot from people who have already built businesses in the country you want to do business in.

Aware of Your Tax Responsibilities: When it comes to taxes, all roads lead to them. Choose a structure that helps you follow local rules and pay less tax. This is a risky and complicated area. Some countries, like the United Arab Emirates, Singapore, and Canada, make avoiding taxes easier. However, in other countries, tax regulations are more complex and time-consuming. In 2018, China, Brazil, and Turkey were the most complex for financial compliance.

Plan Out Your Sales Strategy: Sales strategies vary across different countries. It’s important to research and understand your target market. Customize your approach by considering local ways of doing things, like partnerships, franchising, or hiring local people. Be careful when using contract workers because they could be seen as regular employees, which could cause legal and financial problems. To avoid unforeseen problems, become familiar with country-specific employment regulations, particularly when terminating contracts.

Learn the Laws and Regulations: Knowing and following the export rules is important when you do business in another country. Each country has its own set of paperwork requirements. For instance, the European Union has strict rules to protect people, animals, the environment, and consumers. These rules can be hard to understand, so hiring local experts or talking to business experts to help you follow them and do other administrative tasks to avoid fines is best. And you will be good to go.

Figure Out Where and When to Market: No matter what you sell, a big part of your marketing strategy will be your online presence, like your website and social media. Even though you can do marketing from anywhere, having marketers in the field has its benefits. They can learn about the market, connect, and attend industry events. If you’re expanding abroad and selling directly to customers, having a marketing presence will help you achieve your goals faster.

Foreign Business Structures For Global Entrepreneurs

When you start a business, you must decide what kind of business you want. What kind of business you have will determine which income tax return form you have to fill out. The most common forms of business are given below.

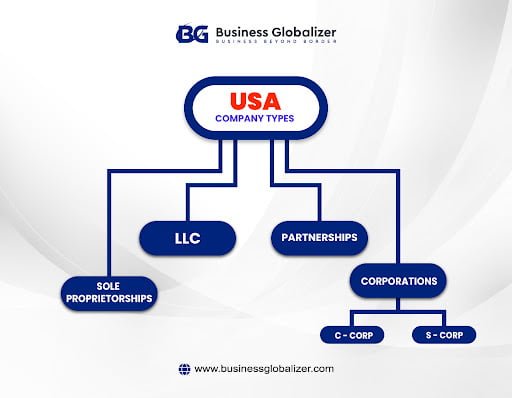

For the US:

Sole Proprietorships

“Sole proprietor” refers to a person who owns an unincorporated business by himself or herself. But you are not a sole proprietor if you are the only member of a domestic limited liability company (LLC) and you decide to treat the LLC like a corporation.

Sole proprietorship examples:

- Freelancer Writer.

- Photographer.

- Housekeeper etc.

Limited Liability Company or LLC

A limited liability company, or LLC, is a business structure that is allowed by state law. Each state may have different rules. If you want to start a limited liability company, you should check with your state.

People who own an LLC are called members. Most states don’t have rules about who can own an LLC, so individuals, corporations, other LLCs, and even foreign entities can all be members. There is no limit to how many people can join. Most states also allow LLCs with only one owner, called “single-member” LLCs.

LLC examples-

- Apple.

- Nike.

- Facebook etc.

Learn more about the differences between sole proprietorship vs. LLC.

Partnerships

When two or more people work together for business or trade, they are in a partnership. Each person puts money, property, time, or skills into the business and gets a share of the profits and losses.

Partnership examples are:

- Spotify and Uber.

- Levi’s & Pinterest.

- Maruti Suzuki etc.

Corporations Business

When people want to start a corporation, they exchange money, property, or both for its capital stock. A corporation’s taxable income is usually calculated like a sole proprietorship’s. A corporation can also take advantage of certain tax breaks. Regarding federal income tax, a C corporation is considered a separate tax-paying entity. A corporation does business, makes a net profit or loss, pays taxes, and shares the profits with its shareholders.

Some Corporation examples are:

- Microsoft Corp.

- Coca-Cola Co.

- Toyota Motor Corp., etc.

Some companies do business under their own names or different business names, like Alphabet Inc., better known as Google.

S Corporations

S corporations are corporations that choose, for federal tax purposes, to pass on their income, losses, deductions, and credits to their shareholders. Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and pay taxes at their individual income tax rates. This stops S corporations from paying twice as much tax on their income. Some built-in gains and the passive income of an S corporation must be taxed at the entity level.

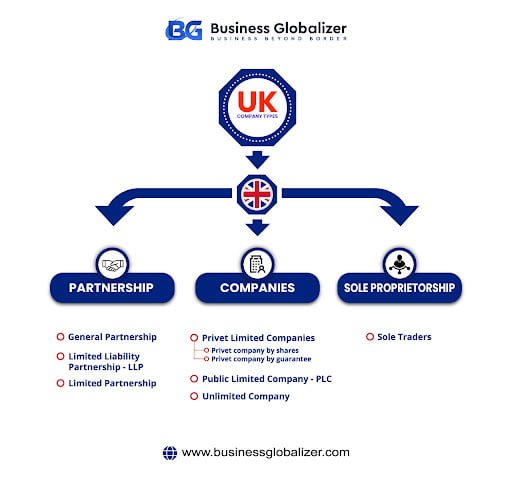

For the UK:

Sole Trader

Being a self-employed sole trader is the easiest way to start a business. You register your business with HMRC and run it yourself. As a sole trader, you can keep all the profits but must pay taxes and national insurance by filling out a self-assessment Tax Return. There’s no limit to how much you can earn, but higher tax brackets may affect your tax efficiency. You are personally responsible for all liabilities, including your own assets and jointly owned ones.

Partnership

A partnership is when two or more people agree to share a business’s profits, losses, risks, costs, benefits, and responsibilities. Partnerships are unincorporated, meaning the partners are self-employed and personally responsible for any debts or losses. Partners are also liable for each other’s mistakes. The profits or losses are divided based on an agreed ratio, and each partner pays taxes on their share.

Learn more about the partnership business entity here.

Limited Liability Partnership (LLP)

An LLP is like a partnership but with limited liability. Partners are only responsible for the money they invest. It needs to be registered with Companies House and HMRC. Annual accounts must be prepared and submitted. An LLP can have two or more members, who can be individuals or companies. Members’ duties and profit shares are outlined in an LLP agreement. Every member must file a personal self-assessment tax return, pay income tax on their share of profits, and pay National Insurance to HMRC.

Limited Company (Ltd)

A limited company is a privately owned business that its shareholders and directors manage. It has its own legal rights and responsibilities, separate from those of its owners. The company keeps its profits after paying taxes and can distribute them to shareholders as dividends. Limited companies have annual reporting obligations—annual accounts, confirmations statements, and others— to Companies House and HMRC. They can be limited by shares or by a guarantee.

Learn more about the differences between Ltd and PLC.

Why Is Starting a Business Important? What Are the Pros and Cons of Forming a Company?

The question may arise, “Why must we form a company?” or “Why starting a business is important.” There are some very important reasons to start a business. If those reasons arise, you will most likely start your own business.

Advantages of Starting a Business

The advantages of incorporating a business or forming a company are given below:

- For Global Client Acquisition: Creating a company is important if you want to get clients from other countries. If you start and grow a business, you can reach many clients in your own country or worldwide.

- Brand Expansion: Brand expansion is when a new product gets its own brand name. By doing this, a company with a brand can grow it. And this can also be called “brand stretching.”

- Customer Acceptance: Customer acceptance means getting a customer’s approval or confirmation that they are happy with a product or service after it has been delivered or finished. It assesses whether the customer’s requirements and expectations have been met. Company formation— Whether in the US, UK, or UAE—is very important if you want to win over customers.

- Payment Gateway Acquisition: Getting a payment gateway service by buying, merging with, or getting a payment gateway provider is a payment gateway acquisition. This lets a business process and accept digital payments through different channels, like online, mobile, or in-person transactions. You need to consider forming a company to get a payment gateway.

- Possible Access to New Business Opportunities: Forming a company gives you access to new business opportunities.

- Legal Protection and Recognition of the Business: Forming a company gives a business legal recognition and protection.

Basic Requirements to Form a Company

Forming a company involves several steps, and the specific requirements may vary depending on the country and jurisdiction where the company is being formed. However, some basic requirements to form a company may include the following:

- Director/Owner.

- Legal agents (Registered Agent /Accountant /Etc.).

- Registered office address in the same jurisdiction.

- Name availability.

Documents to Register as a Non-Resident

The documents required to register a company as a non-resident can vary depending on the jurisdiction in which you wish to incorporate. The basics may include the following:

For The US And UK, both:

- Passport-scanned copy.

- Bank statement (for address verification).

Who Should Form a Company?

Anyone, like an individual, a group of individuals, or even another company, can form a company. People usually start companies to do business, like selling products or providing services.

If you want to start a business and think it has the potential to make money, forming a company could be a good idea. By forming a company, you can protect yourself from personal liability and establish a separate legal entity that can enter into contracts, hire employees, and own property. Let’s take a look at who should form a company:

- Entrepreneurs or business owners who want to expand their business.

- Partnerships or collaborations with foreign businesses.

- Who wants to access and explore new markets?

- Business owners who have clear plans and strategies to invest and provide service.

The Best Time to Register a Business or Form a Company

Incorporation or company formation, means doing business in a company with legal protection. This can help you grow and protect you from getting sued. Even if you already have a business, becoming a company can give you many benefits, like different tax rules and the ability to keep going even if you’re not in charge anymore.

So, if you decide to form a company, when is the best time to do it?

Starting a business has never been easy, and there is no perfect time to do so. It’s normal to have doubts and fears, but you shouldn’t wait for the perfect time because it might never come. You must create the right time by taking action, or you might be waiting forever. Here are some pointers about it, given below:

- Early and brilliantly: Forming your business as a formal company right away can protect you from being personally responsible for any problems that might happen, make your business look more professional, and save you some money on taxes. However, sometimes it’s better to wait before making this decision.

- Readiness: Ensure that the business idea you have or are forming is fully developed and there is a clear plan for how the company will operate and generate revenue.

- Funding: If the business requires funding to get off the ground, it may be necessary to form a company earlier to attract investors or obtain financing.

- Legal Protection: Forming a company can provide legal protection for the founders’ assets, as the company is a separate legal entity. So, if you want legal protection for your assets, it’s time to form a company.

- Tax Considerations: Depending on the location and industry of the business, there may be tax benefits or drawbacks to forming a company at a specific time.

- Timing: Founders should consider external factors such as market conditions, competition, and customer demand when forming a company. If you need to form a company or LLC because you’re worried about getting in trouble or want to save money on taxes, you should do it immediately. But if you’re not in a hurry, it’s best to wait until January and start over at the beginning of the year.

When Is the Best Time to Start a Business for Tax Purposes?

People have always liked to start businesses at the beginning of the year. If you’ve been thinking about starting a business but don’t know the benefits of starting in January, you don’t need to look any further.

Entrepreneurs get extra tax and accounting breaks at the beginning of the year. This means less paperwork, lower costs, and fewer headaches when starting up. It can also help with cash flow and help you make money faster.

Disadvantages of Incorporating a Business

There are also a few disadvantages to incorporating a business. Take a look below:

- Additional Costs: Due to the use of a more complicated legal entity, incorporation comes with extra costs, such as filing the paperwork the first time and higher ongoing legal and accounting costs.

- Extra Paperwork: Rules and regulations about incorporation add to the directors’ administrative work because they cause new tasks to pop up now and then. For example, the company has to pay taxes and file annual returns. Also, the corporation’s minute book must have several records, such as articles of incorporation, bylaws, information about meetings, and registers of directors, officers, and shareholders/members.

- Personal Tax Credits for Losses Are Not Available: If your business is a sole proprietorship or a partnership, shareholders may be able to use their income to make up for business losses. The company is responsible for covering any losses that arise after its formation. However, these losses can be carried forward and subtracted from the corporation’s future profits.

Wrapping Up

And that’s it, folks! We’ve come to the end of our journey when it’s the best time to start your own company. Good luck on your entrepreneurial journey! Hopefully, you’ve learned valuable information to help you make a well-informed decision.

Starting a company is a big step, so take your time, do your research, and ensure you’re fully prepared before taking the plunge. Whether you decide to start your own company now or in the future, always stay true to your passion and believe in yourself.

And, of course, if you ever decide to form a company, Business Globalizer is always here to lend a hand in accomplishing your entrepreneurial dream.