The U.S. makes it easy to register a company. That’s part of the appeal.

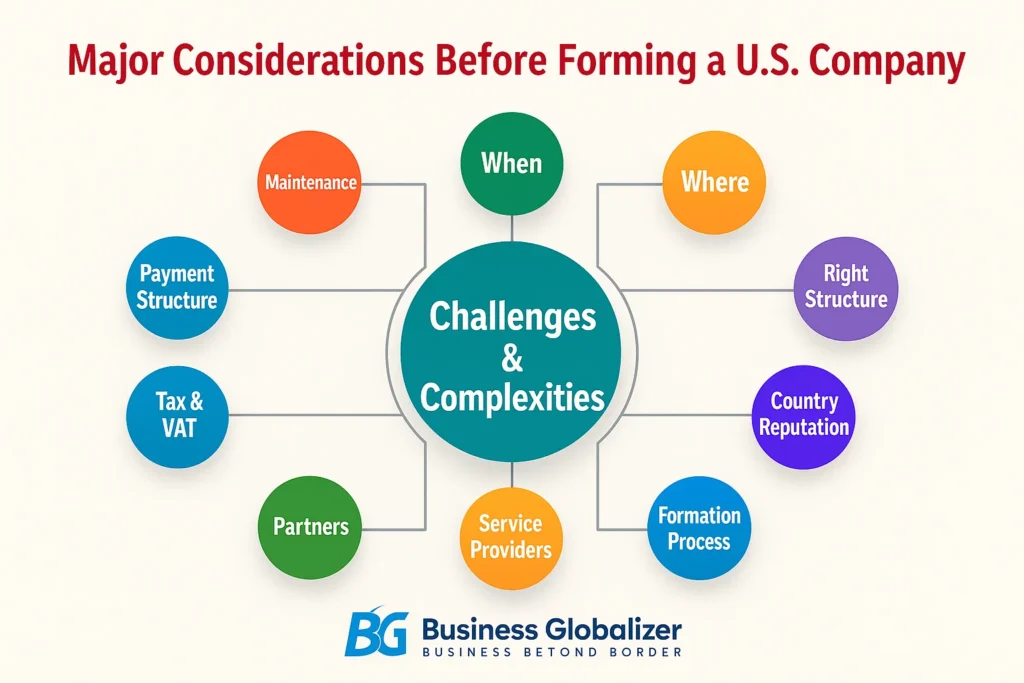

But behind the fast forms and state portals lies a more important layer—the major considerations before forming a U.S. company.

This blog isn’t about which form to fill out.

It’s about the questions worth answering before you start.

Because the real complexity? It doesn’t come from the registration. It comes from what happens after—taxes, partners, maintenance, operations, compliance.

Let’s walk through what actually matters—based on what experienced founders wish they’d considered sooner.

Major Considerations Before Registering a U.S. Company

Without any delay, let’s talk about the factors that should be considered before forming a US company:

1. When Is the Right Time to Form?

Timing matters more than most people think.

If you form too early, you may spend months paying maintenance fees, filing tax returns, and chasing compliance—even if the business hasn’t made a dollar yet.

If you form too late, you might miss opportunities—like early partnerships, grants, platform approvals (Stripe, PayPal), or investor confidence.

Ideal timing? When you have a clear direction, early demand, and a reason to separate your business identity from your personal one.

2. Where Should You Register?

You don’t have to live in the U.S. to form a company there.

But you do have to choose a state—and that choice matters.

Most non-resident founders pick:

This decision affects:

- Tax obligations

- Annual maintenance

- Whether investors or partners take you seriously

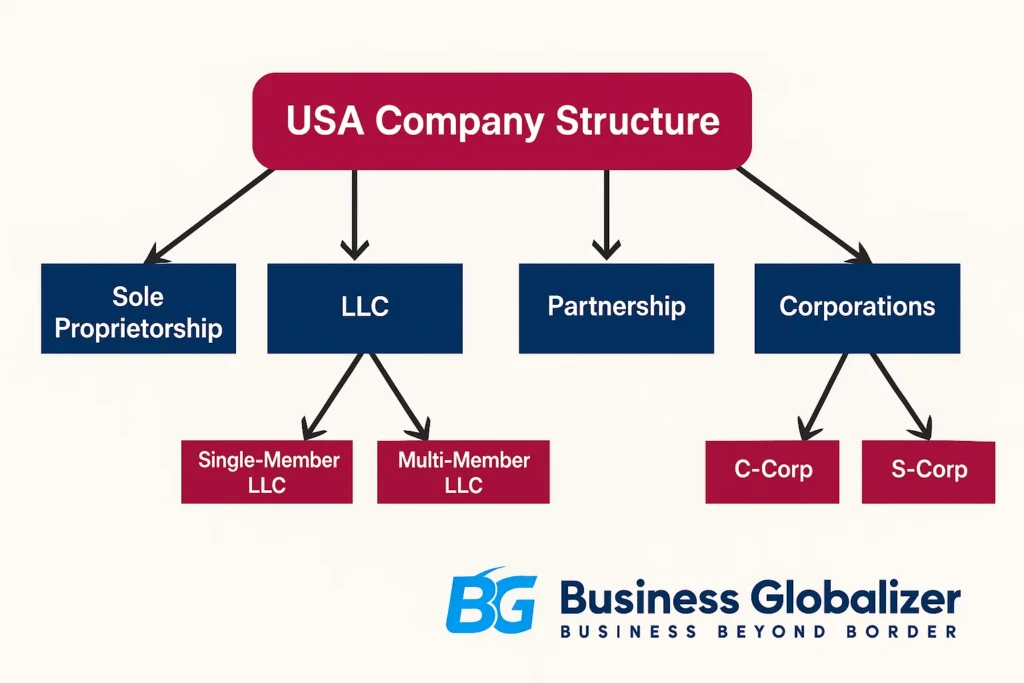

3. Choose the Right Business Structure

In the U.S., you don’t just form a company—you choose a structure. That means deciding between:

- LLC (Limited Liability Company):

LLC is the most popular choice for solo founders, small teams, and online businesses.

It protects your personal assets, has flexible taxes, and less red tape.

→ Can be Single-Member LLC (just you) or Multi-Member LLC (more than one owner).

- C Corporation:

A more formal setup. Built for growth, investors, and stock options.

You’ll pay taxes at the company level—but it’s the go-to if you’re raising capital or scaling fast.

- S Corporation:

Similar to a C Corp, but with pass-through taxation (profits taxed only once).

But—only U.S. citizens or residents can form or own an S Corp, so it’s not an option for most foreign founders.

- Series LLC:

Think of it like one “parent” LLC that holds multiple “child” series under it—each with its own stuff, its own risks, and its own reason for existing.

Useful if you’re running multiple ventures under one roof.

(Note: Not every state supports this. Delaware and Wyoming do.)

Choosing wrong now can cost you money and legal hassle later—so pick based on where you’re headed, not just where you are.

4. What’s the Reputation of the State You’re Forming In?

This one gets overlooked. But your company’s “birthplace” carries weight—especially if you’re targeting global clients, suppliers, or investors.

Not all states carry the same weight.

A Delaware LLC, for example, is instantly recognized by platforms, investors, and legal teams. It’s familiar. It’s trusted.

Wyoming and California? Also respected—but for very different reasons.

Where you form your company says something about how you operate.

So even if you’re forming remotely, make sure the state you pick strengthens your credibility—not questions it.

5. Understand the Formation Process

You’ll need:

- A unique company name

- A registered agent in your chosen state

- Articles of Organization/Incorporation

- An EIN (Tax ID)

- An operating agreement (especially for LLCs)

- A U.S. bank account

And yes—you can do all of this remotely. Just a heads-up—you’ll need a bit of patience when applying for your EIN, especially if you don’t have an SSN. It might take a little longer, but it’s totally doable.

6. Choose Reliable Service Providers

This isn’t the part to save a few dollars. Your registered agent, formation service, tax advisor, and compliance team are the ones keeping your business in good standing while you’re focused on growth.

Cheap setups often lead to:

- Missed filings

- Lost EINs

- Suspended entities

- Delayed bank account approvals

Pick providers who’ve worked with non-residents and remote-first companies. Ask what happens after formation, because that’s where things usually go wrong.

7. Think About Future Partners Before You Form.

You may start alone, but businesses grow fast. If you’re planning to add partners, investors, or team members later, structure it now to keep things clear.

This means:

- Setting up clear ownership in your operating agreement

- Choosing a structure that allows equity sharing (C Corp or multi-member LLC)

- Keeping detailed internal records from day one

You don’t want to redo everything in just six months to add someone legally.

8. Know Your Tax & VAT Position

Even if your business isn’t earning yet, U.S. companies still have tax responsibilities—it’s part of staying compliant from day one.

Here’s what you’ll need to stay on top of:

- File federal taxes annually—required for all U.S. companies, whether you’re active or not.

- Single-member foreign-owned LLC? File Form 5472 + 1120 each year.

- Multi-member LLC? You’ll need to file a partnership return (Form 1065) and issue K-1s to all members.

- C Corporation? You’re required to file Form 1120, and if there are profits, the corporation pays tax on them.

- Selling to U.S. customers? Keep an eye on sales tax exposure—you may need to register in certain states depending on where and how much you’re selling.

And no, just forming in Wyoming doesn’t exempt you if you’re selling into California or New York. Talk to a tax advisor familiar with cross-border filings. Don’t assume zero tax equals zero responsibility.

9. Set Up a Clear Payment Structure

This is why many founders register in the U.S. in the first place—access to:

- Stripe

- PayPal

- Mercury

- U.S. banking infrastructure

But without:

- A clean EIN

- A real U.S. business structure

- A properly named bank account

…you’ll hit walls.

Get the structure in place before applying. Avoid mismatched names, inactive EINs, or shady agents promising “instant approvals.”

10. Maintenance Isn’t Optional

It’s easy to start a U.S. company. It’s easier to forget your first tax deadline.

You’ll need to:

- File state and federal returns

- Renew your registered agent

- File annual reports (depending on your state)

- Track compliance if you’re working in multiple jurisdictions

If you’ve got plans to grow, keep things tidy from the start.

Platforms, investors, and even bank partners will check if your company is in good standing.

Final Thought

You can form a U.S. company in a day.

But whether it stays functional, compliant, and trusted? That depends on the major considerations before forming a U.S. company—the ones you weigh before clicking “Submit.”

Think about your future team.

Think about your taxes.

Think about who’s going to review your documents next year—when you need funding, banking, or a new payment gateway.

Build it right the first time.

Because in the U.S., structure is trust.

FAQ

Do I need to be in the U.S. to register a company there?

No. You can form a U.S. company remotely—without living in or even visiting the U.S. You’ll need a U.S.-registered agent, an EIN, and a business address (can be virtual), but the entire process can be handled online.

Which U.S. state is best for non-resident founders?

It depends.

- Delaware is known for its legal structure and investor trust.

- Wyoming is popular for privacy and low maintenance.

- California only makes sense if you’re physically doing business there.

Your state choice affects costs, taxes, reputation, and compliance—so don’t pick based on trend. Pick based on need.

How do I choose between LLC, C Corp, and other structures?

- Go with an LLC if you want flexibility, simplicity, and single/multi-owner freedom.

- Choose a C Corp if you’re raising funds, issuing shares, or building a scalable team.

- S Corp and Sole Proprietorship are off-limits for non-residents.

Can I get paid through Stripe and PayPal with a U.S. company?

Yes—if your company is properly set up.

That means a clean LLC or C Corp, an EIN, a U.S. business bank account (like Mercury or Relay), and a matching U.S. business address.

If you miss these, your application might hit a delay—or even get turned down.

What are the annual maintenance requirements for a U.S. company?

- State filings (like annual reports or franchise tax)

- Federal tax returns

- Renewal of your registered agent

- Possibly sales tax compliance if you’re selling across state lines

Can I use a single U.S. company to run multiple businesses?

Yes. You can run multiple projects under one LLC using DBAs (“Doing Business As”), or form a Series LLC if your state supports it. Just make sure your banking, contracts, and record-keeping stay separate.

Is it okay to register now even if I’m not making money yet?

Depends on your situation.

If you need a business entity to receive payments, apply for platforms, or protect your name—go ahead.

But if you’re still ideating and don’t need legal infrastructure, wait until there’s movement. Forming too early can create unnecessary tax filings and compliance burdens.

If I don’t live in the U.S., do I still have to pay U.S. taxes?

Yes, you do. Once you register a U.S. company, you’re expected to file a tax return every year—whether you’re living in the U.S. or halfway across the world. It’s all part of staying compliant.