Are you an employer who has hired employees for their business? If yes, then you require an EIN. An important fact: even if you have only one employee, you must have an EIN when running a business. And to obtain an EIN, you must file Form SS-4.

An EIN works similarly to a social security number for your business. The IRS can quickly identify your business when you pay certain taxes through this nine-digit number. That’s why, to apply for this number, you have to file EIN Form SS-4. In this article, you will understand what Form SS-4 is. You will find SS-4 instructions for applying for an EIN and how to do so.

Let’s go ahead!

What Is IRS Form SS-4?

IRS Form SS-4 is the form you must file with the Internal Revenue Service to apply for an Employer Identification Number (EIN). Businesses, non-profit organizations, trusts, estates, and other entities use it to apply for a distinctive nine-digit number from the IRS.

The EIN functions as a tax identification number for the applied entity and is needed for various purposes, including filing tax returns, opening a bank account, hiring employees, and other business-related operations.

On this Form SS-4, you must provide information about your business, including your company’s legal name, address, type of business structure, and the reason for applying for an EIN.

What Is an Employer Identification Number?

An EIN is a Federal Tax ID number that most businesses in the United States require when forming a business, whether residents or non-residents. Simply put, an EIN (Employer Identification Number) is a nine-digit number that the IRS (Internal Revenue Service) issues to identify a specific business entity.

It identifies a business entity and is used for tax purposes in the United States. Each EIN is different, so the IRS can quickly identify a business entity. EINs are usually given to businesses like corporations, partnerships, LLCs, and sole proprietorships, but they can also be given to trusts, estates, and non-profit organizations. An excellent way to protect one’s identity is to use an EIN instead of the business owner’s Social Security Number.

What Is an Individual Taxpayer Identification Number (ITIN)?

An Individual Taxpayer Identification Number is a unique number used as a tracking number by the IRS to identify businesses, individuals, and other entities for tax-related purposes. The IRS issues all U.S. tax ID numbers except for social security numbers. When you want to apply for employment or credit, ITINs are also required. There are different types of tax identification numbers, such as the employer identification number, the individual tax identification number, and the adoption tax identification number.

Why Do You Need EIN Form SS-4?

Before filing Form SS-4, you must know certain conditions determining whether you need an EIN number. Here are some of the reasons you might need an SS-4.

- Employer Identification Number: The main reason for filling out an SS-4 form is to obtain an EIN. An EIN is a unique nine-digit number assigned by the IRS. It is also called a federal tax identification number.

- Business Entity Formation: When forming a business as a sole proprietorship, partnership, corporation, limited liability company (LLC), or any other entity, you need an EIN number for tax and other legal purposes.

- Hiring Employees: If you plan to hire employees for your company, you must have an EIN number for payroll tax reporting and withholding purposes.

- Opening Business Bank Accounts: To open a business bank account at most banks, you need an EIN.

- Filing Tax Returns: An EIN is used to identify your business entity when filing different tax returns, like income tax, employment tax, excise tax, and more.

What Information Do You Need for Form SS-4

To file Form SS-4, you will need the following information and documents:

- The official and legal business name and physical address.

- If your company will operate under a name other than its legal name, you must file a trade name, also known as a DBA.

- The name of the applicant and their ITIN, SSN, or EIN.

- Type of business structure.

- Mailing and street addresses of the business.

- Country and state where the principal place of business is located.

- Responsible party information- generally, it may be the owner, a general partner, or a principal officer.

- Indicate the primary reason for applying for an EIN.

- Date of your business began or acquired.

- Principal product or service of the business.

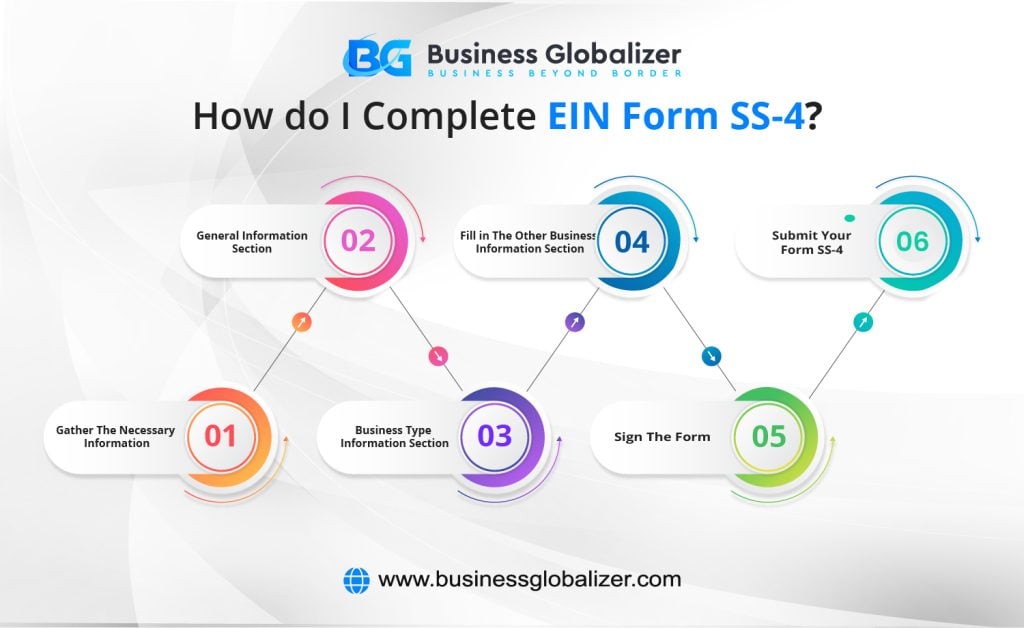

How Do I Complete EIN Form SS-4?

Businesses and other entities in the United States use Form SS-4, also known as the Application for Employer Identification Number (EIN), to request a unique tax ID number from the Internal Revenue Service (IRS). Here’s a step-by-step explanation of how to fill out Form SS-4:

Gather the Necessary Information

Before you can start filling out Form SS-4, you must gather all the important information about your business. This includes necessary details like the company’s legal name, which should be the same as the name filed with the state.

The next most important part of filling out Form SS-4 is figuring out the responsible party for your business. You must find out the full name of the responsible party. You also need to get their Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN), as well as, if appropriate, their Taxpayer Identification Number (TIN).

General Information Section

In this step, you have to fill out general information. Such as:

Enter your Business Information

- Legal Name

- Trade Name

- Trust or Estate Information

Enter your Business Address

- Mailing Address

- Physical Address

- Primary Location

Enter your business responsible party information

- Full Name

- Social Security Number or Taxpayer Identification Number

Business Type Information Section

- In this step, you should check the box to confirm if the entity is an LLC

- Identify the type of entity your business is, such as a sole proprietorship, corporation, partnership, or trust.

Fill in the Other Business Information Section

- Choose the reason for applying for an EIN.

- Date of business start-up and end of fiscal year.

- How many workers do you think you’ll have in the next year?

- Indicate if Form 944 is being filed and give the date of the first wage check.

- Describe primary business activity.

- Do you have any previous EIN numbers?

Here is the pdf link for the SS-4.

Sign the Form

Depending on the type of applicant, the signature should be provided as follows when completing the application:

- If the applicant is an individual, they must provide their own signature.

- If the applicant is a corporation, the signature must be from the corporation’s president, vice president, or another executive officer.

- An authorized and responsible member or officer with knowledge of the organization’s affairs must provide the signature if the applicant is a partnership, government entity, or other unincorporated organization.

- The applicant must provide their signature if they are a trust or estate.

Submit Your Form SS-4

You can submit your Form SS-4 online, by fax, or by mail to the IRS. If you apply online, you will receive your EIN immediately. The online application must be submitted in a single session that lasts 15 minutes.

How Can I Be Done with My EIN Registration?

You must fill out Form SS-04 for the EIN. It can be found on the IRS website. Applying online is the fastest method, so remember that when you try to apply for an EIN online, you must complete the application in one session.

People not in the United States but will be doing business there can apply by phone, fax, mail, or the Internet. The process is pretty simple and uncomplicated. The application must have the following details: the name and personal taxpayer identification number of the company’s principal officer, partner, trustee, owner, or any other title.

Some of the information that will have to be written on the form is:

- The type of entity.

- The reasons for applying (new business, change of organization, IRS withholding requirement compliance).

- The start of the acquisition date.

- The principal industry of business.

- You must have a U.S. or U.S. located-based business.

- You must be a “responsible party,” which means you own or control the entity applying or have the most authority over it.

An EIN will be issued once the online information is verified.

FAQ

1. How do you get Form SS-4 from the IRS?

Answer: To obtain Form SS-4 from the IRS, go to their website and search for “Form SS-4.” You can also call the IRS at their toll-free number and request that the form be mailed to you.

2. If You’re a Sole Proprietor, Do You Require an EIN?

Answer: When you want to operate a business as a sole proprietor, obtaining an EIN number can be beneficial as it separates your business and personal finances, especially if you plan to hire employees or open a business bank account. But if you do not have any employees, you can use your social security number for tax purposes.

3. Are EINs the same as Social Security Numbers (SSNs)?

Answer: Employer Identification Number (EIN) and Social Security Number (SSN) are not interchangeable. While an individual’s SSN is utilized for personal and financial reasons, corporations and organizations use EINs for tax and legal purposes.

Bottom Line

Obtaining an Employer Identification Number (EIN) through EIN Form SS-4 is a vital requirement for all businesses, regardless of size. Like a social security number, an EIN acts as a unique identification that allows the IRS to track taxes and corporate operations.

An EIN is necessary for various purposes, including business incorporation, hiring employees, opening bank accounts, and filing tax returns. The form requires information about your company, facts about the responsible party, and the reason for the application.