Do you know why LLCs are so popular among small and large businesses? The most obvious answer is that an LLC offers you liability and ownership flexibility. This is the only business structure that can give you this advantage. But to get it, you should pick the right LLC management structure according to your business type.

For your ease in selecting the right structure, we are sharing the facts about member-managed vs. manager-managed LLC. Our guidance can help you understand the clear difference between these two.

What Is an LLC?

An LLC is the most popular business structure and comes with the most profitable benefits. It is a separate legal entity from its owners (members) and provides both the benefits that a corporation and a sole proprietorship business structure provide. You can run your LLC flexibly as a sole proprietorship and have asset protection like a corporation. Even LLCs have a flexible ownership structure where adding or removing members is typically easy.

Why Choosing an LLC Management Structure Is Important?

An LLC has two types of management structures –

- Member managed LLC.

- Manager managed LLC.

You might wonder why you should choose one before forming your LLC. Well, there are some obvious reasons. Take a look below:

- Deciding Operating Agreement: The operating agreement is the first step in forming an LLC. Deciding on your LLC type is mandatory before making your LLC operating agreement. An operating agreement specifies how your company will handle members or managers and how responsibilities will be divided. Different LLC management structures have different systems for the agreement. So, it’s necessary for you to decide on your LLC’s management structure.

- Ownership Choice: Not all the members want to participate in the day-to-day operations of their company. To solve this, they hire managers to manage the company. By choosing an LLC management structure between member-managed and manager-managed LLCs, you clarify whether you are an active member (owner) or a passive investor.

- Flexibility: The choice between a member-managed and manager-managed structure determines how much flexibility you can have in your company. Suppose you choose a member-managed LLC. Now you can get all the necessary working flexibility, including quicker decision-making, sharing responsibility, fewer conflicts, etc. But the manager-managed LLC is more formal.

- Deciding Your Costs: Your choice of LLC management structure also dramatically affects your business expenses. Because both LLCs’ management has a separate budget to maintain business, deciding on a structure clarifies your business costs.

- Clarifying Business Types and Goals: Small and large businesses can form LLCs. However forming a member-managed LLC would be better for a small business, and for a large business, a manager-managed LLC would be better. This choice can bring quick success to the company.

So, it is clear that the choice between a member-managed LLC and a manager-managed LLC is essential because it determines how the business will be operated, who will have decision-making authority, and how the business will be managed.

What Is a Member-Managed LLC?

We know that members are the owners of the LLCs. When the LLC members responsibly participate in day-to-day management and decision-making, this is called a member-managed LLC.

Simply put, in a member-managed LLC, each member has an equal say in the management and running of the business. All members are active in the company, and profits are distributed among members according to the percentage written on the agreement.

Is the Member of An LLC the Owner of a Member-Managed LLC?

Obviously, the members of LLCs are the legal owners. They form LLCs together by providing capital. Also, a single member can form an LLC without other members. In both situations, a member is involved in the LLC company as an active manager or employee managing the business.

Each member of an LLC owns a certain percentage or portion of the company. And the company’s profits and losses are distributed among them according to the percentage. These rights are written into an operating agreement.

What Is Manager Management LLC?

When the business members (owners) want to avoid playing an active role in the LLC company, they hire managers (employers) to manage the business and make decisions on behalf of the company.

Unlike a member-managed LLC, members in a manager-managed LLC don’t participate in the day-to-day operation. They just remain passive investors and keep control over the company.

Is the Manager of an LLC the Owner of a Manager Managed LLC?

No, members are the only legal owners of an LLC. Managers are employees hired by LLC members. In a manager-managed LLC, members don’t handle the business actively. They hire external people as managers. And, the hiring managers handle the business, make decisions, and manage day-to-day operations.

It is noted that the members have full control over the business, although they remain inactive. They can elect and remove managers if they want.

Also, a member can work as a manager. In an LLC, some members want to be passive, and some want to be active managers. It can be possible in a manager-managed LLC, but it should be mentioned in the operating agreement.

What Are the Implications of a Member Management or Manager Management LLC?

Your choice between a member-management or manager-management LLC has important implications for your business. You might know that, by default, an LLC will be member-managed. But you can choose a manager-managed LLC if you want. It depends on the specifics of your business. For your understanding, we will explain some distinct differences between member-management and manager-management LLCs.

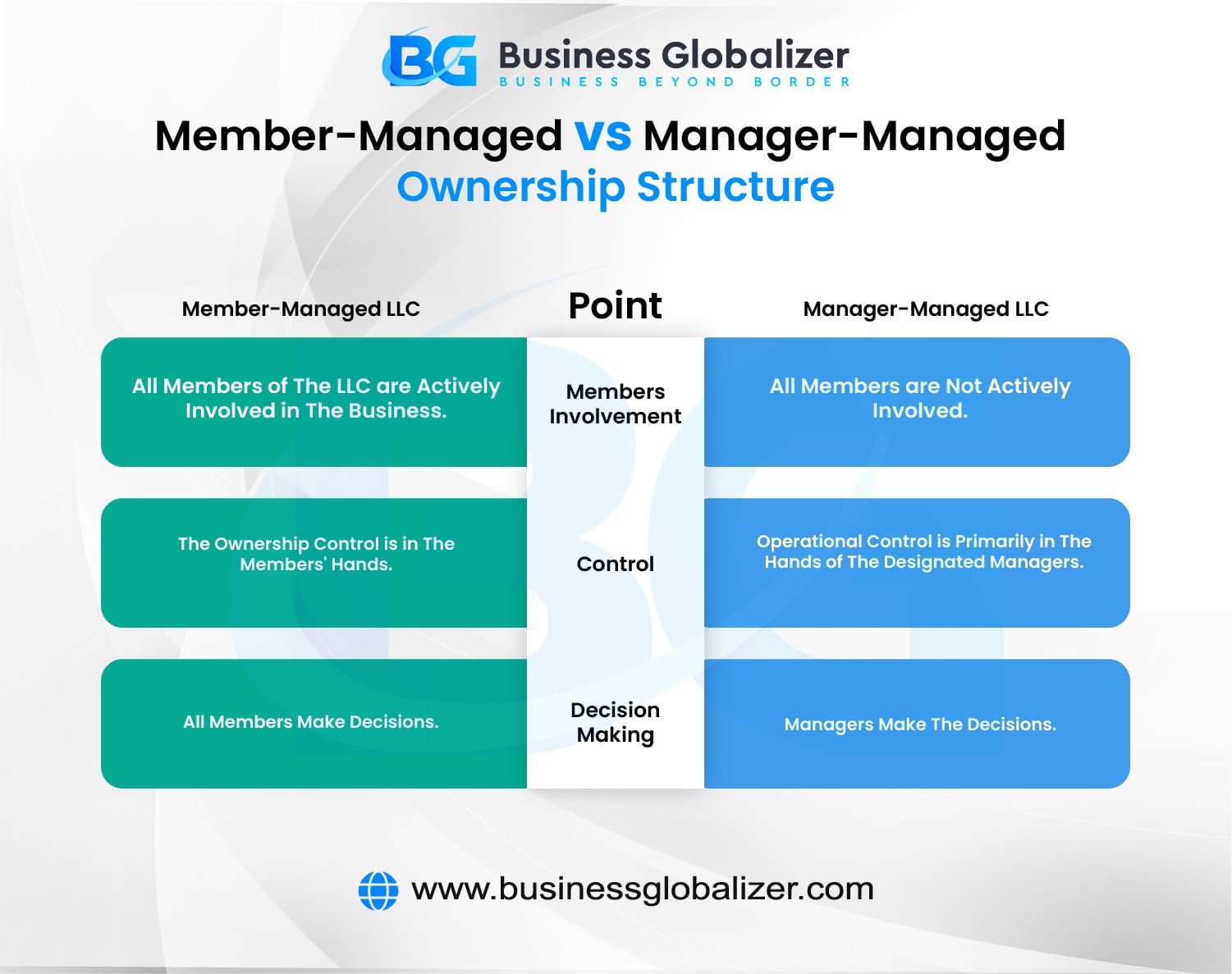

Member Managed Vs. Manager Managed Ownership Structure

| Point | Member-Managed LLC | Manager-Managed LLC |

|---|---|---|

Members involvement | All members of the LLC are actively involved in the business. | All members are not actively involved. |

| Control | The ownership control is in the members’ hands. | Operational control is primarily in the hands of the designated managers. |

| Decision-making | All members make decisions. | Managers make the decisions. |

For better visualization, we have attached an infographic based on member-management or manager-management LLC. You can use it anywhere.

Operating Agreement in Member Managed Vs. Manager Managed

Member Managed vs. Manager Managed in Management

Points | Member-Managed LLC | Manager-Managed LLC |

Responsibility | All members participate actively in management. | Instead of members, managers operate the company. |

Investors | Active members are the investors. | Members are passive investors. |

Managerial authority | Members have the authority to make decisions and handle day-to-day operations. | Managers hold managerial authority over the company. |

For better visualization, we have attached an infographic based on member-management or manager-management LLC. You can use it anywhere.

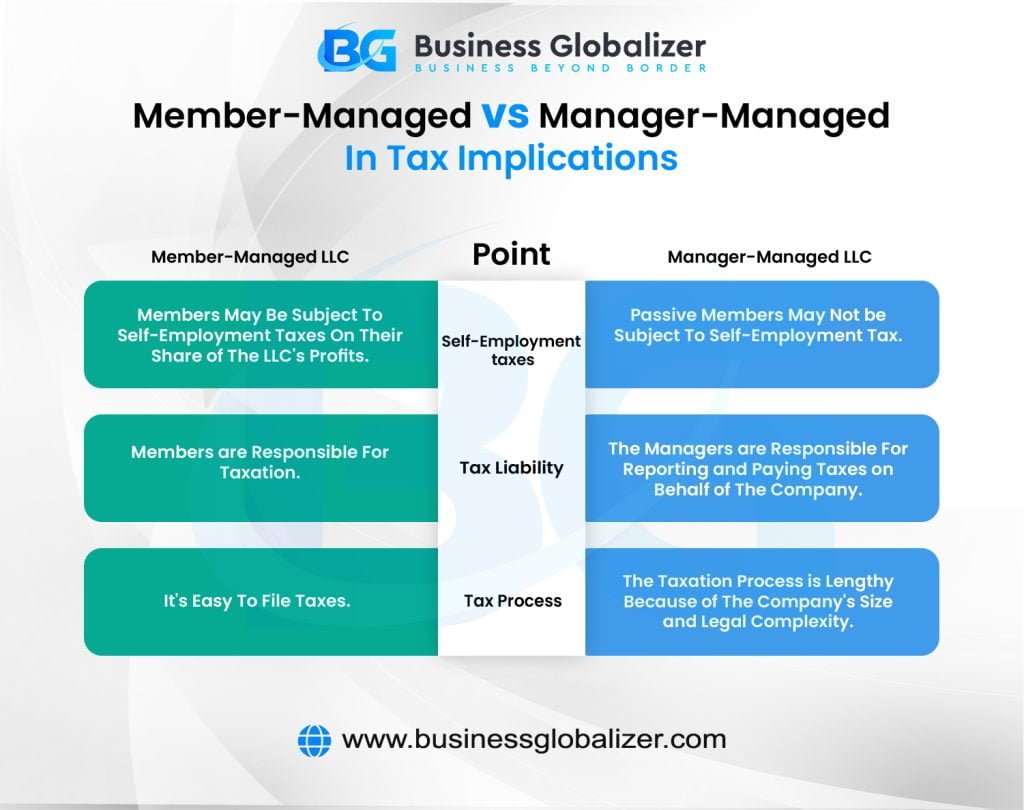

Member Managed Vs. Manager Managed in Tax Implications

Points | Member-Managed LLC | Manager-Managed LLC |

Self-employment taxes | Members may be subject to self-employment taxes on their share of the LLC’s profits. | Passive members may not be subject to self-employment tax. |

Tax liability | Members are responsible for taxation. | The managers are responsible for reporting and paying taxes on behalf of the company. |

Tax process | It’s easy to file taxes. | The taxation process is lengthy because of the company’s size and legal complexity. |

For better visualization, we have attached an infographic based on member-management or manager-management LLC. You can use it anywhere.

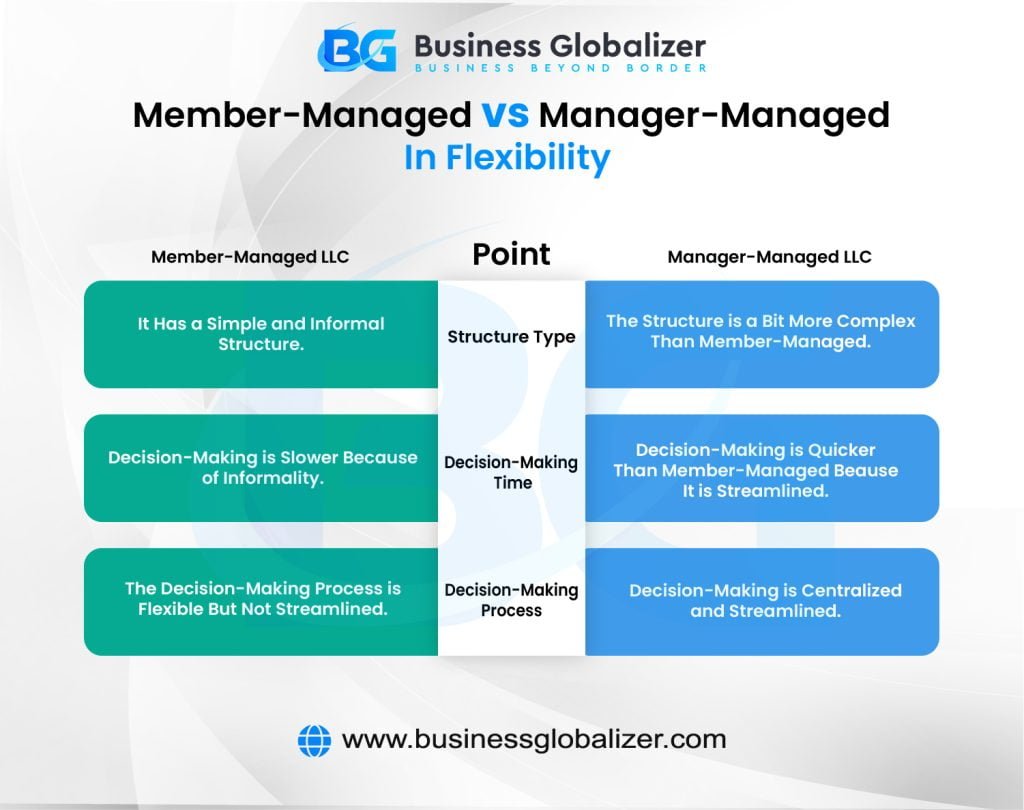

Member Managed Vs. Manager Managed in Flexibility

| Points | Member-Managed LLC | Manager-Managed LLC |

Structure type | It has a simple and informal structure. | The structure is a bit more complex than member-managed. |

| Decision-making time | Decision-making is slower because of informality. | Decision-making is quicker than member-managed because it is streamlined. |

| Decision-making process | The decision-making process is flexible but not streamlined. | Decision-making is centralized and streamlined. |

For better visualization, we have attached an infographic based on member-management or manager-management LLC. You can use it anywhere.

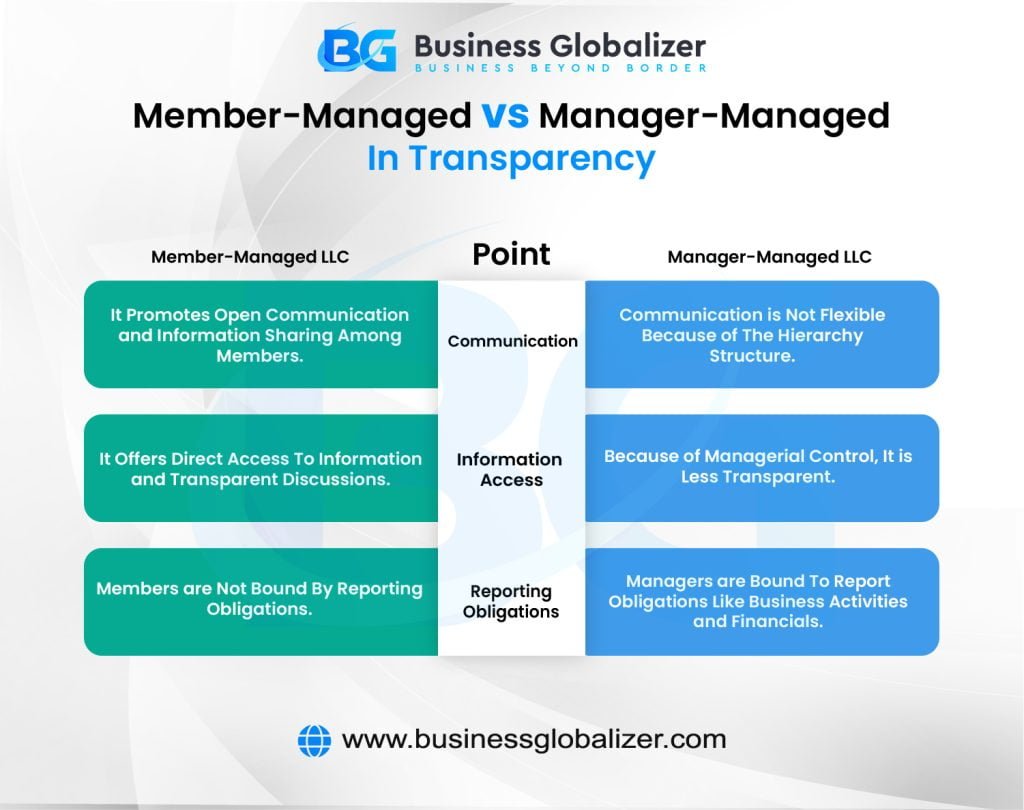

Member Managed Vs. Manager Managed in Transparency

Points | Member-Managed LLC | Manager-Managed LLC |

Communication | It promotes open communication and information sharing among members. | Communication is not flexible because of the hierarchy structure. |

Information access | It offers direct access to information and transparent discussions. | Because of managerial control, it is less transparent. |

Reporting obligations | Members are not bound by reporting obligations. | Managers are bound to report obligations like business activities and financials. |

For better visualization, we have attached an infographic based on member-management or manager-management LLC. You can use it anywhere.

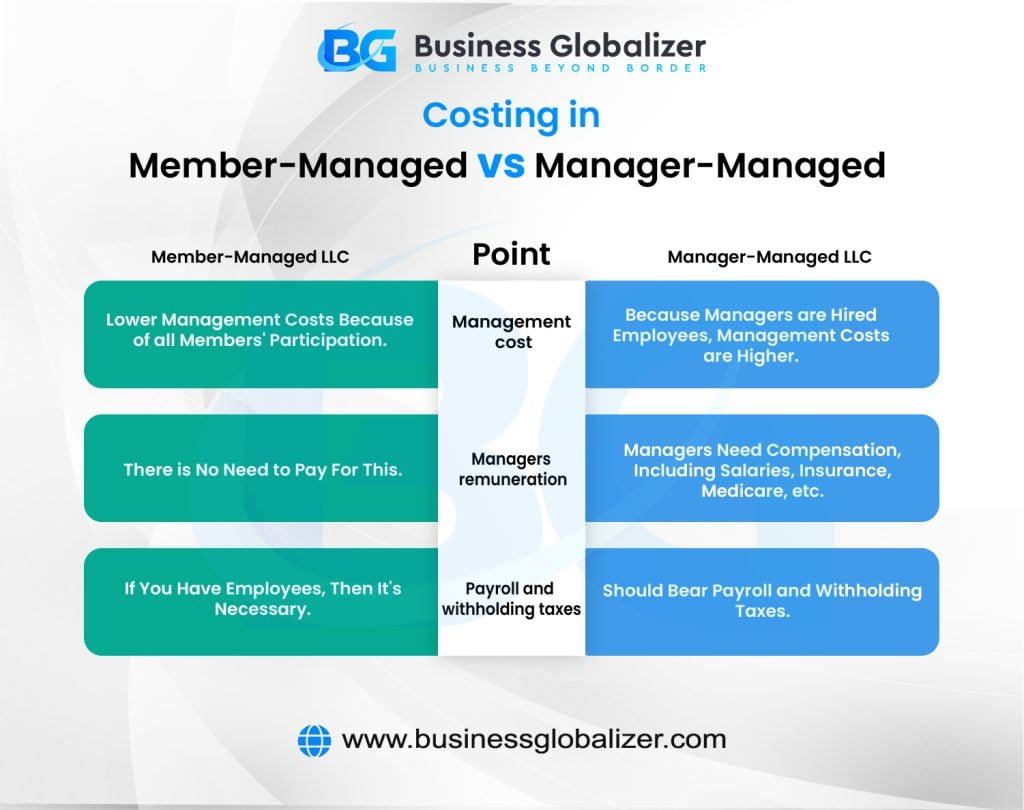

Costing in Member Managed Vs. Manager Managed

| Points | Member-Managed LLC | Manager-Managed LLC |

| Management cost | Lower management costs because of all members’ participation. | Because managers are hired employees, management costs are higher. |

| Managers remuneration | There is no need to pay for this. | Managers need compensation, including salaries, insurance, medicare, etc. |

| Payroll and withholding taxes | If you have employees, then it’s necessary. | Should bear payroll and withholding taxes. |

For better visualization, we have attached an infographic based on member-management or manager-management LLC. You can use it anywhere.

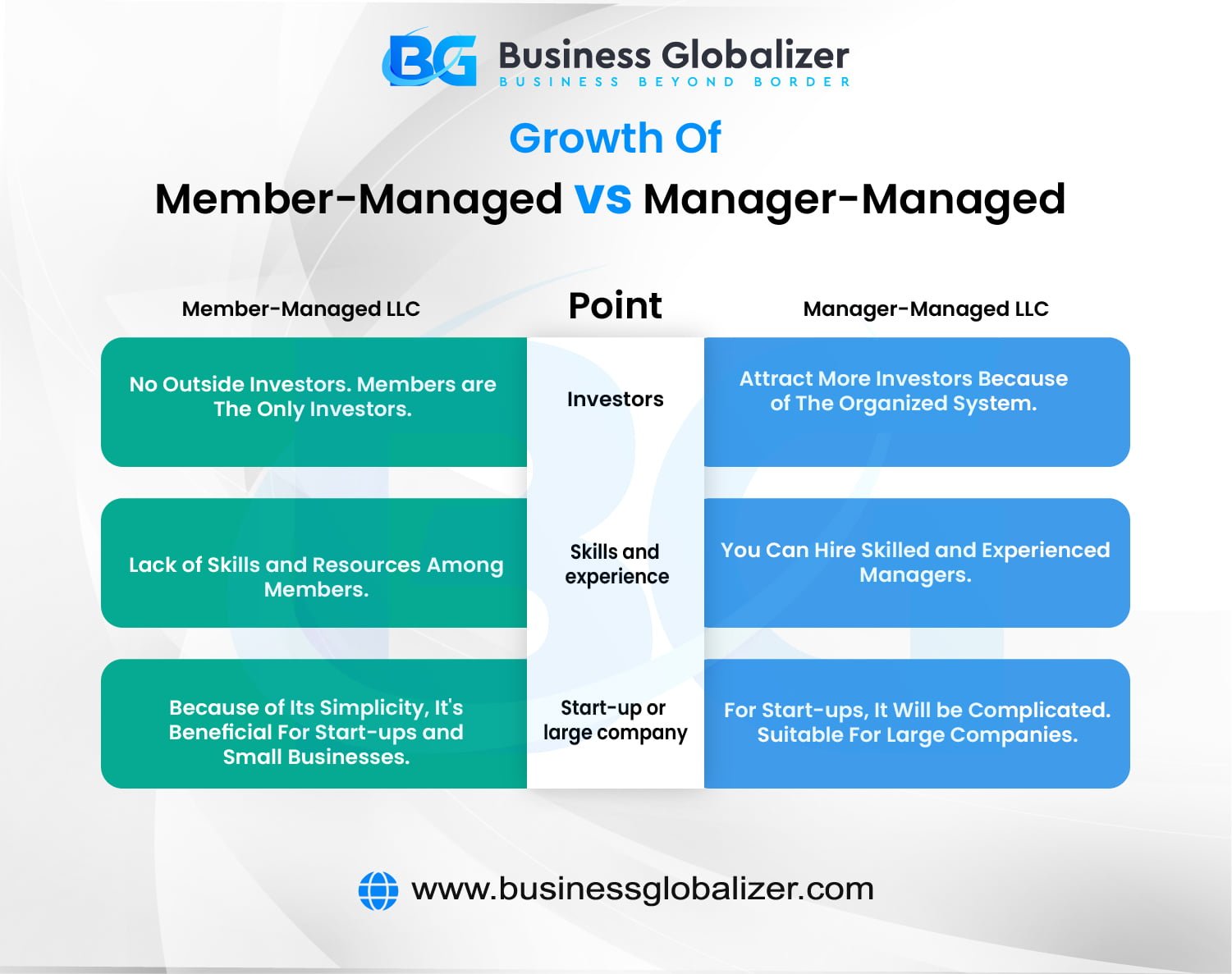

Growth of Member-Managed vs. Manager-Managed LLC

| Points | Member-Managed LLC | Manager-Managed LLC |

| Investors | No outside investors. Members are the only investors. | Attract more investors because of the organized system. |

| Skills and experience | Lack of skills and resources among members. | You can hire skilled and experienced managers. |

| Start-up or large company | Because of its simplicity, it’s beneficial for start-ups and small businesses. | For start-ups, it will be complicated. Suitable for large companies. |

For better visualization, we have attached an infographic based on member-management or manager-management LLC. You can use it anywhere.

Business Requirement of Member Managed Vs. Manager Managed LLC

Points | Member-Managed LLC | Manager-Managed LLC |

Resources | Resources are limited. | Resources are unlimited and can be managed if needed. |

Fiduciary duties and trust | Members owe fiduciary duties to other members. And it has good faith and trust. | Managers owe fiduciary duties to LLCs and their members. It is difficult to find trustworthy managers. |

Privacy | Members’ identities are exposed on public documents, meaning less privacy. | Protect members’ privacy; Managers’ identities are open instead of members’. |

For better visualization, we have attached an infographic based on member-management or manager-management LLC. You can use it anywhere.

Next Step

We hope we have clarified the confusion about choosing one of the mentioned LLCs. Both LLC management structures have different rules and benefits. If the LLC structure specifies your business requirements, you should choose that one.

- Suppose you own a family start-up with limited resources and budgets; then a member-managed LLC would be great for you.

- On the other hand, for a large company with passive investors, unlimited resources, and a budget, a manager-managed will be suitable. And if you have business in different locations, a manager is necessary.

You can consult a business expert like Business Globalizer for a better selection. They can help you choose the most suitable LLC management structure by analyzing your business. Also, you can get help forming an LLC.

FAQs

Q1. What can a member of a manager-managed LLC do to influence the direction of the LLC?

Answer: Although members have a passive role in a member-managed LLC, they hold control over the LLC. Managers manage the LLC Company, but members have the authority to make decisions over the managers. Members can use their voting rights to change the operating system, which can eventually influence the business.

Q2. Do I need to update my LLC operating agreement after changing the LLC management structure?

Answer: Yes, obviously. The LLC management structure of an LLC is the backbone of every business company. And changing the management structure means changing your whole business system. So, it’s necessary to modify your operating agreement. To avoid any problems, you should also inform all third parties.

In addition, you should also update every change in your operating system, like adding or removing managers, changing operating procedures, etc.

Q3. How many managers can a manager-managed LLC hire?

Answer: There are no fixed numbers for having managers under state laws. From one to multiple – an LLC can appoint as many as it needs.

Q4. Which LLC management structure is better?

Answer: It depends on the size of the LLC. A member-managed LLC structure would benefit you if you formed a small business. As well, a manager-managed LLC is better for larger businesses.

Q5. When should you pick your LLC’s management?

Answer: If you decide to form an LLC, you should determine your LLC management structure before making the operating agreement because it will be needed when you apply for business registration with the state office.

Final Words

Choosing a member-managed vs. manager-managed LLC is crucial before you begin operations. Not determining your LLC’s management structure before making your operating agreement can cause legal difficulties.