Welcome to our comprehensive guide on the Advantages and Disadvantages of LLP, a popular business structure choice for many entrepreneurs in the UK. A Limited Liability Partnership (LLP) is a fusion of both partnerships and limited companies, offering the best of both entities: flexibility and limited liability protection for its members. This unique hybrid structure has become a popular choice for professionals across various fields, enabling them to collaborate efficiently while safeguarding personal assets.

However, diving into an LLP arrangement without clearly understanding its benefits and potential pitfalls could lead to unexpected challenges. Through this guide, we will equip you with the insights needed to weigh the pros and cons completely, ensuring your business journey starts on solid ground.

Let’s unravel the intricacies of LLPs together, setting the stage for informed decision-making.

What Is an LLP?

A Limited Liability Partnership (LLP) is a hybrid of partnerships and limited companies, blending the flexibility of partnerships with limited liability protection for its members. This structure is trendy among professionals such as solicitors, doctors, and architects, who traditionally work in general partnerships but seek the added benefit of limited liability. Remember one thing: an LLP is different from the traditional limited companies.

For your better understanding, here’s how an LLP stands apart from a limited company:

- Unlike a limited company, an LLP doesn’t have directors, shareholders, or guarantors. It operates with members, often called ‘partners’. To start an LLP, you need at least two members, but there’s no maximum limit on how many members it can have.

- The rules for LLPs come from the Limited Liability Partnership Act 2000 and The Limited Liability Partnerships (Application of Companies Act 2006) Regulations 2009, instead of the Companies Act 2006.

- For tax purposes, LLPs are treated like partnerships. This means they don’t pay Corporation Tax like limited companies. Instead, each member pays Income Tax and National Insurance on their share of the profits.

If the brief discussion mentioned above didn’t satisfy you, then we also have a detailed guide on Limited company vs. LLP.

LLP Examples

Imagine “Design Innovate LLP,” a collaborative business founded by a group of architects and engineers in the UK. As an LLP, the company operates without directors or shareholders, instead, it is run by its members, who are also known as partners. The firm started with five founding members, but they have the flexibility to include more experts as the business grows.

Governed by the LLP Act 2000, they (the group) enjoy limited liability, protecting each member’s personal assets from business debts. Profits are distributed among members, who then pay individual taxes, avoiding Corporation Tax. This structure supports their collaborative ethos while providing financial and legal protection, making it an exemplary model of a UK LLP in action.

Advantages of LLP Over Partnership

We already established that an LLP is a hybrid of traditional partnership and limited companies. For your better understanding before diving into our main topic, let’s shortly discuss how an LLP could be more advantageous over a partnership:

- Limited Liability: Partners in an LLP enjoy protection from personal liability for the business’s debts and obligations, safeguarding their personal assets. Conversely, partners in a traditional partnership face unlimited personal liability, putting personal assets at risk.

- Separate Legal Identity: An LLP possesses its own legal identity, separate from its partners. This allows it to engage in contracts, hold property, and participate in legal actions independently, enhancing business protection and flexibility.

- Management and Ownership Flexibility: LLPs allow for a more adaptable management and ownership structure. Control and decision-making can vary among partners, and the allocation of profits and losses is determined by the partnership agreement.

- Credibility and Professionalism: Establishing an LLP enhances business credibility and professionalism, as it’s seen as a formal legal entity. This recognition can help in drawing in investors, customers, and new talent.

In short, choosing an LLP over a traditional partnership offers superior protection, adaptability, and credibility, alongside potential benefits in taxation, management, and ownership structures, making it a preferred choice for various businesses.

Advantages and Disadvantages of LLP in Business

For entrepreneurs, an LLP stands out as it combines the protective features of a limited company with the tax and management flexibility of a traditional partnership. However, this attractive package comes with its set of challenges, notably the heightened regulatory compliance requirements. These demands can lead to increased administrative costs compared to more straightforward partnership structures, such as general or limited partnerships. This blend of features makes the LLP an interesting yet complex choice for business owners in the UK, offering both unique advantages and certain drawbacks.

Let’s explore the pros and cons of an LLP together!

Advantages of Limited Liability Partnership

From the concept of “LLP pros and cons,” let’s talk about the pros first. There are a few advantages to forming an LLP. These are mentioned below-

- No Need for Initial Investment/Contribution: An LLP doesn’t require a specific amount of money to start. You can establish an LLP with minimal funds. Plus, a partner’s contribution to the LLP can be in various forms, such as physical items, properties, or even non-physical assets and advantages.

- Lower Registration Fees: Registering an LLP is more affordable than setting up a private or public limited company.

- Protection of Personal Liability: The standout advantage of the LLP structure is its provision for limited liability. Members enjoy protection of their personal assets from the partnership’s debts and legal challenges. In contrast to traditional partnership partners, who bear unlimited liability, LLP members’ exposure is confined to:

- their investment in the business,

- any agreed contributions towards winding up the LLP, and

- personal guarantees for the LLP’s debts.

This protection stems from the LLP’s status as a distinct legal entity, separate from its members. It offers particular peace of mind to those members not involved in daily management or unaware of the LLP’s financial status.

- Flexibility in Management Structure: A key benefit of an LLP is its operational flexibility. It uniquely supports various arrangements for ownership and management, defining members’ duties, decision-making authority, profit sharing, and how members are added or removed.

Unlike general partnerships, where all partners equally share duties and rights, LLPs provide a more tailored approach. Moreover, unlike companies bound by the Companies Act 2006 and articles of association, LLPs operate under specific LLP laws. These laws are more accommodating, giving members the freedom to set their own rules for internal management and organization. - LLP Tax Advantages: LLPs, like general partnerships, don’t pay Corporation Tax themselves. Instead, taxes are passed through to each member, who pays tax on their share of the profits. This means LLP members are seen as self-employed when it comes to taxes. They need to tell HMRC they’re self-employed, file a self-assessment tax return every year, and pay Income Tax and National Insurance on what they earn from the LLP.

Additionally, the pass-through model avoids double taxation—taxing both the LLP and its members. Members can deduct business expenses, reducing their taxable income. The LLP’s flexible structure also enables tax-efficient profit distribution, optimizing members’ tax situations. - Deemed as a Legal Person: An LLP operates as its own legal entity, separate from the people who run it. This setup means it’s recognized by law as a “legal person.” Under the Limited Liability Partnerships Act 2000:

“The limited liability partnership will be a separate legal entity with unlimited capacity. This means that an LLP can do anything that a natural person could do. It has the ability to enter into contracts and hold property and will continue in existence in spite of any change in membership. The LLP’s existence as a separate legal entity makes it more closely akin to a company than to a partnership (except insofar as the internal relations are governed by agreement between the members…)”

This division between the LLP and its members provides them with limited liability, protecting their personal assets from the LLP’s financial responsibilities. - No Mandatory Audits: Unlike all private and public companies that must audit their accounts regardless of share capital, LLPs don’t face this compulsory requirement. You can consider this as a major advantage in terms of compliance.

- Name Protection: When you register an LLP, its name gets legal protection. This means no other LLP or company can use the exact same name or one that’s very similar. Unlike general partnerships, LLPs have exclusive rights to their names, preventing others from registering with matching or closely resembling titles.

- Simple Setting Up: Starting an LLP in the UK is quite easy and affordable, particularly if you opt for an online UK company formation service.

To get your LLP going, you need to fill out a form for Companies House. This includes choosing a unique name for your LLP, giving an official address, and listing all members (you need at least two) and people with significant control (PSCs). Most of the time, Companies House will process and okay your online application within about 3 to 6 working hours. - Confidentiality: LLPs and limited companies both have to share certain information, like annual accounts and official records. However, LLPs get a bit more privacy about how they run things internally.

When creating a company, its articles of association are open to the public at Companies House. On the other hand, the rules and plans inside an LLP agreement stay just between the members. - Enhanced Asset Security with Floating Charges: A key yet often overlooked advantage of an LLP is its capability to secure assets more effectively through floating charges. Unlike regular partnerships, which lack a separate legal identity and thus cannot offer a floating charge, LLPs can use this mechanism to bolster their security when acquiring capital.

This flexibility allows assets to be bought and sold without needing the lender’s approval. Should an LLP utilize a floating charge and a default occur, this charge solidifies into a fixed one, granting the lender the right to appoint an administrative receiver or administrator.

Disadvantages of Limited Liability Partnership

Now, let’s talk about the few problems with an LLP. These are-

- Profit Can Not Be Retained: In LLPs, profits are immediately taxed upon generation and cannot be kept within the business for future use. In contrast, limited companies are subject to corporation tax yet have the advantage of retaining profits for reinvestment or as working capital. This approach avoids the necessity of distributing dividends to members, which might incur taxes at higher rates compared to the corporation tax rate.

- Administrative Burdens: Compared to general partnerships, LLPs face a broader range of administrative duties, such as:

- Maintaining a registered office address.

- Maintaining statutory LLP registers, including a PSC register.

- Filing an annual confirmation statement.

- Preparing LLP accounts for Companies House.

- Informing Companies House about any changes to the LLP (e.g., change of registered office, updates in members’ details, and PSCs).

It falls on the designated members to ensure the LLP meets these obligations. At least two designated members are required for an LLP at any given time.

- Limitations in Capital Raising: An LLP isn’t the right fit for solo entrepreneurs or those looking to expand their business by raising capital via share issuance. It best serves general partners seeking legal protection from business liabilities, like doctors or lawyers, due to its structure.

- Public Disclosure: Limited liability partnerships, while offering limited liability and corporate benefits, are held to the same level of transparency as limited companies, necessitating specific disclosures. Public disclosure is the main disadvantage of an LLP. Partners or owners must submit annual accounts to Companies House for public record. The statements may declare the members’ income, which they wish to keep private.

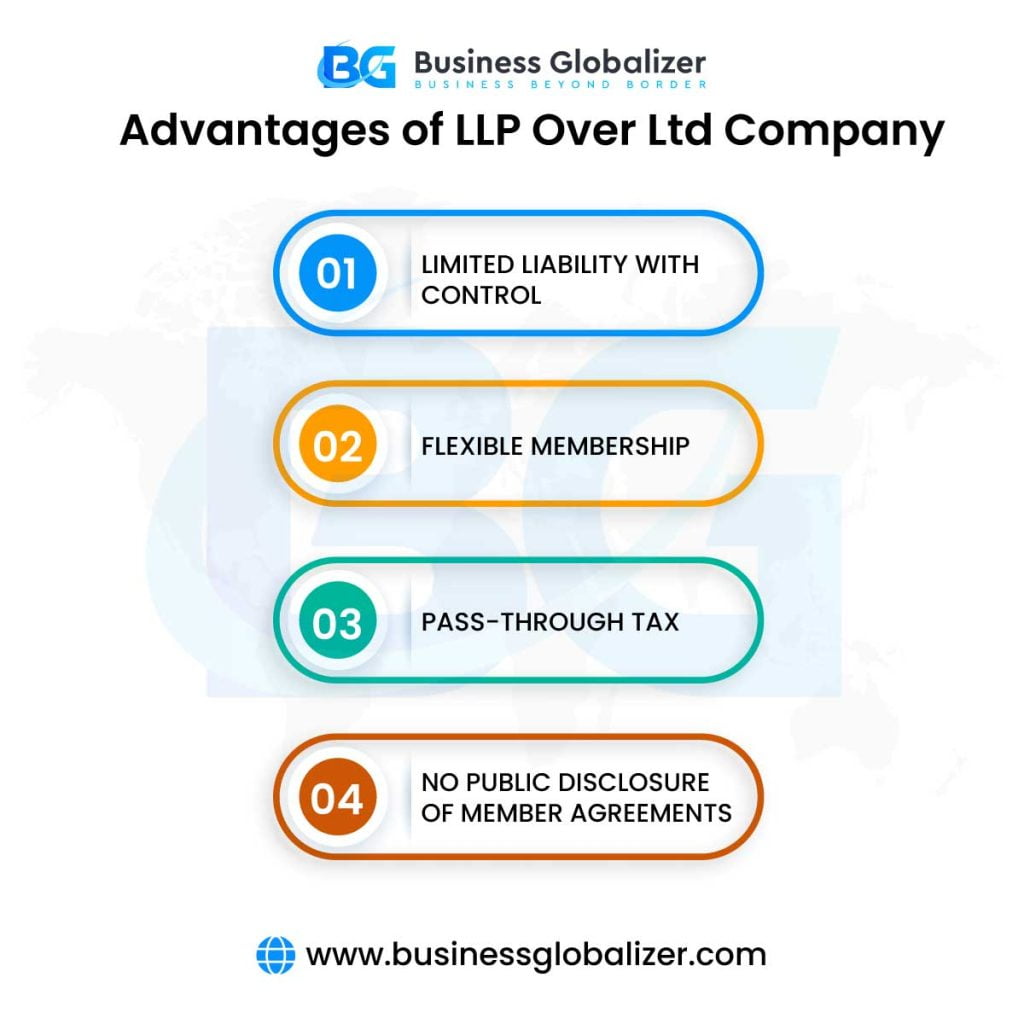

Advantages of LLP Over Ltd Company

Although an LLP has the characteristics of limited companies, there are a few advantages an LLP has over a Ltd company. They are:

- Limited Liability with Control: Members enjoy limited liability like shareholders but have direct control over operations, unlike a limited company’s separation of shareholders and directors.

- Flexible Membership: Joining or leaving an LLP is straightforward, with no tax consequences, and profit shares among members can be adjusted annually.

- Pass-Through Tax: Unlike limited companies, LLPs avoid double taxation by being considered pass-through entities. Profits are not taxed at the company level, but instead “pass through” to the individual members who report them on their personal tax returns.

- No Public Disclosure of Member Agreements: Unlike limited companies, which must disclose articles of association, LLPs maintain the privacy of members’ agreements, not available to the public.

In a nutshell, LLPs stand out by offering direct control with limited liability, tax benefits through pass-through taxation, flexible membership, and private member agreements, distinguishing their advantages from limited companies.

How Do I Form an LLP Online Today?

Forming an LLP online has never been easier, thanks to Business Globalizer’s one-stop UK company formation service. With our specialized expertise, we ensure your LLP is established legally and in full compliance with all regulatory requirements. But our support doesn’t end with formation. We offer a full suite of services to keep your LLP in good standing, including financial institution services, LLP account submitting, confirmation statement filings, bookkeeping, taxation, and overall compliance management.

If you’re ready to bring your entrepreneurial vision to life, simply reach out to us, book a premium business consulting to get rid of your confusion, and learn what’s next for you. We’re here to take care of all the technicalities, allowing you to focus on what you do best. With Business Globalizer, the path to officially starting your LLP is clear, straightforward, and professionally managed, leaving no room for concern. Let us handle the complexities of company formation while you embark on your business journey with confidence.

FAQs

Q1: What Makes an LLP Different From a Traditional Partnership?

Answer: An LLP combines the flexibility of a traditional partnership with limited liability protection for its members, similar to that of a limited company. This structure allows partners to manage the business directly while protecting their personal assets from business debts.

Q2: What Are LLP Features?

Answer: The features of an LLP are:

- Limited Liability Protection

- Separate Legal Entity

- Tax Transparency

- No Capital Requirement

- Flexible Management Structure

- Unlimited Members

- Public Disclosure

- etc.

Q3: Are LLP Members Liable For Business Debts?

Answer: Members of an LLP are protected from personal liability for business debts beyond their investment in the LLP. However, they may be liable if they offer personal guarantees for loans or credit applications.

Q4: Can an LLP Issue Shares to Raise Capital?

Answer: No, an LLP cannot issue shares. This makes it less suitable for businesses looking to raise capital through equity. Instead, funding must be secured through loans or member contributions.

Q5: Are There Tax Benefits to Forming an LLP?

Answer: Yes, one of the primary advantages of an LLP is pass-through taxation. This implies that the company is not subject to taxation on its earnings. Members receive the earnings instead, and they record the income on their individual tax returns.

Q6: How Is an LLP Taxed?

Answer: An LLP itself is not subject to corporation tax. Instead, each member is taxed individually on their share of the profits, making it a pass-through entity for tax purposes.

Q7: How to Save Tax in LLP?

Answer: To save tax in an LLP, members can use the pass-through taxation feature to avoid double taxation and claim allowable business expenses on their tax returns to reduce taxable income. Utilizing the LLP’s flexibility for strategic profit distribution also helps in optimizing individual tax liabilities, offering potential tax savings.

Q8: Who Should Consider Forming an LLP?

Answer: An LLP is ideal for professional groups like solicitors, accountants, and consultants who wish to retain the flexibility of partnership while enjoying limited liability. It’s also beneficial for businesses where all owners wish to be actively involved in management.

Q9: What Are the Reporting Requirements for an LLP?

Answer: LLPs must file annual accounts and a confirmation statement with Companies House, similar to limited companies. These documents become public records, increasing transparency.

Q10: Can Anyone Form an LLP?

Answer: While most businesses can form an LLP, it’s particularly suited to professional services firms. All LLPs must have at least two members, and at least two must be designated members responsible for compliance.

Q11: What Are the Main Disadvantages of an LLP?

Answer: The disadvantages include public disclosure of financials, potentially higher administrative costs due to compliance requirements, and limitations on raising capital through share issuance.

Wrapping Up

As we wrap up our exploration of the advantages and disadvantages of LLPs, remember the unique blend of protection and flexibility they offer, alongside the challenges of public financial disclosures and potential funding hurdles. The choice between forming an LLP or another business structure hinges on what you value most for your venture—be it liability protection, tax advantages, or ease of management. Weigh these factors against your business aspirations and operational needs.

Choosing the right structure is a crucial step in aligning with your long-term business goals. Take your time, assess your options, and pick the path that best supports your journey to success.