If you’re starting a business in the vibrant state of Florida, forming a limited liability company (LLC) can offer numerous advantages. From shielding your personal assets to enjoying flexible tax options, an LLC provides a solid legal structure for your entrepreneurial endeavors.

However, amid the excitement of establishing your business in Florida, there’s a critical component that should not be overlooked – the LLC operating agreement.

An LLC operating agreement serves as a written contractual document that outlines the rights, responsibilities, and operating procedures of the company and its members. It may seem like an optional step to create an operating agreement for your Florida LLC. However, neglecting to create a comprehensive operating agreement can expose you to potential risks and uncertainties that can disrupt your business in the long run.

In this article, we’ll explore the importance of having an LLC operating agreement specifically tailored to the requirements and regulations of the Sunshine State, Florida. We’ll discuss the benefits that can be gained from a well-crafted operating agreement and the potential problems that can arise in its absence. The article will also provide you with essential insights to get started.

So, let’s dive in and discover the ultimate guide to creating an Operating Agreement LLC Florida.

Understanding of Operating Agreement LLC

An operating agreement is like a special contract for a group of people who own a company together. It’s a legal document that says how the company should work and what each person’s position or responsibility is. And also specifies financial decisions and how things should be done.

The operating agreement can be changed if needed, so it’s like a guidebook for running the company every day and solving any problems that come up.

You are not required to file an operating agreement with the government in Florida, but it is a good idea to do so. It helps protect the company by showing who owns what things in case there’s a disagreement.

Types of Operating Agreements in Florida

An operating agreement is a very important document that explains how the LLC works and what its structure is. It also helps the members set up their relationships with each other and what they can expect from each other. It describes how the LLC and its members work, including their rights and responsibilities.

LLC operating agreements in Florida are mostly of two types primarily, such as:

- Florida Single-Member LLC Operating Agreement: A single-member operating agreement is a legal document that protects the owner against possible losses by keeping business and personal transactions separate. Which includes the rights, responsibilities, and operating procedures of an LLC with only one owner.

You can find more information about single-member LLC Operating agreements here.

- Florida Multi-Member LLC Operating Agreement: If you form an LLC with multiple members, the LLC needs to create a multi-member LLC operating agreement that outlines the percentage ownership and membership of the organization. The document describes how members share losses, distribute capital, and resolve internal disagreements, including duties and responsibilities. Each type of agreement has its unique considerations, possible problems, and benefits that entrepreneurs should be aware of.

What Should Be Needed in Creating an Operating Agreement LLC Florida?

So are you starting an LLC in Florida? If this is the case, having an operating agreement for your LLC in Florida is better. According to Florida law, your LLC’s operating agreement can set standards for several things, such as how members or managers interact with each other, their rights and responsibilities, and their relations with the LLC.

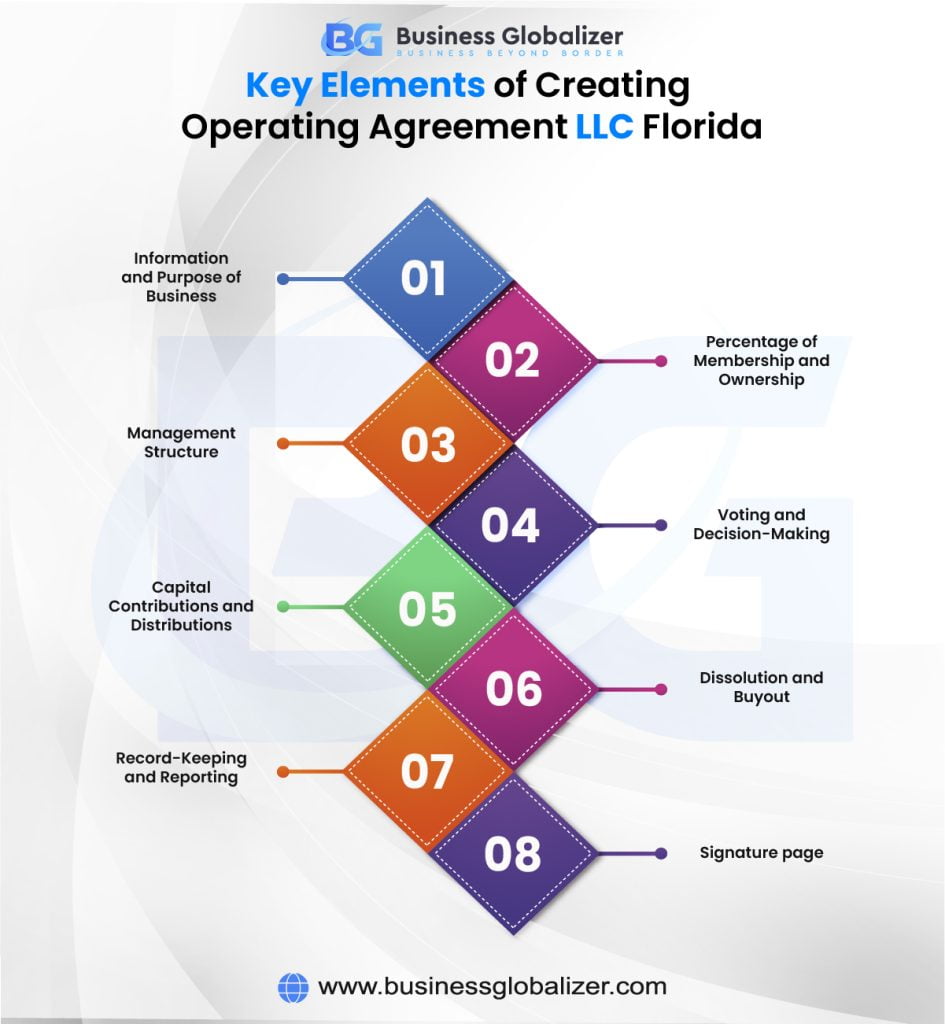

Your LLC’s operating agreement must cover a lot of different things. To create an engaging and effective operating agreement for your LLC in Florida.

Here are some key points to include:

- There should be information like name, location, and business purpose.

- Mention the name of the registered agent.

- The percentage of ownership held by each member in terms of Florida’s multi-member operating agreement.

- Specify the members and their ownership interests.

- Define whether it’s member-managed or manager-managed.

- Outline the decision-making process within the LLC.

- Detail how contributions and profits/losses will be handled.

- Address the process for dissolving the LLC and member buyouts.

- Specify the requirements for financial records and reporting.

- And lastly, add a signature page where you and the members agree to follow the terms of the agreement.

How Do I Create an Operating Agreement for Florida LLC?

Now that you know about the types of operating agreements and Florida LLC operating agreement requirements, you might wonder how to create an operating agreement for your LLC. While it’s not legally required in Florida, having a well-crafted operating agreement can help protect your LLC’s limited liability status and prevent member conflicts.

To make the process of creating an operating agreement engaging and easy to understand, here are the steps to follow:

- Start with Basic Information

Begin by including the essential details about your LLC. Declare your LLC’s name and purpose, which is why it exists. In this section, you should describe what your business does and what you want to achieve.

- Define Membership and Ownership

Describe the members of your LLC and their ownership interests. Specify each member’s initial contributions, such as capital or property, and how profits and losses will be allocated among them. Also, include details on the process for admitting new members or transferring ownership interests.

- Choose a Management Structure

Define how your LLC will be managed. Florida allows LLCs to choose between member-managed and manager-managed structures. All members participate in decision-making in a member-managed LLC, while in a manager-managed LLC, one or more managers are appointed to handle day-to-day operations. Clearly, state who the managers or managing members are and their roles and responsibilities.

- Establish Voting and Decision-Making Procedures

Outline the decision-making process within your LLC. Specify the matters that require a unanimous vote and those that a majority or supermajority can decide. This section should also include meeting procedures, voting rights, and how disputes or deadlocks will be resolved.

- Capital Contributions and Distributions

Detail how members will make capital contributions and the rules for additional contributions if needed. Explain how profits and losses will be distributed among members and when distributions will occur. Include any restrictions or conditions related to distributions, such as required reserves or preferred returns.

- Address Dissolution and Buyout Procedures

Address the process for dissolving the LLC if necessary, including voluntary and involuntary dissolution scenarios. Also, include buy-out provisions if a member wants to leave or sell their interest. This section should outline how the purchase price will be determined and how the remaining members can acquire the departing member’s interest.

- Implement Record-Keeping and Reporting

Specify the record-keeping requirements of your LLC, including financial statements, tax filings, and other important documents. Outline how and when members will receive financial reports and company performance updates. This section ensures transparency and accountability among members.

Remember, consulting with a legal professional is important to ensure compliance with Florida laws and regulations while creating your LLC operating agreement.

Florida Operating Agreement Templates

While the purpose of both agreements is to establish the internal structure and operational guidelines for your LLC, they are very different in how they are set up and what they cover. Drafting an operating agreement may sound like a daunting task, but there is good news for you. You can use operating agreement templates to simplify the process of creating an operating agreement for LLC Florida.

An operating agreement template is a pre-drafted framework that you can tailor to suit your specific needs. It provides a starting point for structuring your LLC’s operations without starting from scratch. Here are some key points to consider when using operating agreement templates for your Florida-based LLC:

- Accessibility: Operating agreement templates are widely available online, and you can find them on various legal websites. These templates are designed to meet the legal requirements of Florida’s LLC laws.

- Customization: Although templates provide a ready-made structure, they are highly customizable. You can tailor the operating agreement to reflect your LLC’s unique characteristics, such as ownership percentages, profit-sharing arrangements, and management responsibilities.

- Clarity and Simplicity: Operating agreement templates use straightforward language that breaks down complex legal jargon into simpler terms. This clarity ensures that all LLC members comprehend the agreement’s provisions, fostering a transparent and efficient decision-making process.

- Efficiency and Time-Saving: These templates provide a clear structure and format, streamlining the agreement’s creation process. By utilizing operating agreement templates, you can save valuable time and effort.

- Legal Compliance: Operating agreement templates are drafted with legal compliance in mind.

Remember, while operating agreement templates provide a convenient starting point, reviewing and modifying them according to your LLC’s specific needs is crucial. You can consult with a business professional like Business Globalizer, who specializes in LLC formations and can provide valuable insights and guidance throughout the customization process.

Our templates are made with the necessary provisions to fulfill Florida’s legal requirements for your LLC’s formation in Florida. A lawyer wrote our LLC operating agreement templates, which can be used in many situations.

Choose the one that fits the needs of your LLC the best:

- Florida-Single-Member-LLC-Operating-Agreement-Template Update

- Florida-Multi-Member-LLC-Operating-Agreement-Template Update

Why Should a Florida LLC Have an Operating Agreement?

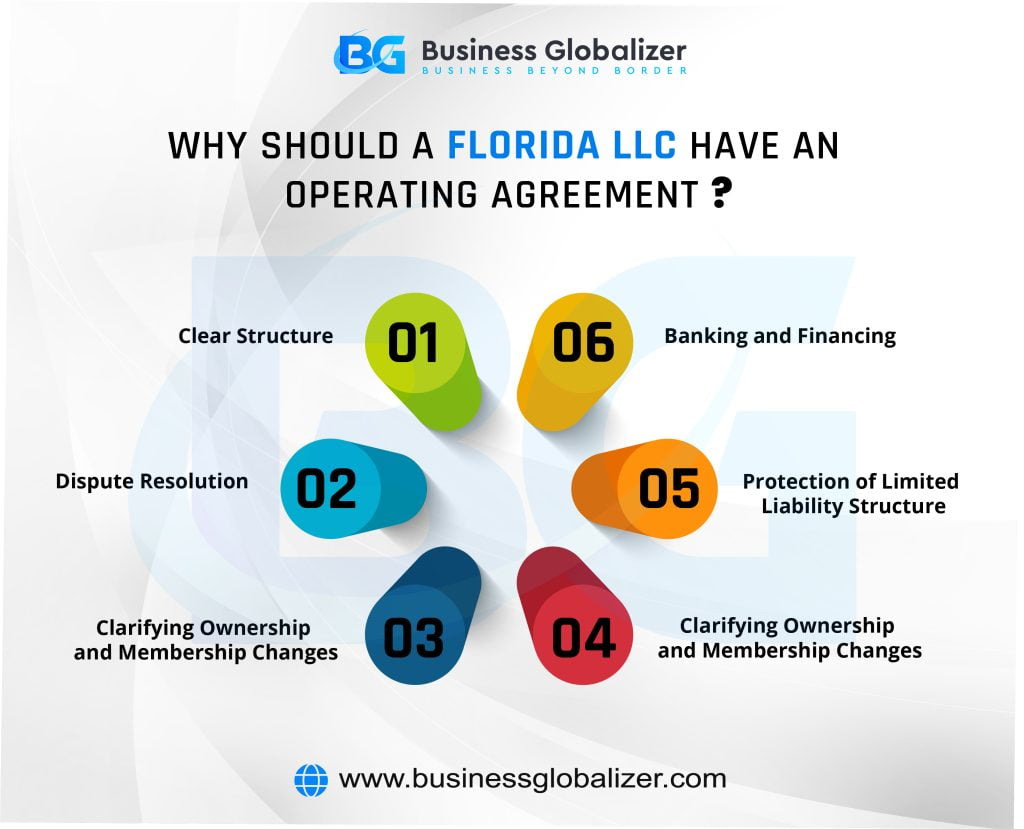

If you are still confused about why you need an operating agreement for an LLC, you are in the right spot now. There are many advantages to creating an operating agreement for an LLC in Florida, such as:

- Clear Structure: An operating agreement helps establish a clear structure and defines the roles, responsibilities, and rights of LLC members (owners) and managers. It outlines how decisions will be made, how profits and losses will be allocated, and how the LLC will be managed.

- Dispute Resolution: The operating agreement can include provisions for resolving conflicts or disputes among LLC members. Providing a clear dispute-resolution process can help prevent disagreements from becoming costly legal battles.

- Clarifying Ownership and Membership Changes: The operating agreement specifies the ownership interests of LLC members and the procedures for admitting new members or transferring ownership. This can be crucial when bringing in new partners or when a member wants to leave the LLC.

- Banking and Financing: Financial institutions often require a copy of the operating agreement when opening a business bank account or applying for loans or financing. A well-drafted operating agreement can make securing banking services easier and attract potential investors.

- Protection of Limited Liability Structure: LLCs must always show that the company is a separate legal entity from its members to keep their limited liability status. Having a well-crafted operating agreement can help protect your LLC’s limited liability status and prevent conflicts among members.

FAQs

Q1: Does Florida require an operating agreement for LLCs?

A: No, an operating agreement isn’t mandatory, but having one offers many benefits.

Q2: Is an LLC’s operating agreement the same as an article of organization?

A: No, they aren’t the same. An operating agreement is an internal document for an LLC. But Articles of organization are required by the state for your LLC.

Q3: Can I make my own operating agreement?

A: Yes, you can, as there are no legal requirements for what to include, but consulting a legal expert is a wise idea.

Final Thoughts

In conclusion, creating an operating agreement for LLC Florida is not mandatory. Still, it’s advisable to consult with an attorney or a business professional to draft one that suits your specific needs and protects the interests of the LLC and its members.

Neglecting an LLC’s operating agreement can give rise to a multitude of troubles. Without this important document in place, you open the door to potential legal and financial nightmares. From uncertain decision-making processes to personal liability risks, the absence of an operating agreement puts your business in great jeopardy.